Overview

It has been another period of turbulence on global markets. Too frequently it feels like one step forward and two steps back. Economic data and geopolitics continue to create uncertainty across the globe giving rise market volatility.

At home, after inflation remained stubbornly high at 8.7% and core inflation (everything barring food and energy) kept rising steadily, the Bank of England raised its interest rate by 50 basis points, double what was expected to 5.0%. Markets are suggesting a 70% chance of another half-percent hike in July.

It is easy with hindsight to criticise the Bank of England for not acting quickly enough to increase rates to keep inflation under greater control. However, it does feel that there is a major catch up underway that will increase the strain on many household budgets, which may result in recession. The interest rate lever seems a very blunt instrument that takes quite some time to have an impact. Perhaps, there are no other tools or levers to employ, but it will come as no great surprise if we hear the rate rises have gone too far and taken too long. However, yet again savers are getting very little of the rate rises: a perpetual issue that needs addressed. Perhaps, the introduction of Consumer Duty will see this problem tackled.

July will see a sizeable step downwards in the cost of power for households and businesses. The mechanics of the UK energy market result in it taking longer for changes in the wholesale price of power to flow through to retail prices than in much of the developed world. This should help reduce headline inflation, albeit it won’t be in the numbers until August.

Bonds

As noted in a recent commentary from Rathbones “UK government bonds have responded to the Bank of England’s (BoE) sharp rate rises by falling in price (therefore the yields have risen, as they move in opposite directions). The largest price falls were in bonds that have one to two years before maturity because the prevailing short-term rate of interest is closely tied to the BoE’s rate. One-year bonds yield 5.35% and two-year bonds yield 5.20%.

Further out, 10-year UK government bond yields aren’t as high. Currently they trade around 4.30%, slightly down from the 4.50% they reached a couple of weeks ago. When short-term interest rates have much higher yields than their longer-dated counterparts, that tends to signal that a recession is coming. Essentially, what this is telling you is that interest rates are going to rise in the next six months or so but then start falling after that, likely because of recession.

Longer-term bonds do best when GDP growth is stagnant or falling and central bankers are cutting interest rates to support the economy. The reason for this is that a long-term bond is a locked in interest rate that becomes attractive when new debts are issued with lower interest payments. This may be likened to a situation where you have a five-year term cash deposit paying you 5% and prevailing interest rates slump to 2%; as you’re getting a better return than what’s offered in the market, you’d be pleased as punch. The difference is that bonds can be sold on to others, so their value can be priced in the market”.

As we look to be nearing peak rates, bonds are coming back into favour and being viewed positively. It’s impossible to know ahead of time where the peak in rates will be, but historically bonds tend to perform well from that point onward.

Equity

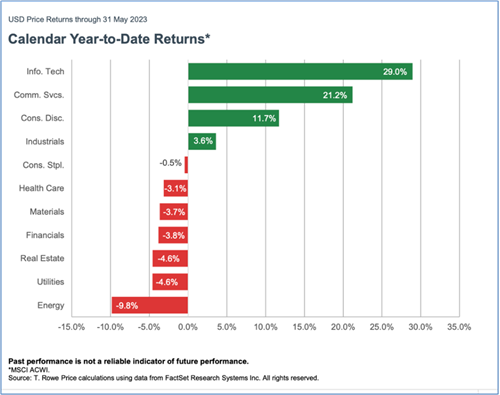

The first few months of the year has seen almost a reversal of the fortunes of the winners and losers of 2022, as the chart on the right shows. Growth has again outperformed value.

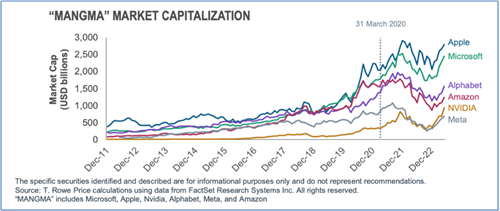

As can be seen in the graph below, the group known as MANGMA (Apple, Microsoft, Alphabet, Amazon, NVIDIA, and Meta) have delivered strongly in the first five months of the year and accounted for more than two thirds of the year’s index return:

It is important to stress that performance over a few months can be very misleading and we would be wary of drawing too many conclusions, particularly in markets which have such wild daily swings.

It does however reinforce the view that patience is frequently rewarded, and that the clamour and noise can be unsettling and result in a compelling need to follow the herd to jump on the “winners”. This is more often than not a mistake and should be avoided.

It has been a very challenging time for investors since late summer of 2021, but hopefully once rates peak and inflation is seen to be under control then the mood will swing, and confidence will return. Currently, enduring upward momentum is elusive.

Douglas Kearney C.A. Investment Director

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.