Investing some of your money should give you better returns than just saving it, and it’s an important part of managing your finances.

It can however be tough for both new and experienced investors to keep their cool during volatile and unpredictable markets, such as those seen in 2022.

Taking a long-term approach to investing, like we do at Intelligent Pensions, can offer many benefits that might help you stay calm and positive about your investments, even when things get bumpy.

Read on to find out how to stay calm in a volatile market and learn how one of our financial planners could help you keep your long-term plan on track.

5 reasons to stay calm in a volatile market

- Market Volatility is Normal – While it might be nerve-wracking, ups and downs in the market are expected. They’re actually opportunities for fund managers, even though they can scare investors.

- Hold onto Quality Investments – If you sell when your investments drop in value, you’ll likely lose money. But if you stick with your long-term plan, markets tend to recover, and so should your investments.

- Long-Term Investing Pays Off – Data from the past suggests that the longer you invest, the less likely you are to lose money. So, sticking with it for the long haul should pay off – as long as you’ve made good choices and regularly review your investments.

- Compound Returns are Powerful – Investing for the long term lets your money grow over time, thanks to compound returns, where you earn returns on your original investment plus the returns you’ve already received.

- Emotions Can Lead to Poor Decisions – Emotional decision-making, like selling during a market dip or following the crowd, can hurt your returns. Sticking to a long-term plan based on data rather than emotions is often a better strategy.

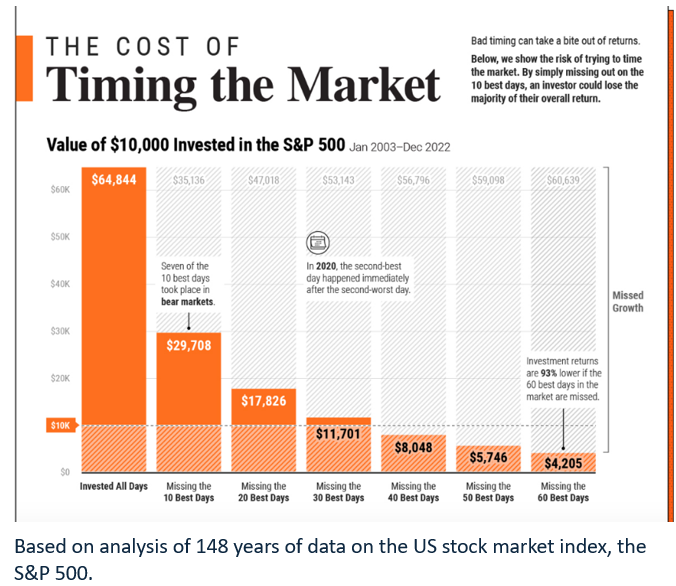

Trying to time the market requires a great deal of expertise (or a crystal ball).

Watching your funds fall in value may feel uncomfortable, but the impact of missing a few of the best days in the market could be more costly than sitting it out.

A financial planner could help you mitigate risk and keep your long-term plan on track

Working with a financial planner can help you stay committed to your long-term plan and avoid emotional decision-making.

At Intelligent Pensions, we also help to mitigate investment risk by investing in collective funds rather than individual companies. This spreads the risk across a wide range of assets and ensures that if one sector does particularly badly it is likely to be offset by better returns in another area.

Our risk-rated portfolios are carefully matched to your personal risk profile, so you’re unlikely to lose more than you can afford. What’s more, your funds have the potential to achieve the returns you need to support you throughout later life.

Get in touch

If you’d like to know more about creating a long-term investment portfolio tailored to your specific needs, please email us at hello@intelligentpensions.com or call 0800 077 8807.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.