You’ve probably worked hard throughout your life to ensure that you have enough money to give yourself a comfortable retirement and provide for your loved ones after you’ve gone.

However, without careful planning, your beneficiaries could face an Inheritance Tax (IHT) bill that means they receive less of your wealth than you intended.

According to research published in Today’s Wills and Probate, the Treasury is expected to raise £7.6 billion from IHT in the 2023/24 tax year, an increase of £500 million from the previous tax year.

Gifting money could be a helpful way to reduce the size of your estate for IHT purposes. If you make gifts during your lifetime, you could also benefit from seeing your loved ones enjoying their inheritance when they need it most.

Read on to find out how you could gift money and reduce a potential IHT bill.

Inheritance Tax in a nutshell

Learning how IHT works may help you understand why gifting can be so important.

In simple terms, IHT is a tax your beneficiaries may have to pay on your estate – including all property possessions, and money – when you die.

The standard IHT rate is 40% but this is only charged on the amount of your estate that exceeds the nil-rate tax band, which is currently £325,000 (2023/24).

In addition, each person also has a residential nil-rate band, which is £175,000 for the 2023/24 tax year. You can use this to increase your tax-free threshold to £500,000 if you leave your home to your children or grandchildren.

If you’re married or in a civil partnership, you could combine your allowances and potentially pass on up to £1 million without your beneficiaries having to pay IHT.

Assets that exceed these thresholds may be subject to IHT. So, you might be interested to learn how to reduce a potential IHT bill for your loved ones.

3 ways to gift money to your loved ones

1. Use your annual gifting allowances and exemptions

There are various exemptions and allowances you could use to reduce the value of your estate for IHT purposes.

Annual exemption

You can give away gifts worth up to £3,000 each year (2023/24) – whether to one person or split between multiple people – without them being added to the value of your estate.

If you have unused annual exemption from the previous tax year, you can carry this forward for one year. For example, if you gave gifts worth up to £2,000 in the 2022/23 tax year, you could carry forward the remaining £1,000, increasing your exemption for 2023/24 to £4,000.

Small gift allowance

You can give as many “small gifts” – up to £250 – each tax year, as you wish, though you need to be sure you’ve not used another allowance on the same person.

Birthday or Christmas gifts you give from your regular income are exempt from IHT.

Gifts for weddings or civil partnerships

You can give a tax-free gift to someone who is getting married or starting a civil partnership. The amount you can gift depends on your relationship to the person. You can give up to:

- £5,000 to a child

- £2,500 to a grandchild or great-grandchild

- £1,000 to any other person.

If you want to give multiple gifts to one person, you can combine a wedding gift with any other allowance, except for the small gift allowance.

For example, you might want to give your child a wedding gift of £5,000, as well as £3,000 using your annual exemption in the same tax year.

2. Gift from income to provide ongoing support for your family

One of the most valuable ways of reducing a potential IHT bill may be by giving “gifts out of surplus income”.

Yet surprisingly, research published in the Express has revealed that only 430 families used this exemption in the 2021/22 tax year.

The “gifts out of surplus income” rule allows you to pass on money from your income directly rather than gifting from savings. And theoretically, there is no limit to the amount you could gift in this way – compared to the annual gifting exemption, for example, which is capped at £3,000 (2023/24).

As such, this can be an effective way to reduce the value of your estate and provide regular support to a loved one who needs it. For example, you might want to pay your grandchild’s school fees or cover the cost of an elderly relative’s residential care.

To qualify for this exemption, you must meet three key criteria:

- Payments should be made regularly, rather than as a one-off event.

- You must be able to maintain a reasonable standard of living while you’re making the gifts.

- Your gifts should come from your income, rather than a transfer of capital assets.

You may need to prove how your payments meet these criteria to HMRC, so efficient record keeping is key.

The rules on gifting out of income can be complicated, so it’s worth talking to a financial planner to help you understand your options.

3. Consider gifting to family early in your retirement

Beyond the exemptions outlined above, most other gifts you give will be classed as potentially exempt transfers (PETs).

If you live for at least seven years after the date the gift was made, it will usually fall outside of your estate for IHT purposes. If you die before this, IHT may be payable if it exceeds your NRB.

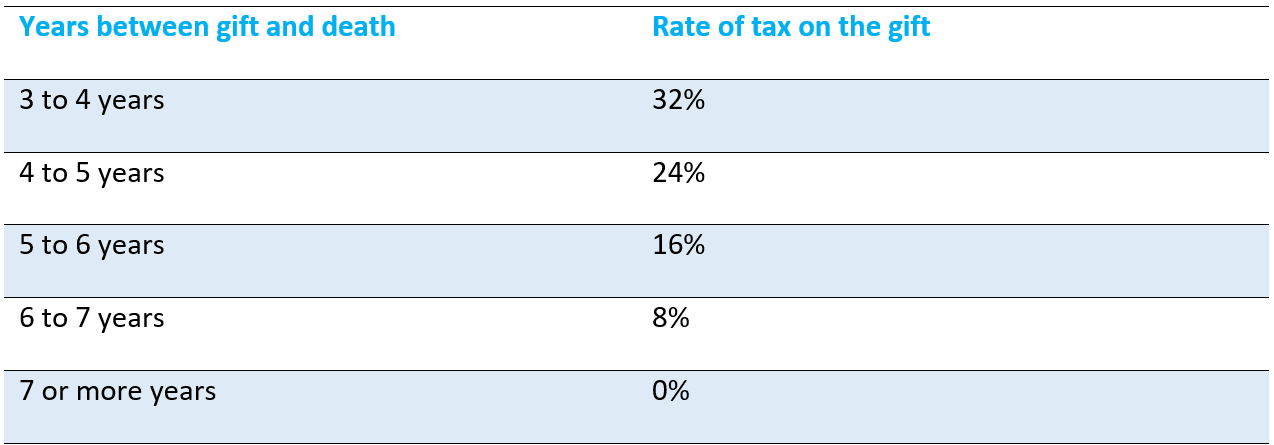

The amount of IHT your beneficiaries could pay will depend on how soon after giving the gift you die. The table below shows how taper relief applies to gifts given at different times.

Source: Government website

As a result, giving earlier in your retirement could allow you to pass on more of your wealth and enjoy seeing your loved ones benefit from their inheritance.

But this is a complex area and it’s wise to make sure you can afford to give a gift without compromising your own financial plan and goals.

A financial planner can use cashflow modelling to help you understand your retirement income needs as well as ensure that any gifts you make meet the relevant criteria.

Gifting is just one of several planning opportunities to reduce IHT and may not be appropriate if you have reservations about control or responsibility.

We are planning to run an IHT webinar on 14 March at 4 pm, one week after the Budget, which is rumoured to contain changes to tax and allowances. So, please contact your financial planner or email us at hello@intelligentpensions.com to register your interest.

Get in touch

If you’d like to know more about gifting money to reduce a potential Inheritance Tax bill, please email us at hello@intelligentpensions.com or call 0800 077 8807.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate cashflow planning or tax planning.

Remember that taper relief only applies to gifts in excess of the nil-rate band. It follows that, if no tax is payable on the transfer because it does not exceed the nil-rate band (after cumulation), there can be no relief.

Taper relief does not reduce the value transferred; it reduces the tax payable as a consequence of that transfer.