2017 has got off to a strong start with Equities continuing to make new highs. The month of January is a busy time for Fund Houses presenting their views on the year ahead and there is a clear consensus that 2017 will be challenging. They all agree that opportunities exist across all regions and asset classes, although Bond and fixed income managers are perhaps less exuberant about the road ahead. The outlook is beset with macro-economic and political risks – not least the forthcoming elections in France, Holland and Germany, Article 50, and of course President Donald Trump.

History will judge the long-term impact of Mr Trump’s immigration order, but his early praise for its implementation will not easily be forgotten. “It’s working out very nicely,” Mr Trump said in a brief response to a question in the immediate aftermath of its implementation, which in hindsight was perhaps premature. While on the campaign trail, it was easy for Mr Trump to roundly decry the US immigration system (and indeed many other US policies) as broken and make a general call for drastic change. As president, however, his team has had to fill in the details and it seems they faced some difficulty translating his pre-election rhetoric into workable immigration policy. This may prove to be the case on the many issues he seeks to tackle, which of course includes trade and protectionism, which could significantly impact global economies and markets. The world is watching closely and the politics will matter not only in the US but throughout the globe. Politics more than economics may have greater influence on markets in 2017.

Unlike late last year, when specific sectors such as financials and energy drove the bulk of global returns, the latest rally in stocks has been broader based. A weaker sterling has driven UK equity performance, though the 12 point speech by Prime Minister Theresa May on Brexit negotiations saw sterling leap higher, and conversely the FTSE 100 retreating. The politics again taking centre stage.

Equity markets have of late focused on the growth aspect of what Trump’s changes might deliver. There is a belief that Trump is good for US and global growth, as well as corporate profits, all of which is supportive for equities. In the US, earnings have been improving, largely on the back of a rising oil price and the US dollar, coupled with growing consumer confidence resulting in the market to rallying. If President Trump can deliver his tax and fiscal promises in full as well as finding a constructive approach to international trade, then as Columbia Threadneedle suggest there “is little reason why the current rally should not continue”. Whether he can deliver will be the challenge as the complexity of running the country is very different from running a business empire. Consensus and agreement may be hard to achieve and perhaps unfamiliar to the President.

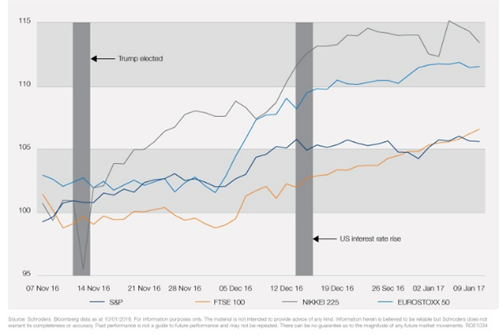

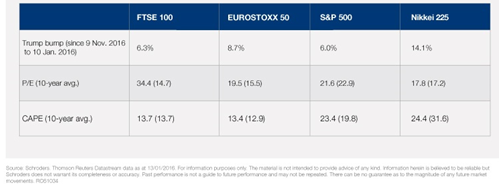

Stockmarkets tend to retreat in the face of political and economic uncertainty. The combination of Brexit, Donald Trump’s election, European elections, the return of inflation and prospect of higher interest rates would normally undermine demand for shares. But instead, stockmarkets have rallied with some indices hitting all-time highs. The chart, produced by Schroders during the month, shows the performance of major markets, in local currency terms, since Trump’s victory was declared on 9 November 2016. The US market’s gain is dwarfed by those in Europe, with the Eurostoxx 50 up 8.7%, and Japan, with the Nikkei 225 14.1% higher. The question on the minds of most investors is whether markets can continue in this trajectory or are falls inevitable from here. There can be no guarantees either way. Volatility will likely be prevalent through 2017, but the analysis from Schroders was fairly positive. Whilst markets are not cheap they are not alarmingly off the scale and based on averages seem reasonably well placed. The data suggests no obvious value reason for a sell off, nor any strong reason why they can’t continue to progress. We would be surprised though to see a repeat of the rate of uplift experienced from June 2016 until now. It surely must be a flatter rise?

The P/E (price-to-earnings) ratio compares a company’s share price and its earnings over the past 12 months. The lower the figure suggesting better value and vice versa. The CAPE (cyclically adjusted price-to-earnings) ratio does the same but averages the profits over 10 years to smooth distortions created by the business cycle. This measure has become popular in recent years, although it has its critics and is not perfect. In the table, Schroders compared these valuations with their average over the past decade.

The US and Japan have high CAPE valuations with the US above the long-term average. Investors justify these valuations by the prospects of the companies. The UK market is in line with its long-run average while Europe is slightly higher. Both markets are significantly cheaper than stockmarkets in the US and Japan. In the US,Trump’s policies have lifted confidence and should be good for economic growth in the US. It could even kick-start faster growth elsewhere. This view is not universal with one senior Baillie Gifford manager questioning this conclusion. Trump’s policies have also raised expectations of higher inflation as employment rises and increases consumer spending. The US is almost constantly thought of as expensive but frequently performs. The US is rarely seen as cheap.

In the UK,the FTSE 100 has enjoyed a boost from a weaker pound so when results are converted into pounds companies enhance their profits or reduce their losses. The CAPE ratio, which is designed to smooth out some anomalies, calculates the FTSE 100 trades on a CAPE of 13.7 times, which is in line with its long-term average. Sterling is likely to remain weak with Brexit concerns so the currency impact is unlikely to reverse any time soon nor is another currency boost expected to be repeated in 2017.

In Japan, Trump’s policies should lift earnings for cyclical shares (companies such as miners and energy firms, which tend to benefit more when the economy and demand improves), and export-reliant businesses, which could see earnings improve if demand picks up from the US. Rising interest rates in the US have weakened the Japanese yen, which should increase profits for Japanese firms converting earnings from dollars to yen. Despite the significant rise in the index over the last two months Japanese shares still look fairly valued on a P/E of 17.8 times, compared with the historical average of 17.2 times. The CAPE valuation of 24.4 times is significantly below the ten-year average of 31.6 times.

The Eurostoxx trades on a P/E of 19.5 and a CAPE measure of 13.4. This is starting to look a little expensive compared with its respective long-term averages of 15.5 and 12.9. However, earnings are likely to improve from a low base and a re-rating of the market could be the result. The outcome of the elections will be critical to markets and if no shocks then positive movements could be expected. We will see.