The global equity rally has now continued for over a year. Politics still continue to dominate with a General Election announced in the UK, the French Presidential election looking less likely to produce a seismic shock, Europe appearing to be moving away from anti-European Union parties and more and more questions over what Donald Trump can actually deliver. The latest of his many setbacks is the infamous Mexican wall which is looking unlikely to rise out of the ground. The sabre rattling of North Korea, whilst disconcerting and unwanted, appears to have helped US and China relations and talk of currency manipulation and trade barriers seems to be off the table for now at least.

Markets had become reasonably optimistic about the global growth outlook and the implication for corporate profits and earnings following the election of Donald Trump. But his inability to push through meaningful healthcare reform started raising questions over his ability to get fiscal spending measures and tax reform through. This, coupled with an increasing divergence between hard and soft economic data has led to question marks around likely economic growth. This in part led to the pullback in equity markets we have recently seen and bond yields coming off their near-term highs.

Appetite continues to grow for European equities for a number of reasons. Firstly, due to recent negative sentiment we saw heavy outflows from the asset class and European stocks became broadly cheaper on a valuation basis, relative to the likes of US equities. As the outflows began to turn, investors were provided with an attractive entry point. Also, European equities posted a strong reporting season, where results were better than already upbeat analyst expectations. The European market is also currently running with low profit margins which, when combined with a lower euro and little wage pressure, have scope to improve.

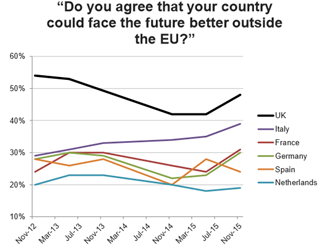

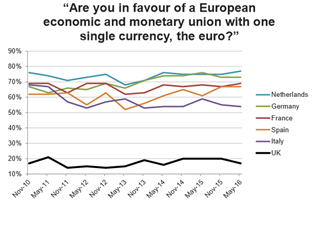

The key question is political risk. Whilst political risk remains a key consideration within Europe, the immediate risks have arguably been overplayed following the market-friendly Dutch election result and Le Pen becoming less of a perceived threat in France. However, longer-term political risk does remain, and that appears high in Italy, where there are elections in 2018 and, depending on the result, significant potential exists for the country to leave the euro. However, we consider that there is time for upward momentum before then and indeed the risk may again be overstated as the charts demonstrate.

European equities have recorded their best quarter for earnings since 2006, the Eurozone grew faster than the US in 2016 and, unlike other markets, there appears to be scope for meaningful margin expansion in a reflationary environment. Many investors have fled the continent in anticipation of political noise during the busy electoral year but we believe a European electoral calendar that passes without incident should reward European equity investors. The French contest is not over yet, but investors are likely to take comfort and to begin to think about the more attractive valuations that European equities offer – a market that has struggled to keep up with the global reflation trade due to political uncertainty.

Asia ex Japan equities rebounded strongly from the last quarter of 2016 to post strong positive returns in the first quarter, spurred on by the broader “Trump bump” rally seen in global stockmarkets. In China, stocks gained strongly and had their best first quarter in over 10 years, driven on by continued positive news for the world’s second-largest economy. Better-than-expected data and a stabilising Chinese yuan led to improved sentiment among investors. Emerging Markets also posted strong gains, with US dollar weakness providing a tailwind to returns. An upswing in global growth and a lack of follow-through on protectionist trade policy from the Trump administration supported risk appetite.

We continue to prefer Pacific funds to the broader Emerging Market funds which include economies that we view as remaining overly volatile. Pacific funds avoid Russia, which posted a negative return and was the weakest index market. A decline in energy prices and reduced optimism towards a significant improvement in relations with the West were the key headwinds. Also excluded is Greece, which recorded a negative return with banking stocks leading the market lower. We will be reviewing our position with our main Pacific and Emerging Market fund managers very shortly. Japan continues to offer attractive value and most portfolios now have direct Japanese exposure.

It is reasonable to assume that the announcement of a UK general election to be held on 8 June will lead to some increased uncertainty for the UK economy as consumers and corporates try to identify the implications of the visions articulated by the competing parties. This uncertainty will be compounded by the fact that Teresa May is explicitly seeking a mandate to push Brexit through parliament. In many ways it could well take the shape of a re-run of the referendum, but this time overlaid by party politics. The announcement of the election saw Sterling strengthen and the value of those companies with large foreign earnings fall as the currency movement reversed some of the gains post the Brexit vote.

Whatever the outcome, uncertainty will continue after the votes are counted. On Brexit, for example, were the Conservatives to achieve a strengthened mandate, as the polls currently suggest, it would still be unclear whether this would lead to the EU agreeing to the UK’s demands in such a way as a WTO fall-back outcome could be avoided. On her other policy platforms, markets would also have to weigh up the extent to which she might be a more economically interventionist premier than her Conservative predecessors. There will also be implications for the Union depending on how the Scottish National Party performs at the ballot box. As a Schroder fund manager said “In short, the election and its aftermath will bring new uncertainties for investors. If the market behaviour around recent political events provides any guide, the coming weeks and months should throw up many such opportunities.” We will remain focused in supporting funds that are covering all sizes of companies as we believe this is the correct stance during these uncertain political and economic times in the UK.

Political risk, market volatility and divergence in central bank direction have created an uncertain backdrop for fixed income investors. Over the past year and into 2017, traditional sources of stability, namely low yielding government bonds have become increasingly challenged. Fixed income remains a major challenge in a rising interest rate and inflationary environment. We remain committed to strategic bonds and high yield bonds but we are constantly reviewing and researching all fixed income sources.

Over the rest of 2017, there undoubtedly will be further bouts of volatility in all markets, driven by political or macro events. The world waits to see how effective President Trump will be in actually implementing his headline grabbing policies, what form Brexit will take, and what the outcomes of important elections in the Eurozone will be over the course of the next few months. However, the competitive position of the companies in the various funds in portfolios and their individual management teams, in particular the latter’s strategy in finding the appropriate balance between investing for future growth and returning cash to shareholders, will drive long-term returns more than the politics that are dominating 2017.