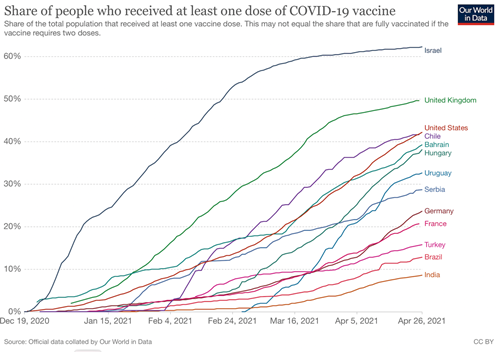

Over the month of April, the UK has seen some significant reduction in lockdown restrictions allowing most of the domestic economy to live again. Retail and many services are now allowed to operate across the UK, albeit with social distancing which reduces capacity and thus revenues. Indoor entertainment, hospitality and some travel remain quite some distance from being permitted to return to anything close to normal. It is hoped that the remaining sectors will be able to return by the end of June. So the road to recovery is mapped. The vaccination rollout continues to be a very impressive operation across the UK. The chart shows that only Israel, with a significantly smaller population than the UK, is leading the global roll out. The UK ‘s notable achievement with around 60%+ of adults having had one vaccination, has enabled the economy to begin to get back on its feet. The US is also succeeding in delivering a strong roll out of vaccines, which is benefiting their economy, and which in turn benefits the global economy.

Most commentators are expecting the recovery to be strong through the remainder of this year (and next) although it is likely to be an uneven path. A combination of massive fiscal support combined with the inability to spend has resulted in a significant accumulation in household savings in all major economies. In the US, the President’s recent stimulus is likely to see US demand bound from the blocks as consumers consume again. The UK looks to be on a similar road, but Europe which, as widely reported, has had serious issues with its vaccination rollout is lagging and recovery is still some way off.

The outlook in emerging markets is also uneven, with much of Asia managing to contain the pandemic effectively. China, which had a short but very sharp targeted lockdown, recently reported its GDP grew by a record 18.3% in the first quarter of 2021. Although the figures may flatten on deeper investigation, it does provide an indication of the significant level of the bounce back. However, the recent data and distressing newsflow from India is extremely harrowing. It was only at the end of January that the Indian Health Minister declared the pandemic had been contained. It is a stark reminder that the challenge of defeating the virus remains and is a global problem that requires a global solution before any true normality can be enjoyed.

What we are likely to see over the months ahead is some of the hardest hit companies in the hardest hit sectors recovering. It would be hard to imagine that airlines, commodities (oil), hospitality, leisure, holidays, and many other sectors not having a stronger year than 2020. The fund managers will be looking at the many potential opportunities; companies in these sectors may offer a possible quick gain but many are unlikely to offer significant long term growth opportunities. It is the long term growth rather than a quick fix that we seek for portfolios. We will be closely monitoring the recovery, but believe that whilst the most wounded will show some significant recovery, the focus should remain on long term growth.

What markets are looking out for is whether the rebound causes a spike in inflation. Some of that looks to be priced in already. Few are suggesting that inflation will be a significant feature over the next few years but it may feature more than it has for many years.

As we can see from the chart below of the VIX (volatility) index, volatility is returning to more normal levels and “fear” has substantially subsided, at least for the time being!

It will be inflation that we must now watch, and see what impact that has on the diverse fixed income sector. We saw the concern about inflation cause markets to be choppy for much of February and March as inflation worries pushed longer term Treasury rates higher. Higher rates mean capital values hit to compensate, means lower earnings, means equity prices hit. Fixed income has been a challenge for quite some time now and it continues to be so.

Property was until the last few years, a good provider of yield and to a lesser extent capital growth. However, since the EU referendum and more particularly, the impact of the pandemic has made this once reliable asset class unattractive. Many, if not all, property funds suspended trading throughout the last 12 months (and some longer) as property values became nigh impossible to establish. Although, this is now easing, there remains huge uncertainty about what the needs and demands will be for commercial property over the next few years.

It is hoped that we can look forward to the start of summer with some hope and optimism on all levels.