UK landscape

The political landscape in the UK looks set to change significantly with Labour potentially gaining a substantial majority in the forthcoming election. Such an outcome would provide a strong mandate for the new government to implement the change they have been advocating for throughout the campaign. The market has long recognised that change is almost inevitable so the only shock would be if the polls are more than wildly wrong.

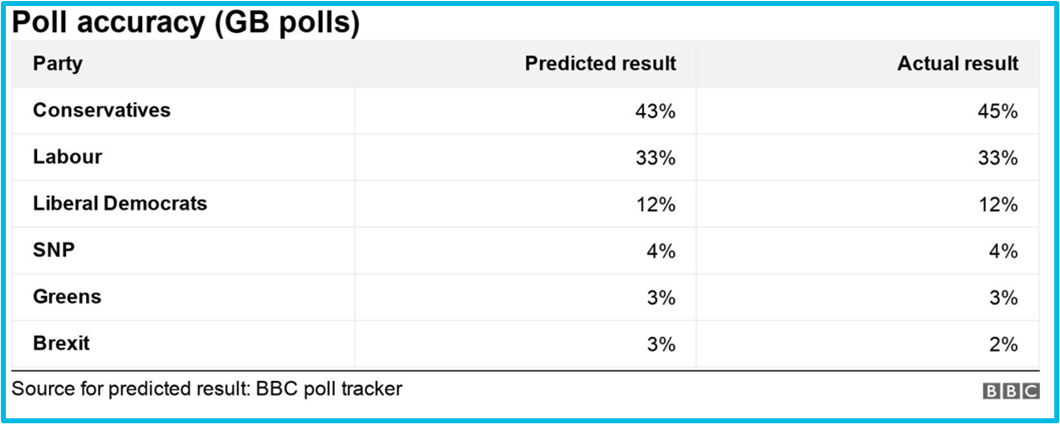

After being widely criticised for their performance in the 2015 and 2017 general elections, the polls have proved more accurate in the 2019 election than in any contest since 2005. On average the final polls in 2019 underestimated the Conservative vote by just under 2 points and overestimated Labour’s by only 0.5 points. So, it would seem inevitable that the predicted result will see Sir Keir Starmer occupy 10 Downing Street. It would the only question is the size of the majority and the size of the opposition.

The UK fixed income market recognises that the Labour Party must be keen to serve two terms, because the party’s project cannot be delivered in one term, so fiscal orthodoxy is virtually guaranteed. Undoubtedly lessons have been learnt from Liz Truss’s brief term of office, and it is unimaginable that any steps will be taken to wrong foot and spook markets.

The recent uptick in unemployment and the gradual decline in inflation point to a peaking in interest rates. Indeed, it would seem highly likely that the Bank of England may cut interest rates at their next meeting on 1st August and if not surely by the following meeting on 19th September. It was unimaginable that rates would be changed on 20th June as the political uproar would have been deafening.

Global changes

2024 is not just an election year. It’s perhaps the election year. Globally, more voters than ever in history will head to the polls. At least 64 countries, plus the European Union, representing a combined population of about 49% of the people in the world, have held or will be holding national elections this year. The US election in November is awaited keenly, perhaps for not the best of reasons.

Thus, the UK election is a small part of the global election picture, much as the UK is a small part of most of our portfolios particularly in equity exposure. The impact of the result on each of us is hard to decipher as very little is being said and indeed some backtracking has been evident. Growth is the key to providing the finance necessary to deliver manifesto commitments but one must wonder how soon that will need to be significantly augmented by tax rises or rule changes to generate the money needed or take on debt.

Fiscal constraints

Both Labour and the Conservatives have committed to the primary fiscal target that is currently in play which stipulates that government debt must be falling as a percent of GDP by the fifth year of the forecast. Achieving this, even without any new tax or spending measures, looks challenging given the pressure on public services.

The Institute of Fiscal studies has reviewed the manifestos and reported on 24th June that “The choices in front of us are hard. High taxes, high debt, struggling public services, make them so. Pressures from health, defence, welfare, ageing will not make them easier. That is not a reason to hide the choices or to duck them. Quite the reverse. Yet hidden and ducked they have been”.

Overall, with both parties acknowledging fiscal constraints, both parties competing in the political centre ground and the well-flagged potential for a change of leadership, there are unlikely to be any significant implications for markets when the vote is counted. A Labour election victory will be a “net positive” for financial markets, strategists at JP Morgan have said, in an analysis that underlines the appeal of Keir Starmer’s “centrist platform” to the City of London.

Growth and Inflation

We came into the year with markets expecting an acceleration in global growth and corporate earnings, declining inflation, and substantial central bank rate cuts. Adding in some artificial intelligence-related excitement, it was hoped that a new and enhanced version of ‘Goldilocks’ was back. In anticipation, bond and stock prices rallied strongly through the turn of the year

The combination of all three of these expectations seemed to be too good to be true, and so it has proved. Growth has been resilient but so too has inflation. This has supported risk assets -equities- but challenged government bond markets as the prospect of large and imminent rate cuts has significantly diminished.

Inflation remains key to the road ahead, having been much stickier than anticipated, and some fear it might tick up later in the year hindering interest rate cuts around the globe.

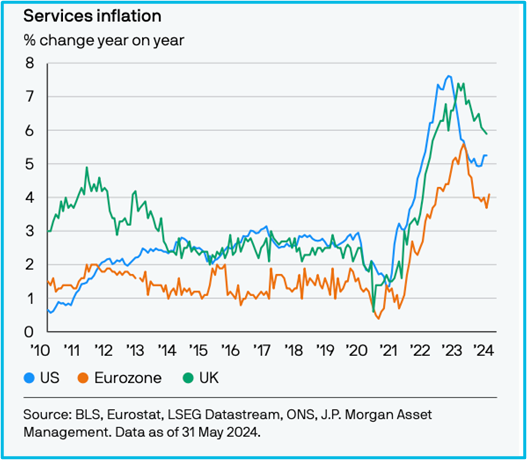

A large part of the drop in US inflation was thanks to food and energy prices stabilising. These favourable ‘base effects’ were slower to materialise in Europe but are now helping headline inflation fall. But underlying inflation in the US is proving very sticky at around 3.5%.

In the Eurozone and UK, the underlying components, like services, also appear to be remaining high However, it was good to record that prices in the UK rose by 2% in the year to May 2024, down from 2.3% the month before, and the lowest rate in almost three years. It means inflation has finally hit the Bank of England’s target, which is encouraging, and services Inflation in the UK recorded a decrease to 5.7% in May from 5.9% in April of 2024.

In their mid-year outlook, JP Morgan commented that they expect all major Western central banks to begin cutting rates before the end of the year, which they will present as normalising policy from restrictive levels rather than easing. They conclude that rates will stay much higher than in the pre-pandemic era.

Douglas Kearney C.A. Investment Director

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.