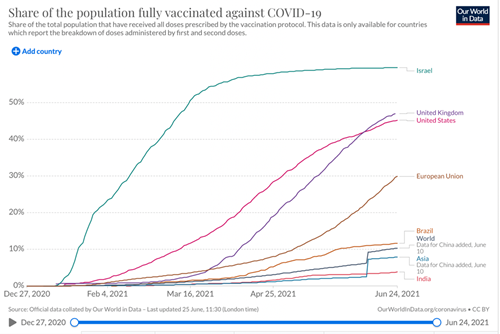

We are slowly navigating our way out of the pandemic as economies across the globe are getting back on their feet, albeit with some bumps and inconsistencies along the way. There is a determination to get everything back to normal as quickly as possible but it is evident that the pandemic is not yet behind us as the case rates in the UK would evidence. The importance of the global vaccination program is so vital to unlocking the doors to normality that had to be closed for over 15 months now. As can be seen from the chart below, only Israel has fully vaccinated >50% of their population as at the 24th June. There is quite some way to go.

Over the last few months, public health data have indicated that the global pandemic, measured by number of cases, likely has peaked in the second quarter of 2021. The seven-day rate of new cases of COVID-19 globally declined from around 5.8 million per week in mid-April to 2.9 million in early June.

At the same time, despite a bumpy start, vaccination rates across developed markets have accelerated, and these countries are now forecast to reach herd immunity over the next few months, although that is not a universal view. However, global rates of new cases and deaths are expected to continue to decline, despite slower vaccination rates in emerging markets countries. As can be see from the chart Asia is lagging as is India. There is, of course, a risk that a new variant that defeats the vaccine could emerge, but hopefully, vaccine technology appears robust to counter this.

However, with the pandemic looking as though it is receding, Government and central bank policy support has also likely peaked. The additional pandemic relief legislation passed in March 2021 boosted the U.S. economy, with positive benefits to the rest of the world. However, the U.S. household stimulus handouts, won’t repeat, and the federal government’s enhanced unemployment benefits are expected to fully expire by the end of Q3. It is a similar picture around the globe and in the UK the furlough scheme is reducing over the months ahead.

Over the past few months, economic recoveries have been uneven across regions and sectors. In the case of the U.S.and other developed economies, this has contributed to supply chain bottlenecks and a bump up in inflation. Currently the US is recording inflation of around 4% and the UK above 2% and likely to hit 3% soon. It has been widely reported that there is a global shortage of semi conductors, which are ubiquitous in any item that uses electronics, which is creating issues for many sectors, and notably the automotive sector. The supply bottlenecks will ease as production ramps up and the backlogs are cleared, but supply could be disrupted well into next year. The result of this supply disruptuion has seen price rises and so the concern is whether higher than expected inflation is with us for a while or not. The UK has also had to deal with the impact of leaving the EU, which has added to supply chain disruption.

We, along with many asset managers, continue to view the factors driving the recent price surges as transitory and, as a result, haven’t materially changed our broader views on the impact of the pandemic, policy, or economic growth. However the second half of the year looks set to be bumpier, but cautiously look to equity markets to continue their upward path, albeit not at the pace of 2020. However, wealthy Americans are optimistic about their long-term investment returns, expecting to earn average annual returns of 17.5% above inflation from their portfolios. according to a survey by Natixis Center for Investor Insightof households that have over $100,000 in investable assets in March and April of 2021. They might just be a little disappointed! Any upward path will not be linear and the uncertainty of inflation worries are likely to contribute to the market’s inevitable anxiety but it will take a lot of bad news to shift the central banks towards a more rapid withdrawal of easy money.

As we have discussed many times over the last few years, the role of fixed income in a portfolio has become challenging. Low and negative interest rates, uncertainty over rate rises, coupled with often a high corelation to equities has changed many of the defensive characteristics that fixed income assets historically provided to portfolios. Forecast returns from many fixed income classes struggle to deliver appealing returns after inflation and costs. Perhaps this will change but it is certainly challenging. Many discussions within the investment world involve seeking alternatives to the traditional fixed income instruments, historically dominated by Gilts or Treasuries as part of a 60:40 portfolio, which is also consigned to history by many fund managers. For us, Commercial property was the prime alternative asset that provided a component of a good home for part of almost all porfolios over many, many years. We recommended, almost without exception, a holding in a direct property fund and it delivered very satisfactorily a blend of income and growth. However, since the EU referendum and more recently compounded by the pandemic, this asset class has suffered from fund suspensions or deferrals. The reason during the pandemic has been that the independent surveyors could not provide valuations to property fund managers with any conviction so the pricing mechanism could not function, making it impossible to trade as we require. The regulator is looking at this asset class and may require trading to be monthly or quarterly or longer. That would not provide the liquidity we would want for portfolios so it is time to move on. Performance is not the driving force for this decision but liquidity is.

There is still a high level of uncertainty in the outlook, including the upside and downside risks to growth and inflation, but no one expected markets to be where they are now when the reality of the pandemic became evident in March 2020.

Douglas Kearney C.A. Investment Director

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.