“2022 is a year many investors would like to forget with the price of both stocks and bonds falling sharply. Next year the global economy is likely to feel the aftershocks of higher inflation and interest rates, but we believe the market has largely pre-empted the macro troubles set to unfold, and both stocks and bonds look increasingly attractive”.

These encouraging words are from JP Morgan’s Investment Outlook for 2023. There are few who will be sorry to see the end of 2022. It was a difficult year for investors as a plethora of negative news including the war in Ukraine, and central banks hitting the monetary brake in a bid to tackle inflation. As the chart above shows and aptly titled, there was nowhere to hide and no matter whether high or low exposure to equities or high or low exposure to fixed income, the outcome was almost identical. Whether it was 80% equity or 80% fixed income, the outcome was a reduction in the high teens. Equities and fixed income falling together had not been experienced for many decades and never to this extent. So, whilst we are extremely wary of making forecasts, the sentiment from JP Morgan about 2023 would seem a reasonable view.

During much of 2021 the message from central banks was that inflation, that had almost been consigned to history, was back but only for a short time as economies got up to speed following the pandemic. The term used was “transitory” and it featured confidently in many of the messages from central bankers. Whether transitory was right or wrong, the war in Ukraine changed that for Europe and to a lesser extent beyond. A war that was never in the reckoning. How wrong was the view on inflation? Thus, we continue to be wary of overconfident predictions.

What we are seeing in the above charts is the movement of US inflation over the last few years and the movement of shipping costs and used cars. The two latter components were often used to demonstrate the dramatic impact of the post pandemic recovery. The charts would suggest that we are heading in the right direction and inflation in the US may have peaked, (although wage and service inflation might not yet have) and it is hoped that the UK will follow very shortly although the calamitous impact of the Truss autumn financial statement might delay the turning point. Shipping costs are returning to pre pandemic levels.

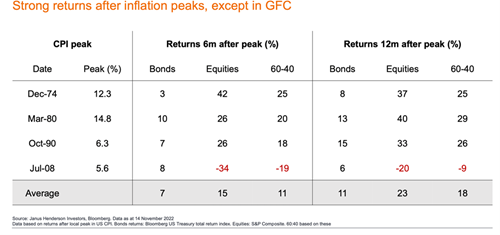

What will certainly give markets confidence is when interest rates have peaked and are thereafter likely to be on a stable and downward trend. A new term for us all is “pivot”. This will be the point when inflation and interest rates are viewed as peaking, and it is then expected that markets will be significantly rid of the dreaded uncertainty. It is hoped that the pivot will be reached sooner rather than later in 2023.

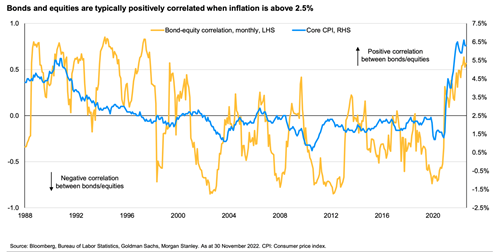

The chart above provides some evidence for a much better year in 2023 in terms of portfolio behaviour. If inflation and interest rates peak and start to fall, then portfolios should again perform as expected for investors. Inflation is not expected to fall to close to 2.5% for some time, so correlation should be restored between fixed income and equity. The death of the 60/40 portfolio was perhaps premature. Our conversations with asset managers suggest the appetite for fixed income is substantial. We would support that sentiment and hope the recurrence of 2022 correlation will not again be seen for a very long time.

We have used a lot of charts in this edition, but the charts tell a persuasive story and are more powerful than words.

Some already believe that the UK is in recession, which we would struggle to argue against but 2023 appears to offer a year of low growth across all developed economies. We will need to see if some of the downside is already in the price. We think it might be. Valuations have been universally battered, some undoubtedly overdone.

Property is an area of concern for the next year or two. We will be keeping this under review as the economic environment is not well suited to this asset class.

It has been a horrible year on many levels, but nothing compares to the brutality the Ukrainians have suffered. As long-term investors we try to ignore much of the noise and look forward to being rewarded with our conviction. 2023 is unlikely to be without its challenges. Russia’s action and China’s covid strategy will both be key. However, light at the end of the tunnel on many levels? We do hope so.

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.