Robyn Caffell is an Intelligent Pensions financial planner based in the south west. She has worked in financial services since 2000 and currently specialises in working with clients planning their retirement.

In this month’s team update, Robyn shares her views on why cashflow modelling is so important to our business and how it benefits our clients.

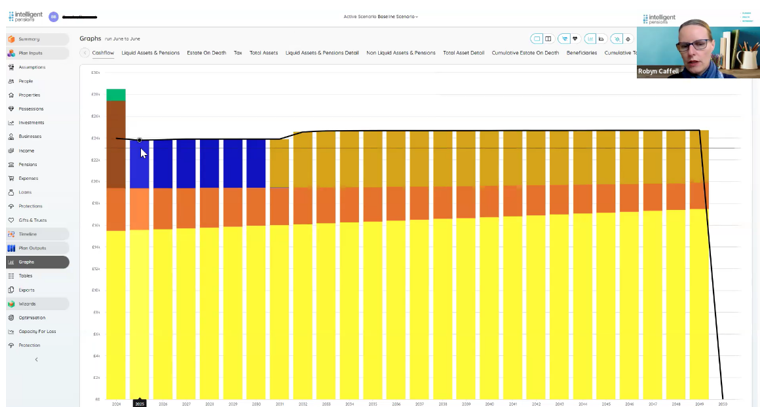

An example of cashflow modelling with Robyn

“For years, I’ve utilised cashflow modelling to guide my clients and I’m continually surprised by how many advisory firms overlook this powerful tool!

“Despite its immense value, many people still don’t realise just how transformative cashflow modelling can be for their financial planning.”

Embracing innovation for your benefit

Intelligent Pensions were pioneers of cashflow modelling and have been using it to help clients for more than 25 years.

In 2021, we made a significant upgrade to our cashflow software which has allowed us to offer a more holistic approach to financial planning.

This development ensures that cashflow modelling remains at the heart of our advice process. As a result, our financial planners can provide you with the most comprehensive and personalised financial guidance possible.

We recommend that clients meet with their financial planner annually to update their cashflow model so that it remains current and relevant. These regular reviews ensure that your financial plan evolves with your life circumstances, keeping you on track to achieve your goals.

Our cashflow software partner is continually investing in and developing their technology to keep us at the forefront of financial planning. By leveraging the latest advancements, we maximise the potential benefits for you, ensuring you receive the best possible advice and support.

Visualising your financial future

While cashflow projections are just one piece of the puzzle, integrating them with your goals and priorities is a crucial element of comprehensive financial advice. Imagine being able to see a detailed map of your financial journey, so that you can clearly understand not just where you are, but where you’re heading.

How can you truly visualise your financial future and determine if your goals are attainable without a clear picture? Cashflow modelling provides this picture and answers fundamental questions such as:

- Can I retire early?

- Do I need to save more?

- What if I fall ill and can’t work?

- What if I die unexpectedly?

The Game-Changing Benefits of Cashflow Modelling

“Cashflow modelling is a game-changer for all of my clients, and it can be for you too”, says Robyn.

At Intelligent Pensions, we can use our advanced cashflow modelling software to deliver the following benefits.

Clarity & Control

Cashflow modelling provides you with a clear understanding of your income, expenses, and future financial position through detailed projections.

It demystifies your finances, allowing you to see exactly where you stand and where you’re likely to be in the future.

Strategic Planning

Cashflow modelling facilitates informed decisions on investments, savings, and spending, helping you to progress towards your financial goals.

With a solid cashflow model in place, you can plan strategically to ensure that your money works as hard as you do.

Risk Management

Cashflow modelling can help you anticipate and prepare for potential financial shortfalls, ensuring you’re never caught off guard.

It’s about being proactive, identifying risks early, and having a plan to mitigate them.

Performance Tracking

Cashflow modelling allows you and your financial planner to monitor financial performance over time and adjust strategies as needed.

Regular reviews and adjustments ensure you stay on track to achieve your goals, make the most of opportunities, and avoid pitfalls.

Business Insights

For business owners, cashflow modelling enhances budgeting, optimises cash reserves, and supports strategic growth planning.

It’s an invaluable tool for managing the financial health of your business, ensuring sustainable growth and building resilience.

Peace of Mind

Ultimately, mapping out your financial future reduces stress and boosts confidence in decision-making.

Knowing you have a clear plan in place can provide peace of mind and allow you to enjoy life without financial worries.

Your reliable financial compass

Whether you’re managing personal finances or steering a business, cashflow modelling serves as your reliable compass. It guides you through the complexities of financial planning, providing clarity, control, and confidence.

By embracing cashflow modelling, you’re not just planning for the future — you’re actively shaping it.

Let’s work together to ensure your financial journey is as smooth and successful as possible.

Get in touch

If you have any questions or would like to discuss how cashflow modelling can benefit you specifically, please do not hesitate to get in touch.

Your financial well-being is our top priority, and we’re here to help you navigate every step of the way.

Please email us at hello@intelligentpensions.com or call 0800 077 8807.