Sometimes the hardest thing to do is to do nothing. October has been a very unsettling month for investors with huge volatility and wild daily swings in markets. Where and when it will end, no one knows, and it would be foolish to believe anyone has that insight. That doesn’t stop many words being written about what the investment landscape will now look like. Articles abound that value will now be the favoured style and growth’s run is now over. We have seen this thesis put forward many, many times over the last few years and each time it has been substantially wrong. The post Brexit sell off in June 2016 and the Trump victory in November 2016 being the most recent.

It didn’t happen then, and it is much too early to judge whether it will happen now. For all investors it is a nervy time as every investor finds it hard to sit on their hands. They instinctively feel a need to do something and struggle to hold firm. It is difficult to be that goalkeeper that stands tall in the middle of his goal and not feel the need to dive left or right until you’re certain you know the right way to dive!

As we have often noted, it is impossible to time markets and that has not changed. Our view is to let the markets gyrate, let the fund managers assess the position once it settles, as it undoubtedly will, and see the landscape then. Good companies remain good and nothing over the period has fundamentally changed that. Indeed, the recent reaction has been on the back of substantially good news out of the US, although global growth may be waning. Interest rates are rising because of the strong economic data but that causes concern that inflation and recession may be around the corner. Of course, that is possible but is it likely? There have been many other issues worrying markets. The trade wars between Trump and predominantly Asia although the rest of the world has not escaped. Major issues with Italy and its financial position and the whole cloud of geopolitical issues which just got worse with the Saudi atrocity in Turkey. There is a lot of uncertainty around markets and the UK has also the twists and turns of Brexit to contemplate.

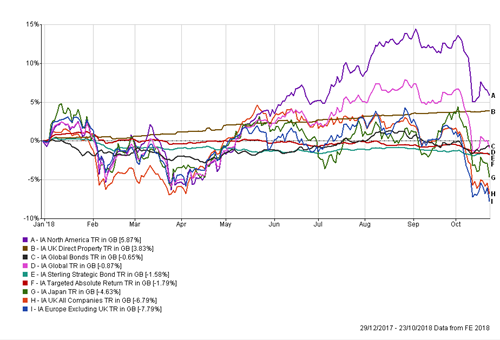

The chart below shows how the main asset classes in a portfolio have performed during 2018. As can be seen, almost all asset classes have behaved in a similar way. The exception has been property. Property had a rough ride following the Brexit referendum but has now again shown its worth in portfolios. It has quietly and steadily delivered acceptable results, while other asset classes are caught up in the washing machine of volatile markets. This again highlights the need for broad diversification.

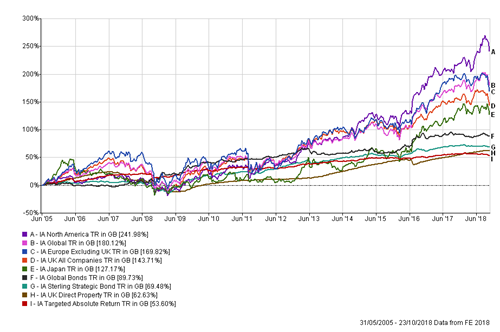

Since the financial crisis in Autumn 2008, it has been a remarkable run of performance for all asset classes as can be seen from the chart on the left. North American equities have delivered an uplift of almost 250%, whilst even an asset class that has generally disappointed, Absolute Return, has delivered over 50%. Investors have come to view such returns as a “new normal” but we know that quantitative easing around the globe was a new phenomenon that undoubtedly saw asset prices rise. We are now in a new phase of watching that easing being withdrawn, and markets are trying to constantly assess the impact.

What we view as happening just now is a reaction to that. As we approach the end of the year, we see two factors that will likely dominate markets and create the uncertainty that markets loathe. The uncertainty of geopolitics (Brexit, trade wars, Trump, Italy and on and on) and efforts to normalise interest rates globally. We have seen more of the latter in action through October, with the US President heavily criticising US central bankers for going too fast and stating the Fed was the biggest risk to the US economy.

The recent decline in values has swept across all companies. The UK, prior to this decline, had been out of favour. This may now have created opprtunities for a variety of UK listed companies that had aleady been heavily discounted because of Brexit risks and might now be overly discounted. The UK could now be seen as offering good value and possibly Europe too. Conversely, the prospect of interest rate rises may impact earnings and valuation multiples over the months ahead, particularly in the US. It is much too early to be certain, the challenge now will be waiting to see what unravels and avoiding the temptation to dive.

Douglas Kearney C.A. Investment Director

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.