The last few weeks in global markets have again been dominated by politics, and almost exclusively stirred up by Donald Trump and his continuing threats and imposition of trade tariffs around the Far East and the EU in particular. Markets have reacted adversely to his rhetoric and actions. The avoidable result has been something of a sell-off. The uncertainty of what the impact might be for the global economy is simply detested by markets.

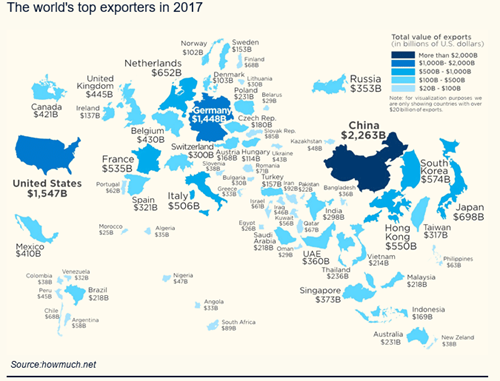

Tensions are escalating rapidly between China and the US. Threatened US tariffs due to come into effect on 6 July met with promises of a reciprocal Chinese response. This in turn saw US President Trump order his officials to draft plans for tariffs on a further $200 billion of Chinese imports. History would suggest there are no winners in trade wars but that does not diminish Trump’s appetite to pursue this damaging policy. In the last few days we have read that Harley Davidson will be moving most of its production for the EU market out of the US, not exactly the outcome the President would have wanted. We also read that US firms using imported steel are taking their grievance to the courts to challenge his actions. We suspect that these will not be isolated reactions as business is business and the President’s actions are hampering business for political and popular gain. Although time will tell if these actions prove popular as imported goods will soon cost a great deal more for the US consumer and some US exports will become priced out of the market.

As the Financial Times recently stated that perhaps “a further geopolitical risk to global markets is yet barely on the radar screens of investors. It is the growing gulf that divides the US and Europe. A parting of the ways that leads to greater barriers to trade and investment between the world’s two largest economies isn’t inconceivable given the multiple tension points tearing at the fabric of the transatlantic alliance. The parties are at odds over a number of items including the Iranian nuclear deal, the Paris climate accord, NATO commitments and data privacy regulations. Add to this toxic brew the US tariffs on EU steel and aluminium shipments, and potential trade barriers in auto trade. The current level of animosity is eroding decades-long trust and has called into question an economic partnership that has underpinned global prosperity and peace for the past 70 years. For decades, the transatlantic alliance has been the anchor of the global economy, creating and regulating the rules of global trade, investment and finance, pulling along less fortunate nations in the process, including China”.

US president Donald Trump has shaken Europe’s comfort zone with his steel tariffs and broader rejection of global institutions. The recent meeting of the G7 leaders was not exactly positive and Trump pretty much walked out on his allies with his now familiar tweet as he left, having cozied up to the North Korean leader prior to the G7 meeting. It will be Germany and France that will need to rise to the US challenge but whether Trump will listen is questionable. It would seem we have a President that is chasing the popular vote at almost any cost. So it is not difficult to see why markets have become unsettled despite most economic data showing a positive picture, albeit Europe and Japan faltering a little and a general global slowing.

It is so disappointing that politics has overshadowed 2018 and is turning it into a very bumpy year. The interesting thing about today’s fragilities is that the majority have their causes or catalysts in the US. A stronger dollar, higher US rates and, as outlined above, the credibility of US policy under Trump represent key risks to markets. These forces have not all appeared overnight, but slowing and less synchronised global growth make them more potent.

The US dollar, for example, is up by 5% since February. While this move has happened fairly quickly, by historical standards it is a small one, with the dollar remaining weaker than it was when it entered 2018. The move has been enough to put pressure on Argentina and Turkey however. Their respective central banks have been forced to raise rates to defend the value of their currencies, damaging growth in the process. While these countries are particularly fragile, the risk is for further spill-over effects. Countries like Indonesia are taking those risks seriously, as seen with the precautionary rate rise in May.

Related to dollar strength are rising US yields, with the yield on ten-year Treasury bonds recently crossing 3%. Rising yields put pressure on equities as many investors use this rate as a discount rate to compare equity values against their future cash flows. This will be most relevant for growth stocks (companies whose earnings are expected to grow at an above-average rate relative to the market) – names including Facebook, Amazon, Netflix and Google — where investors are paying for cash flows increasing over time. For now, the market is confident that their strong underlying businesses make them sheltered to such considerations but that requires to be closely watched, albeit at least one or more of these businesses have impacted each of us (positively) in the developed world and our exposure to them and their like is likely to grow.

The final threat emanating from the US is the Trump impact. Whilst his policies both at home and abroad spark day-to-day volatility, the real and significant risk is that US foreign policy loses credibility – and against the backdrop of a wavering global macro environment this could have negative repercussions for financial markets.

That said, not all risks to markets come from the US – resurgent oil prices have introduced a further potential headwind for investors. Conventional wisdom would suggest that with oil prices nearing three-year highs we may soon see some cracks appearing in equity markets.

JP Morgan stated when reviewing the first half of 2018 “What we perhaps hadn’t bargained for was an increasing amount of background noise from governments – the US administration in particular. The threat of a global “trade war” is dampening corporate spirits in the major export hubs of Europe and Asia. There are no such signs of weakness in the US and growth and interest rate differentials have contributed to a sizeable upward squeeze on the dollar which in turn has created challenges for some emerging market economies. Over the second half of the year we expect some reacceleration in growth outside of the US as the underlying drivers of the synchronised recovery – employment growth and increased availability of cheap credit – reassert themselves. The combination of robust earnings and subdued prices leaves equity valuations less stretched than they appeared earlier in the year. We expect modest gains in equity prices by year end as government bond prices drift lower”.

We would support that view but be cautious that further “background noise from governments” might continue to be unsettling and disruptive whilst an increasing oil price might hinder growth.

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.