It would be fair to say that the Brexit result was not a surprise for the investment world. It was a shock. Despite the closeness of the polls, few in the investment community thought Brexit would become a reality and the 24th June was totally uncharted territory. Sterling dived against other currencies through the night, the Prime Minister resigned but tried to settle the markets before they opened, but the sell-off began. There were few who did not expect that this was to be a prolonged an uncomfortable period as markets found their level.

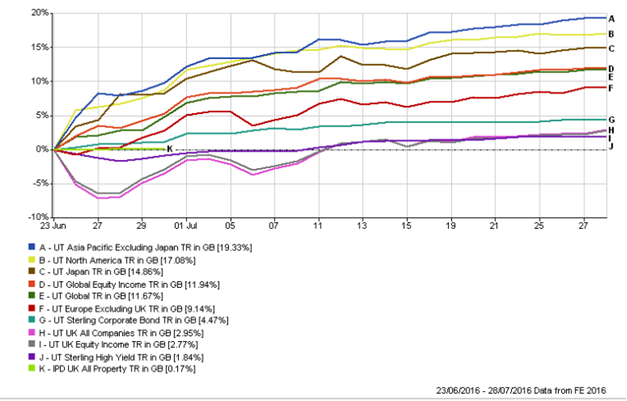

As we can see from the chart below, which reflects most of the asset classes that are included in portfolios, it didn’t happen and it hasn’t happened. Markets headed in an upward trajectory and so far that has substantially been the daily direction since the last week in June. So what has made markets react positively? The political situation in the UK has settled in a way the market likes. The Bank of England has virtually promised to cut rates. It could be as soon as early August, with rates already at a three-century low; a new prime minister is already in place; any trigger of Article 50 on Brexit now appears to be months away; and the new chancellor is seen as a safe pair of hands. The fall in Sterling is a gift to many large listed UK companies who will report an uplift in profits due to currency movements. A partial recovery for UK assets, at least until Brexit negotiations start, has some logic. All this coupled with encouraging economic data from the US and China and the hope, or indeed the expectation, is for more stimulus in the UK, the Eurozone and Japan, and a reversal of course in the US.

The new S&P high breaks a well-established pattern. Several attempts had been made to break through its high from May 21 last year, without success. So the new high is on its face very positive. If the S&P goes so long without a new high, it usually heralds a bear market. But if stocks break out after a long sideways period, it is very positive.

So this rally has the hallmarks of rallies that have preceded it since the crisis. There is no clear enthusiasm, but ever dearer bonds leave no choice for many but to buy equities. US equities had been becalmed since US QE asset purchases ended in 2014. Now low bond yields show that the liquidity sloshing from other central banks can overcome this, so US equities have moved higher. For now, the bizarre post-crisis logic is reinstated, and record low bond yields coexist with record high stock markets.

Certainly over the last few weeks, nothing has emerged that suggests that growth has been miraculously found and the global economy is striding upwards and onwards, but we have all endured periods of jittery markets so let us enjoy the moment. It would be foolish to believe that this is a new dawn and we must be ready for substantial volatility as the Brexit negotiations develop, the election of a new US president and the elections throughout Europe. What we have learnt over the last month or so is to expect the unexpected.

The one asset class that has been adversely impacted by the Brexit vote is UK Commercial Property. Many of the property managers have suspended their funds for the moment. The Brexit result spooked some investors and they instructed their positions to be sold. Undoubtedly, there was immediate concern that London might lose some of its appeal if it was no longer to be part of the Eurozone and many large tenants might look to move operations to major cities within the zone. Property funds consist of many and varied assets and a level of cash to meet “normal” redemptions and fund costs. The level and quantum of redemption requests increased dramatically post the result, with, we understand, one fund seeing redemption requests increasing from around 15 per day to over 400. Liquidity does not exist to meet such demand without realising some assets, which takes time and also should be never attempted under duress or else a “fire sale” price will be the outcome. Once one fund decides to suspend it is almost inevitable that the others will follow. Each fund will review its position at least every 28 days but we believe more regularly than that.

We understand the action some funds have been forced to adopt but we do not view this as a long and significantly detrimental issue for the sector. We understand that property transactions are being negotiated and concluded around valuation and there is no evidence that the sector has seen values tumble. Yields and occupancy remain strong, supply through new builds has not been excessive and is not forecast to exceed demand. The impact of Sterling’s fall makes property more affordable for foreign investors and we, as many property fund managers do, don’t believe they will abandon the UK. We have seen GlaxoSmithKline announce in recent days a significant investment in their UK operations, which would suggest that the door is open. Regrettably, it may take a few months to see the suspensions lifted but it impacts only a few of the property funds that we support.

Undoubtedly, we are at the foothills of a journey to leave the Eurozone. It will be a complicated and hugely testing mountain to climb. It would be foolish to think that the enormous uncertainty that this journey will encounter will not create difficult and volatile markets for the UK and Europe. Over the last few years portfolios have been steered towards a greater global exposure and we believe that not only does this reflect the world we live in and the opportunities offered but also mitigates the impact of country issues, such as Brexit.

So all in all, this rally feels somewhat unjustified and unsupported by the fundamentals. There are going to be a number of headwinds facing the UK economy as we detach ourselves from the EU over the coming years, which will likely reduce economic activity in the UK and impact domestic profits. Moreover, at some stage we are going to have to contemplate the possible impacts on the broader economy of the US election result, while disharmony could yet break out within the European Union. We are also mindful of the global debt burden, as well as China’s ongoing attempts to rebalance its economy.

Despite this hugely challenging backdrop, there are always plenty of companies that buck the macro economic backdrop and we believe the fund managers we support are very capable of finding them for their funds. A challenging environment allows the winners to shine and benefits the long term investor. It will certainly be an interesting period. Hopefully, a little less dramatic than the last few weeks.