It has been a momentous start to the year. The US and the world welcomed a new US President who quickly signalled that America was again outward looking. Joe Biden moved to reinstate the US to the Paris climate agreement just hours after being sworn in as president, as his administration rolled out many executive orders aimed at tackling the climate crisis.

Biden’s executive action will see the US re-join the international effort to tackle the dangerous heating of the planet.

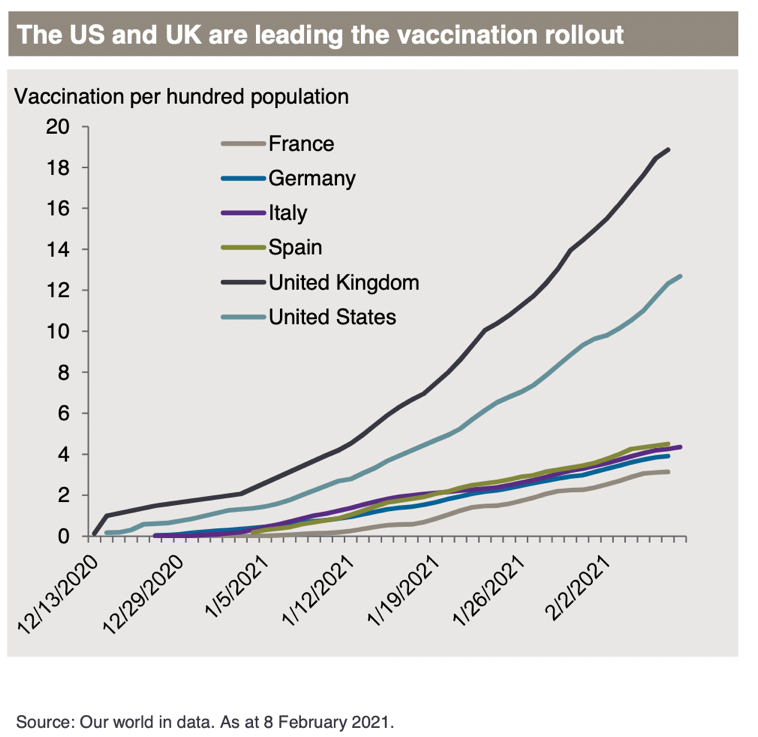

Global optimism now appears to be justified that the global pandemic can be managed following the success of several vaccines that are being rolled out, protecting humanity and providing the road back to a normal life. The chart shows the impressive delivery by the UK and US, whilst the well-publicised supply issues of the EU are evident from the chart below, but they will catch up. Economies will soon be able to re-open and significant recovery and global growth can be expected very soon. The consequences of economies re-opening raise some concerns for the investment world which we are currently experiencing in late February.

In the previous issue of Investment View we commented, “One economist that we follow suggests a volatile period through to March but is optimistic thereafter”. So far, he has been proved right with some fairly volatile days recently. Indeed, the 25th February was the most turbulent day for the US bond market, the world’s biggest, since the height of the coronavirus crisis last March. “The day proved to be nothing short of a rout in global markets, with the sell-off in sovereign bonds accelerating as investors looked forward to the prospect of a strengthening economy over the coming months,” said a research strategist at Deutsche Bank. The turmoil in the bond market spilled into equities, sending the Nasdaq Composite sinking 3.5 per cent, in a trend that followed into European and Asian equities.

The reason for the turmoil in markets is not actually “bad” news. The equity volatility has arisen as investors grow concerned that the worldwide economic recovery from the Covid-19 pandemic could generate inflationary pressures, which might cause central banks to tighten monetary policies and increase interest rates. A re-run of the taper tantrums towards the end of the financial crisis? “With the US economic outlook boosted by pandemic improvement, vaccine distribution and the prospects of President Biden’s fiscal package getting through the Congress, investors are now fixated on the risk of inflation and economic overheating,” said the chief Asia market strategist at JPMorgan Asset Management. The success of the vaccination rollout has been impressive, and economies are viewed as twitching to be let off the pandemic leash.

There has been quite a lot of commentary over the last few months on the probability of higher-than-expected inflation returning and opinions are very mixed. One bond manager we support believes the “reflation trade” is exaggerated. The reflation trade is the buzzword of the investment community; heard frequently in the past month or so. In a general sense, “reflation” is defined as an upswing of the economic cycle where both growth and inflation are accelerating, typically (but not always) following a deflationary period or recession. What appears evident is that no one is suggesting a return to inflation rates of years ago, but it is likely that some increase might be on the horizon, albeit that it may not be other than temporary as the chart above from JP Morgan suggests.

The chart above showing Yields does clearly demonstrate the low yield world. It is too early to conclude who is right. Is this a real crossroads or an exaggerated adjustment impacting markets? In addition, there is much noise around the value v growth debate that we have touched on many times. Certainly, many of the Covid losers will be winners as economies open. The win may be short term and the long-term winners may still be in the new disruptors. Much use is made of the term ‘technology companies’ but the reality is they are good growth companies that exploit new technologies for huge advantage. We will see but draw no conclusion just yet.

The recent rise in bond yields reflects growing confidence that the economy is on the path to recovery, which would seem true, but also expectations that inflation is headed higher, which might prompt central banks eventually to raise interest rates to cool price hikes. Less certain but must not be dismissed. Rising yields can make stocks look less attractive relative to bonds for some investors, which is why every tick up in yields has corresponded with a tick down in stock price.

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.