The last few weeks have continued to be positive for equity markets and so far so good as we head into the final month of the first quarter of 2017. After years in the shadows, politics continues its big comeback as an investment theme. In this new world – where tweets announce policy, and personality moves markets – investors are having to learn on their feet. Assets haven’t behaved the way people thought they would: a Trump presidency was expected to trigger a lengthy sell-off in US equities, but the S&P 500 has continued to climb, buoyed by ‘reflation trades’. March will see Theresa May trigger Article 50 and it will be interesting to see if and how markets react. This is definitely not an unknown unknown. March will also see a general election in the Netherlands. The leader of the Dutch far-right Party for Freedom, Geert Wilders, is on course to win the most seats at the general election in March.

His election would be the latest blow for Europe’s liberal order in the wake of Donald Trunp‘s victory and the Brexit vote. Mr Wilders has pledged to close the Netherlands’ borders, leave the euro and EU amongst other policies if he gets into power. “If the European dream is to die, it may be the Netherlands that delivers the fatal blow. The Dutch general election in March is shaping up to be a defining moment for the European project”, so said The Wall Street Journal at the end of 2016. It is, however, unlikely that a victory for Mr Wilders would automatically lead to a “Nexit” The outcome, though, will undoubtedly have an impact on the French Presidential election that then follows in April with far-right leader Marine Le Penn remaining favourite to win the first round of France’s Presidential election although unlikely to win the second round according to recent polls. We know how reliable polls have been.

Despite all these political events, global growth is steadying and broadening, with 2017 shaping up to be the sixth consecutive year in which gross domestic product (GDP) growth is in the 3%-5% range. Beneath the surface, however, there is great variation even among the major economies, in terms of where they lie within the economic cycle, and risks – not least the political ones. There is a feeling of cautious optimism around the fund house community, which is supported by various economic indicators. However, there is equally a reality that markets are fickle and can turn quickly. Some fund managers are holding higher cash levels waiting to pounce on a market weakness, but some would admit they have been waiting for a while now.

Risk assets are exhibiting an exceptional degree of strength and equity markets are clearly saying that President Trump is good for corporate profits. Markets are expecting a fiscal boost from the new President, which will drive an increase in corporate profitability and earnings – a positive for equity markets, all other things being equal. That is likely to lead to a tightening in interest rates given where we are in the US employment cycle. While there are inflationary pressures picking up in North America, there is a view that says that global deflationary forces and a stronger dollar will help to mitigate that, meaning aggressive interest rate rises are not necessarily on the table but some rises are expected in 2017.

Waiting too long to raise interest rates would be “unwise” as economic growth continues and inflation rises, Fed Chair Janet Yellen told Congress in February. Repeating caution that she and other central bank officials have issued in recent months, Yellen said that even though the fed expects to hike gradually and to keep policy accommodative, getting rates back to normal levels is important. The consequent rise in bond yields would normally act as some sort of brake on the economy, but because of global quantitative easing it is likely there will be an international bid for yield that will keep a lid on the Treasury market. So while corporate profits are picking up, bond yields are unlikely to back up because global investors simply won’t let them.

As we have noted, the US economy is late cycle, which is best seen through the labour market figures, whereas data indicates there is still significant spare capacity in Europe. The reflationary theme (a fiscal or monetary policy, designed to expand a country’s output and curb the effects of deflation), although a broad one globally, is more robust in the US, with early indications that President Trump is pursuing fiscal expansion adding weight to the argument that US growth and inflation will continue to gather momentum.

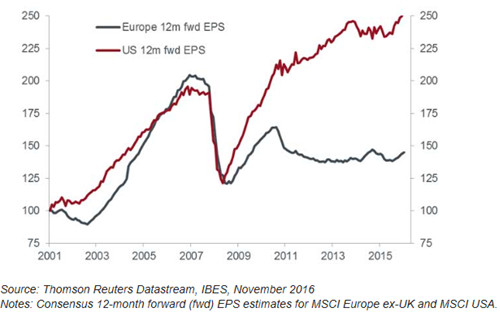

European equities are still relatively ‘unloved’ by investors from a global perspective. The market currently trades on what we believe is an attractive valuation versus the US, although we still like the US, which is almost always consistently viewed as expensive. Not only does the European value story look compelling, we also believe there is scope for earnings growth to accelerate after lagging the US for five to six years, and could be set to close the significant gap on the US as the chart shows. Clearly election shocks in Europe could derail this opportunity. With €100bn having been pulled from European equities last year, it seems that investor disenchantment with Europe continues. Yet the outlook for the Eurozone economy is actually very strong.

2016 closed with the Eurozone displaying some positive economic momentum, with the manufacturing Purchasing Managers Index (PMI) accelerating to its strongest reading for the year. Private consumption is contributing significantly to growth, with unemployment having reached a new post-2009 low late last year.

At the same time, the global backdrop is also becoming more supportive. Europe, Japan and emerging markets are traditionally the three regions which do well out of an accelerating global economy. Europe appears to be well placed to take advantage of a cyclical upswing for now, with a friendlier global growth backdrop feeding into a positive domestic story.

European equities have posed something of a conundrum in recent years; while the economy and company sales have already recovered to post-crisis highs, earnings have remained lacklustre and stuck near their cyclical lows. Yet with growth and inflation picking up, earnings could now begin to come through more strongly. Even some of the most bearish investors are revising up their expectations for earnings growth. Despite expectations for a decline in earnings, the numbers so far have actually been positive. Financials have benefited from stronger loans growth and higher bond yields while industrials could be seeing the beginning of a pick-up in demand for capital goods, as companies step back from their reticence to invest since the financial crisis. Sentiment may now be turning. The Bank of America Merrill Lynch Fund Manager Survey showed fund managers moving overweight Eurozone equities in December, from a small underweight position the month before. With political risks still concerning some, this could simply be the result of many closing underweights, leaving plenty of additional capital yet to flow into Europe.

Undoubtedly, the next few months will be dominated by political activity and markets trying to establish the impact of the Trump victory and whether protectionism will feature as strongly in the administration’s policies as much as it did in the pre-election rhetoric. Understanding what the Trump administration is actively seeking to deliver will be crucial for all asset classes, no matter the geography. During February Donald Trump met with Japan’s Prime Minister,Shinzo Abe. The overall tone of the meetings appears to have been warmer than expected. Mr Abe appears to have pledged little more than some job creation in the US, while Mr Trump appears to have downplayed trade issues, at least for the time being. This positive outcome was not what had been expected but was very welcome and perhaps reflects more of the reality of what we might see delivered – sensible compromise. China will be hoping for a similar response from Donald Trump as will emerging market economies.