2017 closed with the UK market at a record high. Almost all investors will be able look back at 2017 with a warm glow. Some, though, may feel slightly frosty as they held back waiting for the market correction that never arrived. Global growth has been at its strongest for seven years, with both China and the Eurozone surprising to the upside. Japan, Asia, Pacific and the wider emerging market regions didn’t do too badly either. The US continued to grow from strength to strength, with many believing it was defying gravity, whilst the UK performed reasonably but perhaps flattered by sterling’s post Brexit continuing weakness.

A number of political worries on the horizon this time last year notably failed to materialise, including the likely shape of President Trump’s trade policies, the rise of populism in Europe and fears over North Korea. As it turned out, the market shrugged all these aside, with both interest rates and market volatility remaining close to historic lows, while stock markets hit new highs.

As economic volatility has fallen, so has market volatility, increasingly tempting investors into risk assets and feeding a growing sense of wary confidence. Performance has been almost universally positive across risk assets in 2017, with many equity markets delivering double digit returns. It has been a Goldilocks period for investors. A Goldilocks economy is an economy that is not too hot or cold, in other words sustains moderate economic growth, and that has low inflation, which allows a market-friendly monetary policy.

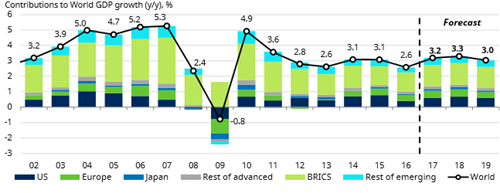

The world economy is enjoying a synchronised upswing, in which most regions are generating good growth despite political upsets in some parts of the world. Most fund houses are estimating that global growth for 2018 will be around 3.0% and some believe it could edge higher. Forecasts are forecasts and must not be relied on! This would be a modest increase from 2017. If correct, this would make 2018 the strongest year for global growth since 2011. It is probably likely that 2018 will see a fading of the Goldilocks combination of better-than-expected growth and weaker-than-expected inflation. Structural factors such as the effect of technology remain important, but cyclical forces suggest that inflation will begin to catch up with the strength of economic activity during 2018.

During December most fund houses consider the outlook for the year ahead and what it might deliver. Almost without exception the mood is cautiously optimistic for equities across all markets, whilst fixed income remains more challenging. No one can predict the future but there is certainly no mood of impending doom or gloom or anyone identifying any compelling reasons that markets will take fright and sell off. There is one caveat, though, and that is the impact of Central Banks reversing QE. This is new for everybody and the impact will require to be monitored closely. It is expected that most Central Banks will be following this path during 2018, except, perhaps Japan. Central bankers would like investors to believe they can withdraw monetary stimulus and normalise interest rates in 2018 without negative consequences. That could be a naïve view.

So nearly a year on, many of the same worries that existed at the start of 2017 remain, compounded by the question of how markets will react to the gradual withdrawal of QE. Investors will question whether these worries have been deferred or whether markets will again take them in their stride. Few would disagree that valuations are stretched nearly everywhere, underpinned by low inflation and minimal interest rates. Perhaps, Japan stands out as one of the few attractively valued equity markets. In both Japan and Europe, stock prices should benefit from expanding profit margins which have room to catch up with other parts of the world.

Schroders suggest that one area of the equity market likely to stand out is value (cheaply-valued stocks). After the longest period of underperformance in over 40 years, the catalyst for a turnaround could be a rise in inflation and therefore interest rates. Schroders tend to have a bias towards value investing but the view is logical.

Standard Life suggest that 2018 isn’t going to be as easy as 2017, a view with which we agree. “A world of synchronised growth, low inflation and steady central bank policy-making looks set to evolve. The growth engines are picking up speed in some areas, such as Europe, but look to be slowing in others, such as China, which may lead investment managers to change how much they’re invested in these areas. Headline inflation is slowly rising, core perhaps less so. However, any upside surprises in either would give ammunition to central bankers to be more aggressive with their interest rate policies”.

Another Chief economist of a major Fund house that we work with suggests “The longest ever US business cycle expansion was in the 1990s. It ran from March 1991 to March 2001, exactly 10 years. The current expansion has been going since June 2009, which makes it eight years and five months. I’m confident that this expansion will be the longest in recorded US history. Of course, most economies tend to follow the US. All of that is good news for the expansion, and I think it can continue for several more years. Well, at this stage in the cycle with interest rates rising and a potential for further increases at the long end of the bond market, the outlook for bonds is self-explanatory. The more interesting point is whether high valuations underlying equities, real estate and other risk assets, require some degree of caution. Well, they always require caution but I think that high valuations on their own are not a reason for moving to cash. Given that the economies are going to continue to grow, earnings growth is also likely. I think we probably have one or two, maybe several, more years of decent earnings growth ahead. Historically that has spelt good news for equity and real estate markets”.

Another major fund house agrees that equity valuations are undoubtedly high by conventional measures, but states that if you use a simple technical model to adapt the cyclically adjusted price-earnings ratio of US stocks for today’s environment, it suggests US valuations could have a further 30% upside.” No one should take that analysis too seriously – nothing lasts forever and some of those factors will look vulnerable in 2018. But it does suggest that the current optimism is not yet fully priced in, and investors might want to pause before cutting equities too quickly”.

So the various views from fund managers and economists paints a cautiously positive view for the year ahead. What we will be constantly monitoring is whether this consensus plays out. What is evident is that there does not seem to be a cacophony of alarm bells ringing from investment professionals who are not prone to being excessively optimistic.The most important point heading into 2018 is that we are currently seeing synchronised growth throughout the global economy – the strongest pace of expansion since the global financial crisis. While there is always some risk of recession over the next 12 months, those risks currently do seem lower than usual.

Whilst the sentiment for equities remains encouraging, we remain convinced that a well-diversified portfolio of both equities and fixed income is essential for a pension portfolio. Sentiment can change very quickly and an absence of defensive assets would be a very brave move that we would not embrace.

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.