February has continued to be another unsettling month with some stomach churning daily swings in markets. The main Japanese market added 7% in one trading day. The positive element is that overall we appear to be gaining some of the ground lost in January but it would be optimistic to believe these large swings are behind us. Historically, markets do tend to over-react both on the upside and the downside and we are experiencing this in a microcosm since the start of the year. Little has changed over the month apart from some hints that more QE might be deployed in Europe and Japan has joined the growing club of central banks offering negative interest rates.

Growth continues to be the scarcest of commodities in global markets, and it will continue to trade at a premium. There has been no aggregate earnings improvement since 2012, and 2016 looks set to be another year of low or absent growth. This has triggered recent fears that we are heading for recession. Simply, we are in a low growth world with headwinds from high levels of government indebtedness worldwide. Lower commodity pricing continues to negatively impact many mining and oil stocks, bringing with it significant dividend risks. However, we wouldn’t get too negative on overall economic prospects for developed economies. We consider that we have yet to see the full benefit of lower commodity prices feeding through into better economic growth rates. It is far easier to imagine the global economy being tipped into recession by a sharp rise in the oil price, not a sharp fall.

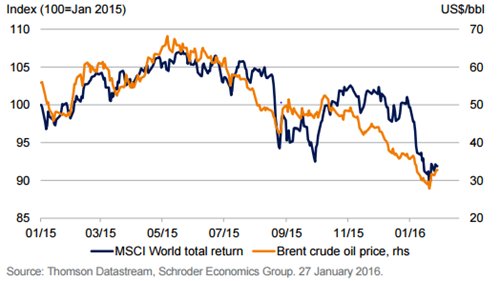

As the chart clearly demonstrates, the oil price has taken on the mantle of a proxy for global growth. Movements in the oil price appear to drive very similar changes to global equities. We are far from convinced that this correlation has any long term validity. Undoubtedly, there is an oversupply of oil around the world as new sources come on stream. The storage of this surplus supply is causing great difficulty as almost all storage is full. The obvious answer is cut supply. However, we believe there is a greater political power play than simply supply and demand. The Middle East suppliers are keen to squeeze the new kids on the block- the fracking industry- until it becomes uneconomic for them to produce. This has also seen many of the oil producing countries realising some very large parcels of assets, which has also impacted global stockmarkets, particularly the financial sector. However, a low oil price should be good for most developed and emerging economies. The recent Saudi meeting agreed to maintain production at no higher than current levels with the caveat that other producers must do the same. Subsequently, on 22nd February oil rose as much as 7 percent after the world’s oil consumer body, the International Energy Agency, said it expected U.S. shale production to fall this year and next, potentially easing a glut that has driven prices to their lowest in more than a decade. It is much too early to tell if the price of oil has bottomed out, but the sense is that it might have, which would be positive for markets.

The direction of interest rates is the subject of much discussion and commentary, and is perhaps the greatest risk, along with Brexit, to the market outlook. The US Federal Reserve has possibly backed itself into a corner. Having been so confident and ideological about raising rates, it is hard to imagine that they would now backtrack and make a cut in the face of a deteriorating economy. Is launching QE5 beyond the realms of reality? The markets appear to have priced in that a rate rise will not happen in March or indeed anytime soon. There is a wide divergence of views on whether the four anticipated rate rises will happen or whether it will now be less or none at all. Most think four increases highly unlikely. The March meeting of the FED will be important for investors as it should provide some indication of their thinking and mood. A rate rise in March would surprise markets adversely. It looks as though 2016 will not see a rate rise in the UK but the picture has become blurred due to the referendum on Europe on 23rd June. Already, Sterling has weakened and a vote to exit would likely see it weaken further. It is too early to judge the likely outcome but as one experienced fund manager said “Forget the opinion polls, look at the odds on the betting sites”. The bookies think an “out” vote unlikely.

However, the uncertainty stemming from the upcoming referendum on EU membership will hang over the UK market for at least the first half of the year. This should not come as a surprise. It does add to the risk of investing in the UK, and the potential for it to weigh on the market should not be underestimated. In terms of which parts of the market may be more exposed to this referendum risk, there are too many unknowns at this stage to make any conviction investment conclusions. Nevertheless, it is possible the market might take a view that certain UK companies experience more volatility than others in the run up to the referendum. Global multinationals and those with a high proportion of assets outside of the UK may be perceived to be less vulnerable compared to companies with a high proportion of assets in the UK that have a relatively high amount of trade with EU countries. The Fund Managers are very aware of these issues.

If the experience of 2014’s Scottish referendum is any guide, then the currency market could well be the arena where referendum fears and hopes are predominantly played out. On a trade-weighted basis Sterling has depreciated by over 7% over the last two months, and the danger and likliehood is that the currency stays under pressure in the run up to the referendum. In this scenario, companies with a high proportion of sales outside of the UK would be key beneficiaries. The recent weakening of Sterling will be an unbudgeted boost to earnings to the many quoted companies with foreign earnings. This will be a welcome lift to earnings and is more than a silver lining in the Brexit cloud. The other area likely to be most affected is property as investors delay until a result is known. We don’t expect valuations to be impaired but we do expect that transactions may go slower or be put on hold until an outcome is known, and if an exit what the implications might be. Much of the return from property is generated by the rental income and that should not be hampered in the short term.

Inevitably, during of times of correction, as markets have seen over the last few weeks, money moves towards safe havens, most notably Government Bonds and Treasuries, which continue to be unappealing and poor value. We remain committed to property, strategic or International bonds and high yield bonds which provide sensible diversification. As we stated in the previous edition of Investment View, nothing fundamental or seismic has changed in world economies nor has some unknown issue suddenly been revealed. China’s growth is slowing in terms of percentages, GDP moved from >7% to slightly below that but still a substantial figure. China over the next ten to fifteen years is expected to grow at around 3%, but that 3% is substantially larger than the actual growth of today. So beware of headline figures!

All equities have had a very torrid start to the year, which has been unpleasant for all of us to endure. However, we don’t believe good companies have become suddenly bad and the fund managers report that there is no sign of fear or stress within individual companies that they’ve met. The world is fragile and overall growth is quite anaemic, but it has been for a while. Inflation can create growth, but if unfettered can be destructive. We remain very positive about Europe. We believe there are good opportunities in Japan. The US is rarely seen as anything other than expensive, but a good manager can drill down and find value. Emerging markets and the Pacific region have had a tough few years but again opportunities abound and should flourish as economies heal. Perhaps a steeper hill for Brazil and Russia to climb though.

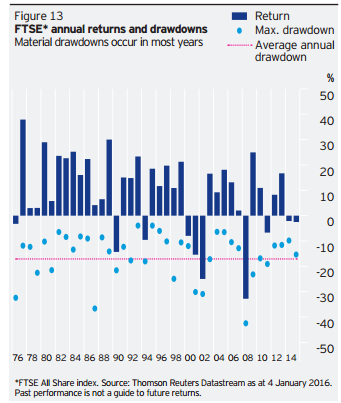

The UK economy is making progress, albeit the Brexit debate might hamper the first half of the year. The chart, produced by Invesco Perpetual, shows the history of the FTSE All Share. The darkest days during a year rarely, if ever, provide an indicator of the eventual outcome for that year. The drawdown, the maximum percentage fall during the year, exaggerates the gloom. Perhaps, and we hope, we have reached that point for 2016, albeit we know all markets will be volatile.

“Higher levels of volatility have been a feature of stockmarkets for a number of weeks now. There are several reasons for this including disappointments over Chinese growth, currency moves, and oil price weakness. In our view, what we have seen is very much a market correction as opposed to a serious deterioration in the global economic environment. These periods of sharp market moves understandably make headline news. However, it is important to remember firstly that equities can be a volatile asset class, and secondly that equity investing is a long-term business. For active managers taking a long-term view volatility can give rise to opportunities. In times of fear, markets tend to sell off across the board. The result is that solid businesses with good prospects for growth trade at lower valuations than they did previously, offering an opportunity for investors”. Schroders.