As autumn fast approaches, markets have had (so far) a fairly settled summer with the odd jitter here and there. Politics continue to dominate the investor landscape with tensions rising in North Korea, causing a brief flight to perceived safer assets and the continuing turmoil of the Trump administration that constantly seems to grab the headlines for almost always the wrong reasons. There are few remaining who believe that his much heralded policies can be delivered as he had pronounced on the campaign trail. Many now wonder whether Donald Trump will complete his term of office, and it is not hard to see why that view has foundation. Although the US economy is cooling, it is certainly not looking in bad shape despite the failure to deliver new policies that were viewed as potentially providing an economic boost to many sectors. Europe has had a fairly settled period with the risk of a breakup now unlikely. Some elections are around the corner. The recent polls suggest, however, the German election is by no means a foregone conclusion. If Angela Merkel were to lose, that would unsettle European markets. It would also heighten the attention on the Italian election that follows. The euro, as Mario Draghi stated recently, is perhaps too strong and could be a drag on growth. We will wait to see whether the European Central bank takes any action to address its strength or whether the German election result provides a surprise that would impact the Euro.

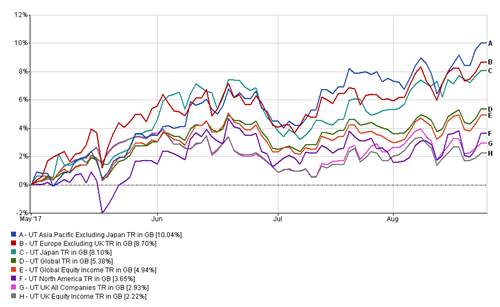

Equity asset classes have had a reasonable summer, again so far, with positive returns being enjoyed. As can be seen from the chart above, all the main equity asset classes that tend to feature in our bespoke portfolios are positive in “the sell in May and go away” period. Asia Pacific and Europe lead the way over the summer months as they have done throughout the last year. Asia recording growth of almost 23% and Europe almost 24% over the last year. The UK remains the laggard over both the year and the summer months. The UK All companies showing annual growth of 13% and the UK Equity Income sector increasing by over 10%. Overall equity returns have been attractive with many market highs reached over the period.

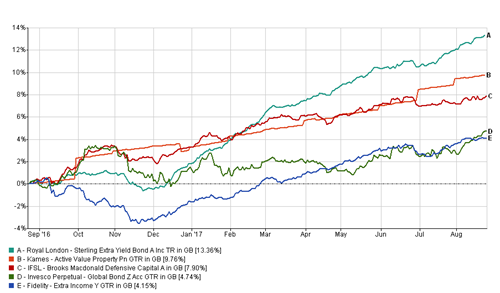

Lower risk assets have also delivered satisfactory performance. The main lower risk asset classes include fixed income and property. The chart shows the performance of some of the funds found in many of our portfolios over the last year and the results are pleasing despite lower risk assets existing in a challenging environment. Property has substantially recovered from the post Brexit shock and provides a sensible yield albeit significant valuation uplifts will be unlikely to be seen in the current economic landscape.

So a brief review of both equity and lower risk assets indicates an encouraging picture, but many investors are worriers and worry that markets must be in for a correction sometime soon as this picture cannot be sustained. We are climbing a wall of fear, climbing but the fear is nagging. Is this fear justified? We keep looking to history to help and reach conclusions. Certainly, it would be a very brave and perhaps naïve investor who believes that the momentum seen in markets recently can be sustained at these rates. Equally, it would be unwise to ignore that some correction to markets could occur and what is the likelihood? We spend much time contemplating such issues but no one has the definitive answer. The best that can be done is to look at the evidence and form a view. What the evidence can never provide is some curved ball appearing, whether political, economic or geographic, the unknown unknown, that alters investors’ and the markets’ confidence. As this view is being written, North Korea has sent a missile over Japan and equity markets are retreating but will likely bounce back overnight.

A fund manager at Royal London Asset Management, said that after months of calm ‘investors are starting to get rattled’ but despite the unease now could be the time to add to positions in equities. “It pays to buy when others are fearful and we are starting to add to the equity positions in our multi-asset funds, increasing our overweight positions there,’ he said. At the same time a global equities portfolio manager at another fund house sounded a note of caution. This manager said the ‘storm of political uncertainty’ seen lately has contrasted with the VIX equity volatility index, which has hit new lows as equity markets have reached record highs. ‘In this environment of great uncertainty and lack of market leadership, investors acting on macro forecasts must not only be correct about the anticipated event, but also about how the market will react to it – which as we know following the UK’s EU referendum and the extended Trump rally, can be just as unpredictable to commentators’. There are many such contrary views around at present.

A recent paper from Standard Life concluded “While the outlook for corporate profits growth remains very positive into 2018, the view is also assessing such issues such as the risk of policy errors, whether political uncertainty could revive, and the valuations of certain assets. All in all, the view remains pro-risk, but is not looking to add extra risk to portfolios. Into 2018, we expect global equity markets to benefit from more confidence about a continued expansion, sustaining buoyant corporate cash flow”. This sentiment was followed by a comment from Schroders recent global review which stated “Looking into 2018, global growth is expected to remain stable at 3% with modest downgrades to the US, offset by upgrades to the Eurozone and emerging markets”.

The mood around equity fund managers does seem to remain quietly positive but realistic. It is probably reasonable to support the view that now is not the time to substantially add risk but equally there is nothing obvious to give great substance to the fear. Experience suggests that more forecasts of an impending crisis turn out to be wrong than right or at least take so long to become ‘true’ that it ends up being very expensive to wait. The biggest lesson we can learn from the past is how deeply chaotic it is, and how little we can truly know about what is going to happen.

N.B. The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.