2019 has seemed quite a difficult year to navigate and often felt as though we were rarely out of choppy seas. However, it has been a good year for investors and a transformation since the end of 2018. Most of the major asset classes have performed strongly, delivering very acceptable returns. This against a very noisy backdrop of politics, talk of recession, trade wars, Brexit, impeachment, tweets, and a host of other issues long forgotten.

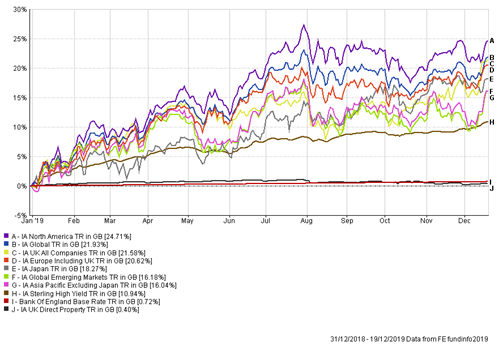

The chart below shows various asset classes performance over the year. It certainly has not been a straight, smooth upward line for most asset classes. As can be seen, North America yet again performing strongly, which also boosts Global Equity up the table as it has a significant component of US exposure. The unloved UK may become better loved now some political stability might have been achieved, but it is a mighty big task getting 27 countries to agree to a trade deal. We would imagine that will be a very noisy item for UK and European markets to manage through 2020. At this time last year, many thought Emerging Markets would be the best performing asset class for 2019. It has done perfectly fine but suffered from the trade wars that the politicians have been waging throughout the year.

Perhaps the surprise of the year has been fixed income. This broad asset class has had its obituary written many, many times. Almost as many times as the US is overvalued and should be avoided and commentary heralding of the return of value investing, but these are other subjects altogether. Few expected fixed income to deliver such impressive returns in such a challenging market. Can it be repeated?

Regrettably, during the year we have seen liquidity issues arise with one of the UK’s best-known fund managers. Although, we have never been investors in these funds, we are always conscious of the expectation of investors to have ready access to all funds in portfolios, albeit we are a house that has long term views and strategies. Direct property funds are currently under the spotlight as one substantial property fund, which we don’t support, has “gated” investors until some assets are realised. The sector has been a little out of favour since the referendum result and not helped by the changing shape of retail. We are looking closely at this defensive asset class and considering what best to do, but undoubtedly performance through the year has been weak, but in our view, it hasn’t become a terrible asset class. Long term performance has most definitely delivered.

2020 will see the Presidential election in the USA. This will impact markets without doubt. As yet the candidates are not yet selected but it is likely to be a bruising encounter. Both main parties appear to be in favour of Trump’s stance with China so an end to the trade wars is unlikely unless an agreement is reached prior to the election. Undoubtedly, some other unexpected global event will come along and wobble markets.

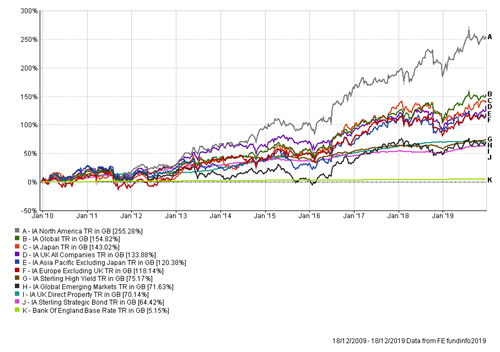

Wobbles are uncomfortable. Our confidence is tested. Our instinct is not to fight but take flight. How many wobbles can you remember over the last decade? Probably quite a few! Was the anxiety worth it? Below is a chart of the main asset classes that we have supported over the last ten years. (Indeed, many individual funds have done even better) “A Picture Paints a Thousand Words” perfectly sums up the chart below. For all the anxiety, news flow, political uncertainty, central bank machinations, trade wars, euro crisis, Greek crisis and on and on, the asset classes have produced extremely pleasing outcomes. So, cash under the bed wasn’t a great strategy! Here’s to 2020 and beyond!

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.