The positive momentum in markets that we have seen since late June has continued into the autumn delivering very welcome returns for investors. The post Brexit anxiety was short lived, although in reality Brexit hasn’t reached the start line and its impact is a long way off. We suspect the anxiety will return as Brexit negotiations begin to unfold. We now know that Article 50 will be triggered by the UK by the end of March 2017 and perhaps Brexit will follow two years later, although few would be surprised if that timetable wasn’t fully met. The main impact of the leave vote has been on Sterling, which has now weakened further to a 31 year low following the announcement that Article 50 will be triggered by March. The announcement has, though, seen the FTSE 100 break through 7,000 as many of its component companies will have an earnings boost through the weaker pound.

The other asset class that was quite significantly impacted by the leave vote was commercial property. Many funds, albeit mostly retail rather than property pension funds, suspended trading shortly after the vote as the demand from investors to redeem their holdings accelerated dramatically. This was based on a fear that UK property values would fall as a result of Brexit. The suspension allowed managers time to sell properties in an orderly manner to provide cash for departing investors. The suspensions are now nearly at an end and almost all property funds will be fully functioning by the end of October. What is clear is that the property sales needed to build cash reserves have been achieved at close to pre-Brexit value; the emergency valuation adjustments pre suspension were draconian, albeit put in place to protect the remaining investors; the reaction by investors has been an over-reaction. We continued to buy into property funds during this period, as many of the property funds we use remained open, and we believe that strategy will be rewarded. Property is an asset class that should predominantly provide good yield and that remains true. We would not expect substantial uplifts in capital values, but conversely we do not expect a repeat of 2008.

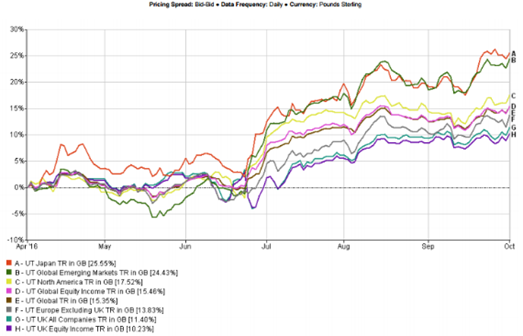

In many ways it is hard to fathom why markets have moved so positively over the last few months as economic data and company earnings have not suggested any global growth spurt. As can be seen from the chart, the main equity asset classes that we include in almost every portfolio have performed strongly. The UK has done well due to the impact of the fall in value of Sterling. The main reason for the momentum we are seeing is that investors are struggling to find attractive homes for their money in a low interest world and equities, whilst up the risk curve, offer a fairer return. Negative yielding bonds do little to whet the appetite. We continue to watch markets closely but we are satisfied that the global strategy we adopt continues to be appropriate.

The remaining months of 2016 and indeed into 2017 look likely to be dominated by political events. We have the ongoing Brexit, which will be extremely complicated and far from easy to conclude and an array of elections in 2017 in Europe. However, November sees the election for the next President of the US.

This time last year political pundits ruled out Donald Trump as the Republican candidate, now they are watching him fight a tight race for the Presidency with Hillary Clinton. He has surprised everyone by riding a wave of populist sentiment for change which could take him to the White House. As we know, the Brexit vote in the UK demonstrated that a large number of people can vote for change, even though they are not sure what that change actually is.

For the US election, the opinion polls still point to a Clinton victory. The polls had been narrowing, especially after Clinton took time off from her campaign for health reasons. The widely respected website www.fivethirtyeight.com had put a probability of 55% on a Clinton win on 26 of September, just before the first TV debate. At the beginning of September this was over 75%. The latest reading shows a bounce to 63.7% for Hillary, reflecting what is widely seen as a victory for the Democratic party candidate during the debate. The opinion polls are the first source of information on the likely outcome of the vote, but we would note that the US equity market has a good track record.

There is a well-established rule that the S&P500 sells off in the run-up to the presidential vote when the incumbent party loses. Markets are more concerned about change than whether the President is Republican or Democrat. This has proven correct in 19 of the past 22 elections going back to 1928. There is still time for a sell-off to develop, but so far the S&P has been robust, reaching record highs, suggesting that Clinton will win. We suspect that markets would react negatively to a Trump victory. At face value, both parties offer fiscal expansion. Trump’s policies focus on significant personal tax cuts offset by significant spending cuts. At face value they will boost growth; however, they are also likely to bring forward a tightening of monetary policy by the Fed. In addition it is likely we will see higher tariffs on imported products adding to inflation and slowing growth as retaliatory trade barriers increase on US exports.

Investors in Europe face a tough year with plenty of political risk. Hungary’s government is using a referendum on accepting a quota of migrants to pick a fight with the EU. Political crises seem to have become synonymous with Europe in recent years. The union can barely get through a quarter without another episode promising to destroy the returns of investors. Unlike past incidents, the next 12 months are full of crucial events that have the potential to change the direction of the Eurozone and the European Union. Brexit has focused the minds and efforts of anti-establishment/protest political movements, highlighting the growing tide of anger and frustration with the status quo. While change is always inevitable in a political cycle, the potential transformation of the political landscape may require markets to demand greater premiums for future risk.Elevated risk may be the reason why European equities have struggled to keep up with their US counterparts, despite having more attractive valuations. Banking problems remain, but are well known. Deflationary risks are also priced in. But political risk is the type of risk that can be extremely costly for investors, and as a result, they demand a greater discount.

More generally, the Brexit vote and the presidential election highlight the fact that the “muddle along” tepid growth rates experienced since the global financial crisis are not exciting. The world economy has experienced growth of 2.5% since 2012 compared with 5% before the crisis. The growth rate has halved. Of course, the 5% pre-crisis growth rate was unsustainable as it was based on an irresponsible boom in bank lending, so perhaps the comparison is unfair.

Schroder’s forecast the 2.5% muddle-through can continue into 2017. However, there is a question now as to whether such a growth rate is sustainable, not from an economic perspective, but from a political one as voters turn to populist solutions. Those solutions vary but all identify globalisation, the free movement of goods and people as a threat to living standards. Reversing such trends will only weaken rather than accelerate growth. The politics will matter.