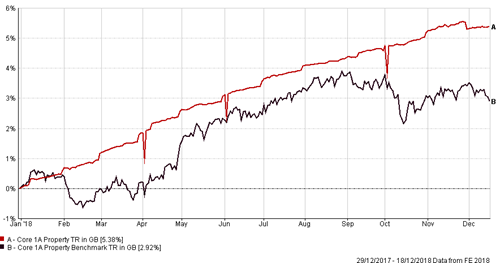

2018 has proved to have been an extremely disappointing year for investors. Almost all markets, both equities and bonds, have fallen in value this year, under pressure from rising interest rates, political developments such as Brexit, and the damaging trade dispute between the US and China along with an overhang of deep investor anxiety of markets overheating. Markets have certainly cooled now. The only major asset class that we support that performed with any distinction has been direct property. Cash continued to be beaten by inflation and was no great safe harbour.

Markets are pricing in at least some of the identified risks and valuations have adjusted downwards for the good, the bad and the ugly. Greater realism has arrived with the significant falls in global stock markets since September. Perhaps markets were priced for perfection at the start of the year and were vulnerable to bad news – and there has been plenty of that. In 2017, a year which delivered strong returns across almost every asset class, bad news was shrugged off and markets advanced. Not so for 2018 and likely to be not so for 2019 but hopefully we will see asset classes return to producing positive returns over the year.

It is easy to be overwhelmed by the pessimism now affecting markets. Undoubtedly there will be more bad news in 2019 – the trade dispute between the US and China showing no sign of significant resolution and with the potential to damage economic growth around the world, talk of a US recession and the chaos and uncertainty that Brexit has created. Thankfully, there are signs that market returns should be more positive in 2019. A gradual slowdown in growth in the US in 2019 and 2020 is very likely but: most commentators and fund managers do not expect a recession to happen in 2019 as many of the forces that led to a strong year in the US in 2018 are still in play. The recent earnings season in the US was encouraging with many companies exceeding expectations. The gradual slowdown might mean that the cycle of rising US interest rates may end soon or at least slow down, which the FED has now hinted at the December meeting. Markets wanted more than was suggested and reacted badly. However, if only another couple of 0.25% increases happened through 2019 that would be a modest peak compared to past economic cycles. The underlying concern is that the track record of the FED is that there is a tendency to over-tighten and hasten recession and that cloud has not gone away. A recession in the US in 2020 is certainly being talked about.

Many equity fund managers suggest that slightly higher inflation may be with us next year and will benefit those companies that have strong market positions and the ability to raise prices. Managers also see more attractive valuations for many good companies. Even in Europe and the UK where growth has been disappointing, the return from dividends alone looks more attractive compared to cash or bonds for a while.

Weaker growth in the US should lead to the US dollar losing ground against other currencies. This is good news for emerging equity and bond markets as a strong dollar drains money away from these markets. Emerging markets, including China, have suffered particularly badly in 2018 and wewould not be surprised to see them recover in 2019. Depending on the outcome of Brexit, the UK looks interesting as valuations have been very depressed and could be very well worth watching if something of a (sensible) deal is eventually agreed. A hard Brexit is likely to spook markets and hit sterling hard.

The challenges within fixed income markets continue and it would be prudent to expect low returns from fixed income next year. However, as we have seen this year, challenges often bring volatility, which in turn creates opportunities that can be exploited. Global trade wars, political uncertainty and worries about rising interest rates will likely temper returns from credit markets in the months ahead. Despite this, there are ample opportunities according to the fixed income managers we support.

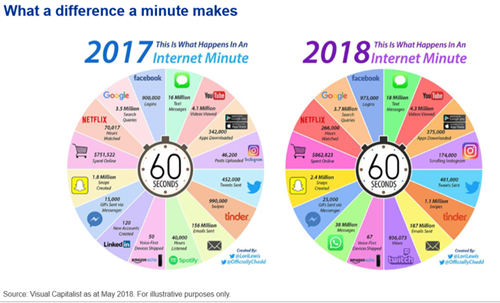

Technology companies, particularly the FANGs (Facebook, Amazon, Netflix and Google), were constantly being berated throughout the year. Wow, they were valued highly and maybe some reality has taken place with the market corrections. The chart below highlights their significance and others creating technology and “disruptor” models that challenge historic business models. What can be seen is the speed of growth and eye watering volumes that are being processed every minute of the day. Many becoming household names and shaping the way we live. The chart is meant as fun, maybe bore your friends? But it certainly demonstrates that technology is delivering rapid growth and that comes at a price. Combine that with growth in consumers throughout emerging markets and maybe it is not such as gloomy a picture. Has Amazon delivered to you, is Netflix part of your entertainment? What is Twitch? It is a rapidly changing technology driven world with lots of opportunities. Investment opportunities arise either directly or indirectly in supporting these companies’ growth and there are many companies across the globe for managers to investigate. It looks interesting!

“This may be a good time to remember Warren Buffett’s famous comment “Be Fearful When Others Are Greedy and Greedy When Others Are Fearful”

It has been a very rough end to 2018’s journey and we all look forward to a smoother 2019, which we hope should not be too hard to achieve but the seat belt sign may need to stay on just in case.

Douglas Kearney C.A. Investment Director

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.