After a brutal U.S. Presidential election campaign, Donald Trump has emerged victorious. Trump’s victory was achieved by tapping into, and to a large extent, stoking general voter discontent. Voters were encouraged to vote for change, very much as UK voters were urged to do the same during the Brexit referendum. It would be fair to say that in both campaigns exactly what that change might end up looking like did not seem to greatly matter but more of the same was not appealing.

As with Brexit, most of the campaign, on both sides was negative. Trump’s populist messages of lower taxes, gun rights and a conservative religious agenda, allied with opposition to trade agreements and illegal immigration, were ultimately successful in producing a winning message. Markets had been anticipating a Clinton win, which would have represented a continuation of the status quo. Trump’s victory, by contrast, has raised global uncertainty, partly because of the threat of a trade war and partly because it is not clear which parts of a very ambitious agenda of tax cuts, increased defense and infrastructure spending and health care reform can, or will, be implemented. For investors, however, the question is not how markets have reacted, but what might be the long-term outlook in the wake of the U.S. elections.

It must be said that making predictions has always been a fool’s game but 2016 has surely taught us to expect the unexpected, so looking forward to what might happen must be wrapped tightly in health warnings.

The U.S. economy that The Donald will inherit is in pretty good shape. Real economic growth has picked up in recent months while the unemployment rate, at around 5%, is close to most economists’ definition of full employment. S&P 500 earnings have rebounded smartly from the oil and dollar induced slump of 2015 and inflation is still moderate. Moreover, the global economy is also showing signs of life with the global manufacturing purchasing managers’ index hitting a two-year high in October. All of this, ignoring political uncertainty, would be positive for stocks and negative for bonds.

The immediate uncertainty and volatility following the U.S. election suggested the probability of a Federal Reserve (Fed) rate hike in December reducing, although the Fed will want to leave its options open until it can assess the market and economic fallout from the election result.However, the December interest rate hike now looks more likely to be on as the economic impact of the election result has surprised on the upside. Mortgage rates in the US have already risen by c0.5% and US Treasury yields have moved upwards.

While the remainder of the results represented a Republican sweep across the Houses, actual policy change may be far less dramatic than was proposed by Trump during the campaign. We have already seen significant tempering of the aggressive election rhetoric in recent interviews and statements. First, it should be noted that there is a wide gulf between Trump’s agenda and that of many “establishment” Republicans and the latter may well balk at unfunded tax cuts or spending increases. In addition, both the new President and Congress will likely act more slowly on dismantling the Affordable Care Act or trade agreements, until some better alternatives can be found.

As has been the case elsewhere in the world this year, voters have chosen change over caution and politicians are inclined to respond to what voters want rather than what they need. While the Trump agenda is unlikely to be implemented in full, members of Congress may be willing to go along with some proposals to increase spending, lower taxes, and reduce illegal immigration and increase tariffs. If they do so, they may well further stoke inflation in an economy that is already heating up. Longer term, increasing government debt to fund these initiatives has obvious dangers.

The immediate knee-jerk reaction of investors to the result was to sell U.S. and global stocks and buy Treasury bonds. That was a very, very short lived reaction. The backdrop of an improving economy, further stoked by expansionary fiscal policy, should favour equities and markets quickly woke up positively.

The Trump shock has magnified political uncertainty linked to rising populist pressures ahead of key votes in Europe. The president-elect has said throughout his campaign that he would overturn or renegotiate trade deals. If, and it is a very big if, he follows this through then undoubtedly this could hurt the global economy — particularly export-dependent emerging markets — and spark risk-off sentiment and a weaker Chinese yuan. The next few months will see how his trade policies take shape and this will be key to assessing the potential global impact. It is hoped that we will not see extreme policies put in place and create trade wars that history shows are damaging to all. We hope that any significant restructuring or imposition of tariffs would be on a more selective industry by industry basis rather than simply a blanket imposition by region.

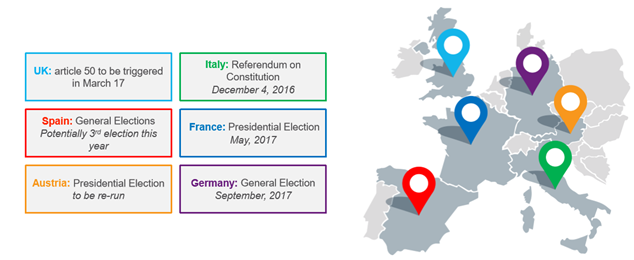

The end of 2016 and through 2017 will see some significant political events across Europe as the chart below shows. What we have learnt during 2016 is that populist voting cannot be ignored and that change could sweep through Europe, potentially changing the political direction of the European integration project rejected by the UK voters. European equities offer attractive valuations and the recovery potential for corporate Europe is encouraging.It is the elections and the triggering of Article 50 that will impact European equities more than the US result. Perhaps the UK will use the Supreme Court and Parliamentary approval to delay the trigger if the mood is seen to be moving to the populist movements. Unlikely but don’t rule out the unexpected!

Our portfolios remain well diversified outside of U.S. stocks and bonds and have wide exposure to alternatives (mainly property) and international securities. In light of the Brexit vote and the U.S. elections, 2016 has proven decisively that populism is a good political strategy—whether it proves to be good for long-term economic fortunes is another question entirely. We believe our approach remains very valid.

Since the election result almost all fund houses have been considering the outcome and impact and we close with the comment from the head of Global Securities at OMGI, which is a fund house we use in most portfolios. His comments elegantly reflect the approach that almost all our fund managers adopt.

“Given the intense degree of attention on the election, and its undoubted political importance, it may seem surprising that within the global equities team we made no attempt to predict its result. We are not in the business of trying to predict events that are very hard to predict. Striving to forecast a binary (either/or) event such as a close-run election is, in our view, not a good way to invest. We have built our investment process on other – we believe sounder – principles Macro events and geopolitical events, like the US election, affect our investment process indirectly rather than directly. They impact the market, and this is the key for us. We are much more interested in how the market is behaving because that gives us the clues as to how we should position our portfolios”