We are now halfway through a year we will never forget. A year that has changed everyone’s life. A year that has changed every business. A year that has altered the way we work and live. A year with the fastest ever sell off in markets but also the fastest recovery. A pandemic that has yet to be truly contained, although at times that seems to be forgotten. As we head into the second half of 2020, we can look back at the market maelstrom of March and reflect that once again sitting tight and avoiding panic reactions has yet again been the sensible route.

We must remain cautious about the road ahead in the short term as the fear of a second wave of the pandemic constantly casts a cloud over markets and adverse news flow triggers volatile reactions. As long-term investors, we need to avoid the unsettling disruption of short-term noise and work with asset managers to find the long-term winners with the potential to deliver strong cash flows and growth.

Since the sell off the fund managers have been reviewing portfolios and making changes to take advantage of the over- correction in markets, which saw all companies marked down almost without exception. This has allowed many of fund managers to buy into companies that were attractive but too expensive. As a result, we are seeing many of the equity funds we support recovering faster than the market, which is very pleasing.

The UK Market

The UK market is the laggard and is likely to remain so as the FTSE 100 is dominated by energy and financial companies that are out of favour. This coupled with dividend cuts or indeed worse and the dreaded Brexit uncertainty has resulted in a much weaker recovery across all UK markets. There are undoubtedly opportunities but overall the UK is a bit unloved. The impact of Brexit has been put into a different context as a result of the dramatic economic effects of the Covid-19. Nonetheless, it is back in the spotlight and is likely to remain so in the coming months. Despite the disruption caused by the pandemic, the UK government is refusing to allow for more time to complete the trade negotiations before the Brexit transition period comes to an end. A no deal Brexit is being mooted once again.

As mentioned earlier, the recovery has been remarkably fast and strong, which has surprised almost all fund managers and commentators. It is much too early to draw any great conclusions other than if economies can be opened without any significant further disruption or lockdowns then the dramatic falls in economic activity will be quickly reversed. In the last few days, we have seen almost endless queues at various fast food and retail outlets, which suggests there is a strong pent up consumer demand.

Global markets

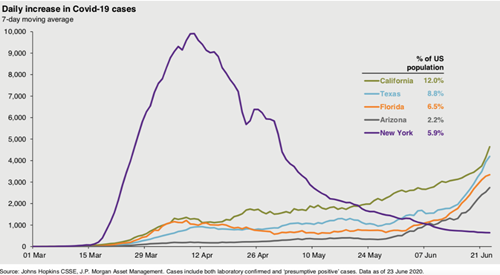

However, as can be seen from the chart of Daily Increases in US Covid 19 cases, the daily change is causing some concern. The increase in cases is going in the wrong direction, apart from New York, which is causing markets to be jittery. This is giving rise to a fear that recovery might be derailed.

Whilst, the policy response has been commendable, it is possible the market’s expectation of the recovery might be too optimistic. As a commentator from JP Morgan said “It’s not that we believe people will permanently change their behaviour – we are social animals, after all. We just think it will take a little longer to get back to full normality”.

“Chief among our concerns is that the virus itself may linger and some need for social distancing will remain, in countries such as the US and UK, at least. In addition, high unemployment and a dramatic increase in public and private debt may serve to restrain spending in the recovery. We may also be at the beginning of a period of difficult political fallout as politicians seek to apportion blame for the crisis. The US election of 3 November could have important market implications. With the UK having left the EU but not yet having secured a new trade deal, Brexit might also – once again – generate volatility”. We would broadly support these views and continue to take a cautious view of what might be ahead. We are looking at cash as a home for short term needs until greater clarity emerges.

Property funds

The issue with property funds continues. Property funds continue to be deferred or suspended which is hugely frustrating. It is done to protect investors and that is welcome, but it is nevertheless a frustration.We don’t have any evidence to believe this position will change soon. The reason remains that valuers can’t reliably establish values for large portions of the portfolios due to the coronavirus and its subsequent impact across each key sector. More data is needed to allow meaningful valuations to be established. Leisure, hotels, retail and indeed offices are all in the spotlight as we all come to terms with what the impact might be upon many sectors of the property market. We have all seen shopping habits change prior to the pandemic and the changes have further accelerated since the outbreak. Leisure has been hugely impacted and looking forward with social distancing remaining for some time, this sector looks very vulnerable to failure. This would include restaurants, bars and gyms. Home working has raised serious questions about the continuing need for large office space as home working has been enormously successful. It would be reasonable to expect that a very conservative view on values will be adopted on resumption.

Despite some negative press commentary about the sector, we understand the property funds still collect a substantial portion of the rental income due. Undoubtedly, some tenants are in distress and may be casualties of the coronavirus fallout. It is very easy to take a pessimistic view, but we must be mindful that in the immediate aftermath of 911, it was heralded as the end of air travel. It wasn’t and whilst property needs may change, they will not vanish.

It is still too early to accurately predict the ultimate impact of the coronavirus on economic activity and corporate earnings. The sooner the virus is confidently contained, the quicker the recovery in economic activity will be, particularly given governments and central banks are acting decisively to shore up the economy and support the prospects for recovery. However, the longer the period for which social distancing measures are required, and the longer the period of reduced travel to restrict the transfer of the infection, the greater will be the impact on corporate earnings. So, our message is to remain cautious but look beyond the noise.

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.