Another very challenging year comes to a close with a new variant of Covid causing significant concern. It is too early to draw conclusions how severe or not Omicron is, but defences are being put up around the globe which inevitably has caused markets to be volatile and jittery. It is clear that there is still a long way to go before Covid is not headline news and the uncertainty of the virus, its variants and the impact will hang heavy over economies and markets through 2022. Perhaps we have all been wishful in thinking that we could quickly put the pandemic behind us as it seems it will take a good bit longer to truly overcome and cope with it.

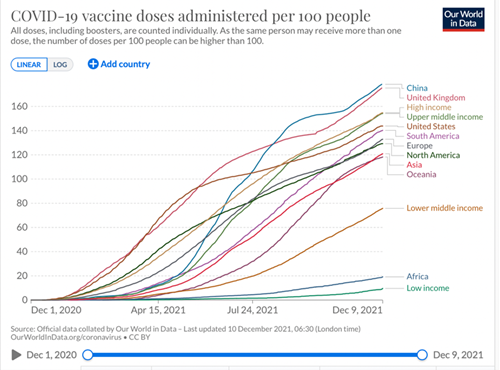

Undoubtedly, for humankind and the global economy the rapid discovery, testing, approval and distribution of vaccines to combat Covid has been unprecedented and will be written in the history of 2021 as a major milestone in medical science and public health. It is pleasing that several of the companies involved in this amazing achievement are included in some of the funds in many portfolios. The vaccine roll out has been a remarkable achievement.However, the chart shows a very variable picture of how the vaccine is being administered globally. By September 2021, 6 billion doses of COVID-19 vaccine had been administered across the world. But this global figure hides great inequalities between continents and income groups. Vaccine doses have so far been distributed very unevenly: low-income countries, particularly those across Africa, lag.

In August, the United Nations, International Monetary Fund, World Bank, World Health Organization and World Trade Organization called for international commitment and support so that every country would have vaccinated at least 40% of its population with at least one dose by the end of 2021.

What will 2022 bring for investors? Many of the asset managers at this time try to anticipate what might be coming our way. It is interesting reading the various views, but we are mindful that it is very hard to get it right. Inevitably, already the outbreak of the Omicron variant has altered views as it is quite likely to hinder global recovery. As we have seen the immediate impact on hospitality and travel has been significant and is likely to spread to other sectors. It is too early to conclude whether this is a short term set back or more severe. Hopefully, it will be only short term but it demonstrates how quickly views and sentiment can change. It is worth remembering that the funds we support are taking long term views of the companies and their prospects.

We saw through late 2020 and into 2021 following news of the vaccine that sentiment moved for a time to what are called “value” companies. The chart demonstrates the value v growth performance since the news of the vaccine late last year. Value investing is the art of buying stocks which trade at a significant discount to their intrinsic value. Value investors achieve this by looking for companies on cheap valuation metrics, typically low multiples of their profits or assets, for reasons which the investor believes is not justified over the longer term. Value has been out of favour for quite some time, as can be seen on the chart below which tracks the performance of growth and value over the last 3 years.

Many thought the economic climate of 2021 was the moment for such value companies to shine. They did, but not for long, and very quickly growth companies again edged ahead. Growth investing is a style of investment strategy focused on capital appreciation. Those who follow this style, known as growth investors, invest in companies that exhibit signs of above-average growth, even if the share price appears expensive in terms of metrics such as price-to-earnings or price-to-book ratios. There will be much discussed about these styles through the year ahead as economic conditions change. We have tended to favour growth, which has been rewarded with excellent performance but do not close our minds to value and portfolios do have some value exposure. We are not driven by style but by a manager’s ability to identify long term opportunities.

A lot of commentary throughout 2021 has been around inflation and interest rates. As global economies opened up there was a stuggle to meet pent up demand across many sectors, with used cars costing more than new cars due to lack of supply. We all heard of or experienced bare supermarket shelves, lack of care workers, hospitality workers, food processors, HGV drivers, rocketing shipping rates, energy and a world shortage of microchips so essential for many products. These labour and product shortages have caused inflation to increase rapidly in almost every developed economy. However, whilst there are varying views on whether inflation will be at elevated levels for a while, it is worth noting that the 30 year inflation curve is lower than 10 year which is lower than 5 year. As with any forecast, no one can know but on balance it would seem there is more of a consensus that it will ease and is not a long term issue.

Views on interest rate rises are changing rapidly as the impact of Omicron is analysed, albeit with limited data and fast changing conclusions. The latest headline from The Telegraph reads “Omicron is less severe than Delta variant and two Covid vaccine jabs give good protection, study suggests”. This is more positive than initial information suggested. December has now seen a rate rise from the Bank of England and the US indicate three rises in 2022. Concerns that the covid outbreak could hinder the recovery and growth have been trumped by fears of sustained inflation. This could all change very quickly.

We expect the early months of 2022 will be volatile as the fog clears around the impact of this strain of Covid. It is uncertainty that causes markets to be volatile and currently significant uncertainty exists. Hopefully no further strains emerge to cause further disruption. Overall, sentiment seems positive for equities for next year, which is encouraging. However, we must temper expectations as returns over the last few years have been elevated and it would be wishful thinking to believe double digit returns are the norm in a low interest and volatile world.

The challenge of fixed income in portfolios will continue into 2022. Fixed income has become highly corelated to equities which historically was not the case. Thus, if equities fall, fixed income tends now to do the same. Fixed income or lower risk funds do have a place in portfolios to provide a foundation and a safe harbour in difficult times. Direct property has proved a challenging asset class as liquidity ceased during the pandemic and many such funds have now decided to close. We will be looking at some alternative asset classes that might provide the robustness and negative corelation that we seek for portfolios. Absolute return funds have substantially struggled to deliver the intended performance and we have had to look to cash to provide the certainty, albeit a tricky asset in a higher inflation world.

No doubt 2022 will turn out to have its own twists and turns, but fingers crossed that it is a good year for us all.

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.