2020 has been a year like none of us have ever experienced. Few will have shed a tear to see the passing of a year that has caused so many huge challenges, so much distress and grief globally. The start of 2021 has not been what we would have chosen as it feels that despite the many personal and economic sacrifices, we have returned to square one. The announcement of a further lockdown across the UK in the first few days of the year with the closure of schools and more draconian social restrictions has hit us all hard in the dark days of mid-winter and left us wondering when this will ever end.

However, the reality is that despite the gloom we can look forward with some confidence and optimism to 2021 that some normality is on the horizon as several vaccines have been created and approved in record time. That achievement is absolutely monumental. We now need the delivery to match. It is perhaps over optimistic to believe our lives significantly improving with the vaccine by March.

Out of adversity comes opportunity, according to Benjamin Franklin, and that was so very true in the investment world of 2020.which will bring benefits for the years ahead. The need for remote working saw Zoom increase its customer base from 10m to 200m users almost overnight. Is Zoom a word you knew this time last year? Probably not, but it was more than likely in your portfolio. Such growth is only possible by the cloud computing facilities of the likes of Amazon and Microsoft.

Online shopping became the norm with the likes of Shopify there to make purchasing easy. That message to tell you that our delivery was about to happen was most probably enabled by Twilio. Twilio were less busy letting you know which gate your plane was leaving from. Very quickly watching Netflix or Amazon Prime or other such providers became the norm. At the height of the COVID-19 pandemic, 10 years of ecommerce growth happened in just 90 days. According to an article published by Twilio, Covid-19 sped up companies’ adoption of digital communications strategies by 6 years.

Will 2020 be looked upon beyond the pandemic as the year of a digital industrial revolution? It has certainly brought about massive and rapid change. Property needs are being challenged. Do we need that office, does the sandwich shop have relevance, do we want to commute? How will we shop? Will cinemas now have to compete with streaming? As we have discussed many times throughout the year, property demand and needs have changed and whether that is temporary or permanent only time will tell. We will be addressing this issue as we review portfolios. This asset class has been a loyal friend in portfolios for many years but sadly we are concluding this asset class should be retired from portfolios. The main reason for our view is that the problem of liquidity is a challenge that we do not consider is necessary or wanted in a portfolio. The FCA is considering the liquidity issue but our minds are pretty much settled.

Another reason for some optimism for 2021 and beyond is the political landscape in the US will be changing significantly with a new occupant of the White House. The US has over the last four years disengaged from much of the world and become extremely insular. The new President recognises the huge catastrophe that climate change will deliver across the globe if action is not taken. A catastrophe that would be almost impossible to remedy with the forest fires such as those seen in Australia that heralded the start of 2020 becoming a frightening feature of modern civilisation.

Joe Biden has confirmed that the US will again be party to the Paris Agreement on climate change. This is a move welcomed by global climate scientists. President Trump made the decision to withdraw from the Paris Agreement because of the unfair economic burden imposed on American workers, businesses, and taxpayers made under the Agreement. The US equity market, led by the technology companies, had a spectacular year in 2020. It would be hard to imagine that will be repeated but despite a volatile start to the year, it is hoped that attractive returns can be achieved. One economist that we follow suggests a volatile period through to March but is optimistic thereafter. A lot is riding on March!

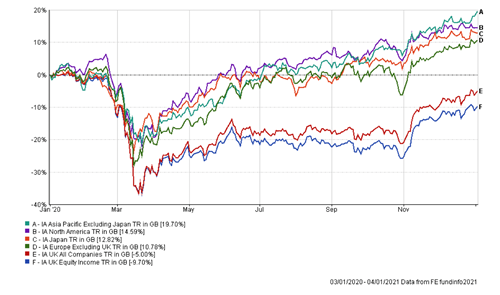

The last week of 2020 saw Brexit finally concluded after a very long four years of negotiations and arguments that resulted in a trade deal between the UK and Europe. It is too early to be clear about whether it is a good deal or not, but our Prime Minister suggested we have “our cake and can eat it”. That is a very bold statement. Time will tell whether that is indeed so. A deal certainly helps both the UK and European companies avoid unwanted tariffs and a time of extreme economic stress. The UK had a very poor year in 2020 so it is hoped that 2021 sees a better performance but it does lack the “new” companies of other global markets that have powered ahead.

2020 was a dreadful year with so many deaths caused by this horrendous virus, but out of the adversity has come opportunity which has driven portfolios to levels that seemed impossible in mid-March. It is a fool’s game to forecast but hopefully we can continue to find the fund managers who can uncover such exciting companies and opportunities that are the future.

What must never be lost sight of is that diversification remains so hugely important and that in a period of stress, whilst the temptation is to follow the flight instinct, it is usually rewarded to let the fund managers fight to find the gems. We never want to experience a year such as 2020 ever again but out of adversity came opportunity. Let us all hope for the opportunity and avoid any more adversity.

Douglas Kearney C.A. Investment Director

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.