This investment view is written against a backdrop of unimaginable and brutal suffering that the Ukrainian people have been facing for two months now. The pictures and reports coming from the country are distressing and hard to comprehend. The investment world has been thrown into turmoil but pales into insignificance against the distress, death and destruction inflicted against that country and its resilient people. Whilst commentators make endless predictions, there is no end in sight for this horrendous conflict and no certainty to where it might lead in the weeks or months ahead.

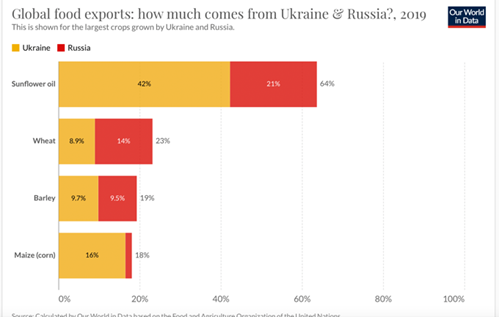

The conflict has had enormous ramifications particularly across Europe. Ukraine and Russia are major Global crop producers and Russia is an extensive energy supplier to Europe. The conflict started at the end of February and added to the global economic turmoil of a post pandemic developed world (although China continues to have major covid issues). The global economy was in the foothills of trying to come to terms with rampant inflation, which is now accepted as more than transitory, rising interest rates, energy costs spiralling to unprecedented levels creating a cost-of-living crisis. (Does increasing interest rates whilst a cost-of-living crisis grows help or hinder? Will increasing rates dampen consumption that is already under pressure? Is stagflation coming at us?) The result of these issues has created huge market uncertainty, volatility and as the Financial Times recently reported “Nowhere to hide for investors in recent market turbulence”. It has been a very challenging period and regrettably it is not abating. It will end but it does not seem imminent.

Markets have been indiscriminate in axing many valuations, particularly of growth companies. Much of this is explained by the possible negative impact of rising interest rates on the earnings of companies. That is perfectly understandable if the initial investment decision had been assessed on almost zero interest rates. The theory is that rising rates will impact profitability, which is true, but it matters what rates were assumed.

From our discussions and knowledge of asset managers, much higher rates are used in the investment analysis. Thus, the impact of this assumption may not be as damaging as the market calculates in most cases. Although growth might be slowing, few are yet seriously expecting a recession to be on the horizon. That may change as did the view that inflation was transitory. Our conversations with asset managers suggest in the main that companies remain very positive about future growth and that the storm will pass. Inflation will subside and the extent of interest rate rises will become clearer over the next few months. However, energy supply and cost remain a concern and the duration and outcome of the conflict in Ukraine is simply unknown. So, it is very hard to see reduced volatility until these issues start to have clarity and some certainty. The Vix index reflects the current elevated volatility concerns but is no where near the levels of March 2020.

The first quarter of 2022 has been bruising for almost all asset classes and the FT was right that there was almost nowhere to hide. The FTSE All World stocks index fell over 5 per cent in the first three months of the year. At the same time, inflation and tighter monetary policy saw the Bloomberg Global Aggregate Bond index fall by 6%. We have discussed many times how the correlation between bonds and equities was changing and becoming positively correlated. Historically the negative correlation between bonds and equities had been the foundation of portfolios but over recent years this relationship has been challenged and the last few months has brought it into clear focus. We have been advocates of using alternative asset classes, principally property. However, this asset class failed through Brexit and the pandemic as liquidity froze.

For many, portfolio construction historically has revolved broadly around, a 60/40 balanced approach, where investors allocate 60 per cent to equities, for capital appreciation, and 40 per cent to bonds, to potentially offer income and dampen risk. This worked well over the past decades as equities surged in a near-straight line to record highs and interest rates fell to new lows, pushing up bond prices. For some time now, the need for reliable alternative assets out with bonds or equities has been growing. Absolute return funds, which were heralded as the solution, disappointed almost universally. Property, as mentioned earlier, was found wanting and has seen many asset managers withdraw from this asset class. Infrastructure has much appeal as has been introduced to many portfolios. Cash has a place, but inflation is a destroyer. We are looking at a range of alternative asset class funds to enable exposure to bonds to be challenged and substituted if needs be.

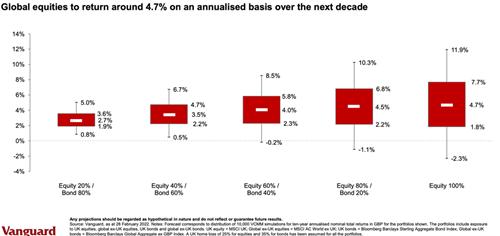

The classic 60/40 portfolio generated an 11.1 per cent annual return from 2011 to 2021, according to Goldman Sachs Asset Management, or 9.1 per cent a year adjusting for inflation. But fund managers are warning that these kinds of returns from a balanced portfolio do not look sustainable over the next decade. This message of lower returns is almost universal across the industry, and it will be hard for each of us to accept the stellar returns over recent years are very unlikely to be repeated in the years ahead.

The chart recently produced by Vanguard illustrates the likely outcome of returns over the next decade. It is computed using thousands of simulations. The results are stark, and we will all need to wake up to much lower return expectations. Other asset managers have produced expected asset class returns and the output is also considerably lower than we have all become used to.

The Vanguard Life Strategy Moderate Growth fund, which allocates 60 per cent of its assets to global equities and 40 per cent to bonds, has delivered a total return, after fees, of 9.1 per cent over the decade to December 2021. Vanguard has now cautioned that returns over the next decade for a 60/40 balanced portfolio are expected to be under half that — even before inflation is considered. Diversification to alternatives seems inevitable, perhaps.

As one commentator recently said, “it’s easy to say that you need to diversify but it’s not that easy to implement, especially as asset classes like commodities have had monster moves up and no one has forgotten oil was at negative prices only two years ago.” We must be wary of making knee jerk reactions to turbulent markets, but it does seem that bonds are likely to be a reduced feature of portfolios over the years ahead.

One of the managers of an alternative fund that we are introducing recently commented “Forty years of a bull market, where for decades ‘buying the dip’ has been a sure-fire idea, is clashing against circumstances and events which may break this benign and predictable investment pattern. Is another investment mantra heading for the shredder?

The last few months have been very difficult for investors and the immediate landscape is quite uncertain, which markets simply hate. This uncertainty may take longer to clear than we might wish.

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.