“I have a cunning plan” said the Prime Minister to her cabinet after her Easter holiday. It now looks as though the cunning plan was indeed more Baldrick than brilliant and has spectacularly failed. Losers thinking they’ve won, and winners feeling as though they are losers. The snap election that was meant to provide the incumbent Government with a healthy majority to allow a strong platform for the Brexit negotiations has crashed but not yet burnt.

Markets tend not to be overly bothered about the colour of Government. However, we often talk about markets and certainty and this outcome has caused a strong element of uncertainty, although many now believe that a softer Brexit must follow. A real risk is that the Government is very fragile and cannot be held together and another election with a very different result takes us back to the Brexit starting line with the clock ticking loudly. Meanwhile, Mr Macron, the recently elected French President, saw his new pro-European party sweep to power in France. A European break up, which many worried Brexit would herald, seems to be moving now very far over the horizon with European markets reacting positively to the Macron outcome.

In the US, President Trump continues to struggle to deliver the promises that swayed voters to support him. He has withdrawn the US from the Paris Climate Change Agreement as he threatened to do, much to the rest of the world’s dismay but has suggested the Mexican Wall could be clad in solar panels. The Trump reflation rally initially continued at the start of 2017, but has faded away slowly over the course of recent months. His promise to cut tax, increase infrastructure spending and deregulate industry and banking were music to the ears of investors in US companies. Investors piled in to sectors that were set to benefit from Trump’s agenda, like energy, banks and some tech stocks. From a macroeconomic perspective, extra fiscal spending and deregulation could spur faster growth, and with unemployment already at cyclical lows, concerns over inflation returned. Despite all this, US equities have continued to perform well.

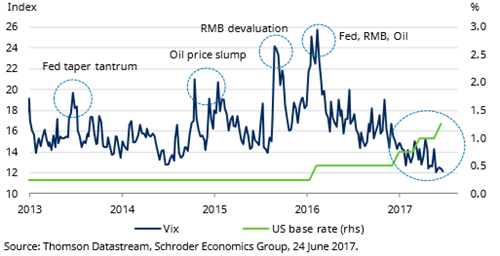

The rally in equity markets continues with the MSCI World index reaching new highs in June. However, the strength of equities against a backdrop of falling bond yields and elevated political uncertainty has raised the question as to whether investors are becoming complacent. Evidence of such can be found in the behaviour of the VIX index, often referred to as the “fear gauge”, which has recently touched new lows. The move is particularly surprising given that the US Federal Reserve has just hiked rates for the second time this year and is signalling another move in September.

The next shock to markets may not be driven by the Fed, oil or China. It could be geopolitical in origin, for while political risks may have eased in Europe they are building in Asia where tensions between the US and China will rise if North Korea does not ease back on its nuclear weapons programme. Notwithstanding such an outcome, more conventional economic risks are not insignificant. In particular the market appears to be underestimating the potential for US interest rates to rise. The desire to normalise remains high and rates are still well below where most models would have them given where the US is in its cycle. However, such pressures will not become apparent until further out. Low inflation will keep the Fed cautious.

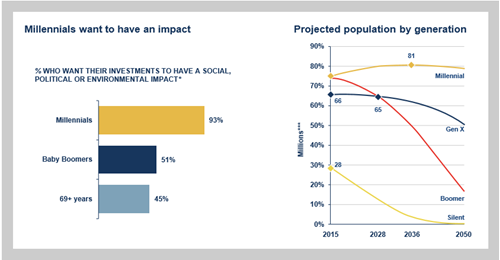

In recent days the regulator announced “a package of remedies” following its investigation into the asset management industry. The remedies feature all in pricing, more transparency and clearer objectives. The fund industry will be addressing these issues over the months ahead. However, reflecting on what happened in the recent UK election might be worthy of serious consideration for all of us in the asset management industry. Although, there would be few who would applaud the conservative election campaign and many would argue that the result was self-inflicted as twists and turns unsettled many of their traditional supporters; something fundamental was happening which seemed to be missed by pollsters. The Labour campaign targeted the younger voters through social media channels and got them motivated. This younger group, mostly “Millennials”, born in the last 20 years of the 20th century have a very different view of what they want out of life and indeed what they want from investments.

The chart based on extensive research reveals that around 93% of Millennials want their investments to have a social, political or environmental (positive) impact. This is more than double the percentage of those 69 and over and very close to double of the “Baby Boomers”. If these figures are anywhere near correct this will require the investment industry to think hard about their fund objectives over the next few years. Currently, the focus is very much driven by investors seeking outstanding performance but that sole focus looks like it will need to change to reflect the change in the Millennials objectives. However, it may be that change will evolve naturally as “new” companies that offer the greatest growth and investor returns might indeed meet these objectives.

We are already seeing exciting companies providing technologies, products and services related to more efficient, safe and superior usage of natural environmental resources and energy. Also coming to the fore are companies engaged in the ownership, provision of assets, development and maintenance of sustainable infrastructure. The investment focus is on environmental resources, low carbon solutions, transportation, pollution abatement and waste management. Also evident are companies providing technology, products and services which enhance human wellbeing, consumer choice and communication whilst minimising environmental impacts. So the change may occur by a combination of demand and technological innovation.

The FTSE 100 now looks vastly different from the 1980s. From the time of its inception in 1984 at 1,000 points, just 27 of the original 100 remain listed on the index. UK-focused businesses and conglomerates have been replaced by international juggernauts, so it is very likely that the investment focus wanted by the Millennials will occur naturally but certainly there is clear evidence that more socially aware investing needs to be moving up the agenda.

The reaction to Donald Trump’s withdrawal from the Paris Climate Change Agreement is rightly of great angst. However, many fund managers already running Socially Responsible and Ethical funds believe that economics will win the day and force the change to more environmentally friendly solutions. Renewables are already cheaper, battery technology will change the car industry and fossil fuels will be uneconomic. There are already more wind turbines in Texas than oil wells as the revenues from the turbines are more attractive. Economics may overrule the politicians and the change the Millennials want may be heading our way already.