The EU referendum produced a result that has created huge uncertainty in the UK, Europe and far beyond. The result was predicted by the polls, but not the bookmakers, to be close and the outcome likely to be “remain”. Historically, “don’t know” voters have tended to back the status quo but it seems that the opposite substantially happened in this vote for whatever reason- perhaps a protest against Westminster more than against the EU. It will take quite some time for any clarity to appear. There has been a mountain of words spoken and written around the world since the result, with varying tones that so far have added little to providing clarity. It is not the “sound bite” headlines that matter but what now follows that matters.

It would seem foolish that any of the many involved in this momentous event would seek to achieve a pyrrhic victory. Indeed we have seen Boris Johnson and George Osborne begin to pedal back from their stark positions prior to the vote and we suspect sensible compromise will be sought both at home and with the remaining EU leaders. Undoubtedly, there will be some within Europe fearful of referendum contagion breaking out and wanting to make an example of our seemingly petulant attitude. However, we suspect, and hope, that a solution can be found. Europe has a history of finding solutions- Denmark and the Maastricht Treaty comes to mind. Solutions, perhaps not perfect but allow the wheels to keep on turning. It should be remembered that Johnson some time ago did say a “leave” vote would be the basis of renegotiation rather than absolutely leave, whilst Cameron retorted that “leave” meant he would invoke Article 50. Astutely, Cameron will not be invoking this Article and it remains to be seen if anybody will. Will there be an austerity budget? Looks now unlikely. Might there be a General Election at which this is at the core? Who will be the leaders? Lots of questions but sadly no answers as yet. Nothing is certain.

As yet it is much too early to be able to assess the impact on the investment world other than to refer back to the Investment View of a couple of months ago. In the short term asset classes will be negatively impacted but US, Japanese and Global equities will be more pre-occupied with other events: the US Presidential election taking centre stage in the autumn. Our message is absolutely clear. Do not make any rash decisions in the midst of this turbulence. Let markets settle, see some clarity and direction both at home and in Europe, let our fund managers spot opportunities that have been oversold. The position will settle and although some of the ramifications of the vote may be with us for years, markets will recover as they have done consistently after major events.

Prior to the referendum, Schroders produced a paper which looked at the aftermath of major events in world markets and what subsequently happened. It is factual and reassuring reading. We summarise their findings below.

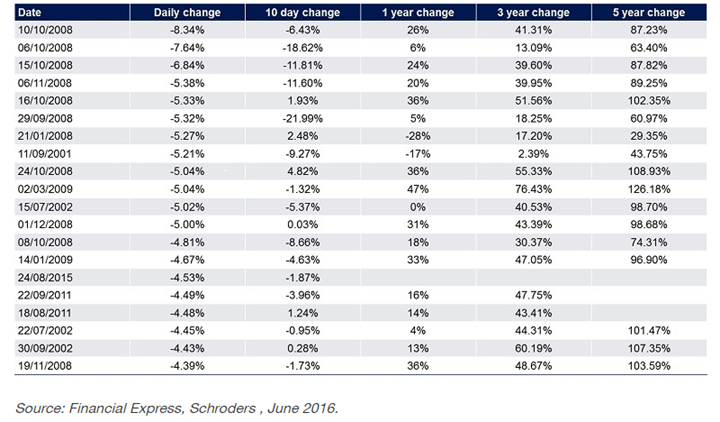

“We looked at the FTSE All-Share, the broadest measure of the UK stock market, over a decent timeframe – the past 25 years. We then filtered the data to show the 20 greatest one-day falls and looked at what happened over the days and years that followed. On the worst day, during the depths of the global financial crisis on 10 October 2008, investors lost 8.3%. However, one year later, the index had surged and returned 26%, including income paid through dividends, to investors. The returns continued: after three years the total return was 41% and after five years it was 87%.

The figures apply to those holding investments before the market fell. Those who bought at the lows on those days would have seen even greater returns.

Most of the worst days, as the following shows, were during the severe market turbulence of 2008. Look back to 11 September 2001, the day of the terrorist attacks on the US, and the fall was 5.2%, the eighth worst in the last quarter century. The market struggled in the years after that as the technology bubble continued to deflate, but after five years, it was 44% higher.

The most notable five-year gain following one of the top 20 worst days was 126% after a 5% fall on 28 February 2009, another episode in the financial crisis and shortly before the UK bank rate was cut to 0.5% and the Bank of England’s programme of quantitative easing was announced.

It’s worth noting the wild volatility that often follows a big one-day stock market fall. For example, in the 10 days after 27 September 2008, the sixth worst day, the FTSE All-Share lost 22%. Yet still, the total return was 61% after five years.

Greatest one-day FTSE All-Share falls in past 25 years and subsequent returns

Trying to move in and out of markets, to call the top and the bottom, is exceptionally difficult. And, if you get your timing wrong, this can have a damaging effect on returns. Consider this example. If you had invested in a basket of equities investments in global stock markets – the MSCI World index – between 2005 and 2015 you would have received a return of 60%. But if you missed the 10 best days within that period then you would have lost 5%, according to Financial Express data compiled by Schroders. It’s an extreme example but demonstrates the risks of trying to time markets.

The lesson from history is to keep your nerve at times of turbulence. But data also highlights the merits of long-term investing. The timeframe of five years is usually suggested as the minimum for stock market investment on the basis this allows investors to experience the ups and downs of a normal market cycle; though, as ever with investment, nothing is guaranteed.

Therefore, although the last few days have been hugely unsettling our message is do not rush and history suggests this will be the sensible action. The Global road to recovery was not without its bumps but this is a major diversion. It will be a challenging journey with many surprises.