UK and US Politics

As expected, the General Election delivered a landslide result that saw Labour return to Government. We now await their budget in October.

The Institute of Fiscal studies reviewed the Labour manifesto prior to the election and commented: “…delivering genuine change will almost certainly also require putting actual resources on the table. And Labour’s manifesto offers no indication that there is a plan for where the money would come from to finance this.”

Day after day prior to the election the mantra that Labour will not raise taxes on working people was the unwavering message. Inevitably, we are now repeatedly told the books are in a very poor state and the focus is firmly on raising capital taxes to provide the money that is needed to deliver the Government’s manifesto. Pension taxes and reliefs are also a likely target according to commentators. However, as previously commented, markets in the UK anticipated the election result and so were not fazed by the change in Government.

Perhaps, the political surprise over the summer was the very positive reaction that the US Vice President, Kamala Harris, has received on replacing President Biden as the Democratic Party candidate for the November presidential election. Prior to her nomination her press was very negative towards her but that has quickly changed, and she is providing a serious challenge to Donald Trump returning to the White House as several recent polls have confirmed.

August Market Volatility

The outcome of the US election will be important for markets, but as we saw at the beginning of August, perhaps not as important as decisions (or lack of them) by the Fed and other central banks, unexpected and disappointing economic data, fears of recession in addition to inflation remaining sticky. We have consistently stated that moves in interest rates would have the greatest impact on markets, but no one foresaw what happened in early August.

The VIX is often referred to as the market’s “fear index or fear gauge”. The performance of the VIX is inversely related to the S&P 500 – when the price of the VIX goes up, the price of the S&P 500 usually goes down.

As can be seen in the VIX chart, it rocketed at the beginning of August and reached 65.73 on 5th August 2024, its highest level since late March 2020. Equity markets saw a very significant sell off with Japan falling almost 10% in a day.

As can be seen in the VIX chart, it rocketed at the beginning of August and reached 65.73 on 5th August 2024, its highest level since late March 2020. Equity markets saw a very significant sell off with Japan falling almost 10% in a day.

When the VIX becomes elevated, we suspend trading as the fluctuations in prices, both up and down, can be significant. Holding firm can prevent unnecessary losses and ensures clients do not miss out on any recovery such as the upswing seen on 8th August, which was the largest since 2022.

The VIX has now reduced to a more normal level, in the mid-teens, and the falls in markets over the first week in August have been reversed.

This is a clear example of how patience in turbulent markets is essential and making snap decisions can be costly.

Asset Classes

The return of market volatility has provided investors with a much-needed reminder of the importance of diversification across asset classes and regions, and that chasing momentum works until it doesn’t.

Bonds have offered multi-asset investors some reassurance as this more classical growth-driven sell-off has seen government bonds cushion part of the blow in equities by moving in the opposite direction. While no major equity market has been immune to the recent turbulence, some regions/sectors have performed better than others.

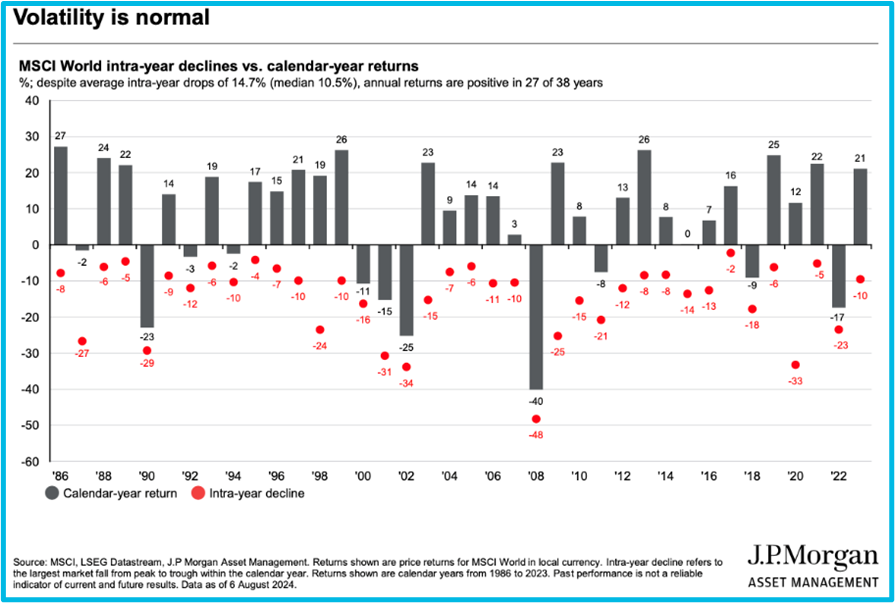

Equity markets are volatile, but a wide range of crises has not stopped equities delivering higher average returns compared to bonds and cash since 1980. It is important for investors not to panic and stay on course. The best days for markets tend to follow the worst. As such, even if you think you can avoid the worst, you are probably likely to avoid the best.

‘Drawdowns’ (a decline of less than 10%), are frequent. Since the early 1980s, there has been a greater than 5% drawdown in the S&P 500 Index in every year other than 1995 and 2017.

‘Drawdowns’ (a decline of less than 10%), are frequent. Since the early 1980s, there has been a greater than 5% drawdown in the S&P 500 Index in every year other than 1995 and 2017.

Even in the current year, which had felt relatively benevolent until the past few weeks, the S&P 500 Index experienced a 5% drawdown in April before climbing to an all-time high in the middle of July.

On the other hand, corrections (declines of greater than 10%) happen less frequently.

Corrections typically don’t just emerge out of nowhere. Often, they’re the result of policy uncertainty and/or surprising weakness in economic activity. The market has currently gone since early November 2023, without a correction, representing a 188-day period of a resilient economy and declining inflation.

One of many reasons that has been offered as a trigger for the sharp and unexpected drawdown last month was disappointing earnings from some of the tech giants and a change in sentiment towards AI (Artificial Intelligence).

After benefitting from stellar returns, investors started to unwind big positions in the likes of Apple, Nvidia, Microsoft, Meta, Amazon, Alphabet and other tech stocks following the earnings news. These companies make up an enormous chunk of the overall value of the S&P 500. When investors sell off tech stocks, that has a massive detrimental effect on the broader market. Heavy index concentration can help to drive returns for passive investors when the dominant firms perform well, but it is likely to pose a significant challenge when those firms perform poorly. History shows that the more skilled active managers typically have performed well coming out of concentrated markets.

After benefitting from stellar returns, investors started to unwind big positions in the likes of Apple, Nvidia, Microsoft, Meta, Amazon, Alphabet and other tech stocks following the earnings news. These companies make up an enormous chunk of the overall value of the S&P 500. When investors sell off tech stocks, that has a massive detrimental effect on the broader market. Heavy index concentration can help to drive returns for passive investors when the dominant firms perform well, but it is likely to pose a significant challenge when those firms perform poorly. History shows that the more skilled active managers typically have performed well coming out of concentrated markets.

While markets appear to be in a tailspin over recent US economic data, it’s too soon to conclude the US is headed toward recession. Indeed, sentiment has moved over recent days suggesting a recession is unlikely. Economic data provides some support for this change in view. However, the combination of a slowing jobs market, cooling inflation and the negative market reaction should lead the central bank to finally act. Historically, markets have tended to perform well in easing cycles that were not associated with recessions. All eyes are therefore set on the Fed’s next meetings scheduled for September, November and December. The turmoil and noise of early August once again reminds us that economists have predicted nine of the last five recessions.

Douglas Kearney C.A. Investment Director

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.