2024 Review

2024 was dominated by geopolitical uncertainty as nearly half the world’s population had the opportunity to vote in national elections, while interest rates remained at elevated levels for longer than expected due to inflation proving stickier than forecast, leading to increased market volatility. Inflation in the UK rose in October and November 2024 which is disappointing and will impact the rate at which interest rates can be reduced. This is not isolated to the UK. Indeed, whilst the December meeting of the Fed resulted in a small cut to rates, the message was clear that the path for further cuts would be slower. The US markets responded with a 3% fall and the dollar rising to a 2-year high. Donald Trump’s return to the White House is expected to lead to tax cuts and tariffs, which many economists fear could stoke inflation. Whilst in the UK, money markets indicate the Bank of England is only “certain” to cut rates at least once in 2025, with the next reduction potentially coming as late as May. Traders think there is a roughly 80pc chance of a second cut by November, compared to very recent previous expectations of three cuts in 2025.

2024 was a good year for portfolios. If we look at markets in 2024, Artificial Intelligence has been a massive driver of returns, particularly in the US. In general, equity and fixed income markets have achieved solid gains. US economic momentum has proved resilient, helping the S&P 500 to outperform other major regional equity markets once again. The concentration within the S&P 500 remains a key issue and indeed risk. The Magnificent 7 group of stocks have accounted for 60% of S&P 500 returns. However, economic resilience and political changes have led markets to revise the path of monetary policy, which has been reinforced following the recent Fed meeting.

Outside of the Eurozone, investors have pared back their expectations for rate cuts, and global government bonds delivered negative returns over the year, despite some expecting this asset class to be a 2024 winner. The concentration of returns over 2024 will have affected portfolio weights and again reinforces the need for regular rebalancing.

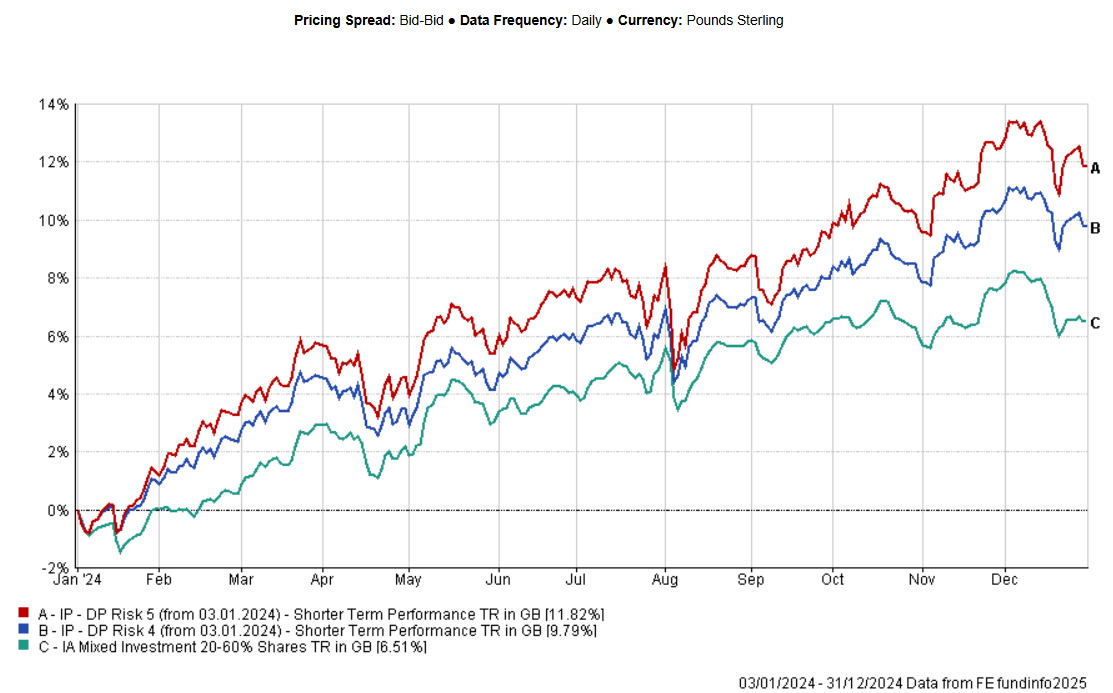

The charts from FE Analytics show the annual performance of some of our risk rated portfolios over 2024. It is pleasing that the relevant benchmarks have been beaten without a heavy exposure to the Magnificent 7. All eyes will be watching how AI develops in 2025. The likely winners will be those companies that can improve productivity and earnings as this evolving technology becomes more and more integrated into processes across almost all sectors. It will also be interesting to see whether the Magnificent 7 will continue to dominate the S&P 500. Earnings forecasts for these leading companies continue to look strong but nothing is ever guaranteed as history will confirm. What is almost certain is that it is rarely “different this time” and we must be mindful of being in a bubble.

US Election Impact

In the weeks since he was re-elected Donald Trump has threatened to impose tariffs on America’s three biggest trading partners, announced plans to deport millions of illegal immigrants despite a tight labour market, endorsed crypto currencies, and done little to dampen speculation he’ll meddle with central bank independence. The S&P 500 responded positively to the election result albeit it has had a setback following the Fed’s December meeting and the guidance that followed. There’s also been a significant uptick in the pace that global investors have pulled money out of Europe and Emerging Markets in order to buy US equities over recent weeks, according to data compiled by Barclays.

Perhaps the most concerning policy for global markets would be the introduction of substantial tariffs. Most economists agree that tariffs on imports would lead to higher prices for US consumers, which would ultimately be bad news for US companies too. One explanation is that investors are choosing to believe in the parts of the Trump agenda they like the sound of – tax cuts and deregulation – while choosing to ignore the fact that the president-elect is tooling up for a trade war.

According to Absolute Strategy Research’s (ASR) latest assets allocation survey, one of the best gauges of investor sentiment and the first since the US election, suggests money managers are increasingly worried that Trump is not bluffing and is now showing a 58pc probability that inflation, having steadily fallen steadily since its peak in June 2022, will be higher a year from now. ASR concludes this reflects investor concerns about the consequences of higher tariffs combined with Trump’s plans to deport millions of illegal immigrants at a time when the labour market is already tight. Yet the research outfit’s findings also show a sharp swing in favour of US equities with the probability they will outperform non-US equities jumping by a chunky 11 percentage points since the previous quarter to hit 63pc. Many commentators suggest that US equities will perform ahead of the rest in 2025. It could be herd mentality, but we will soon see.

It would seem the change in US President will have an impact on many levels across the globe. The UK remains undervalued compared to long term averages but whether that is an opportunity is far from clear. The UK economy is struggling as the Governor of the Bank of England explained. Growth has failed to materialise, and the recent budget has been widely blamed for adversely impacting the economy. UK borrowing costs are climbing as stagflation fears grow. Autumn 2024 saw yields exceed the Truss meltdown level. It will be a challenging time for fixed interest but with higher rates and volatility, some opportunities should exist.

As the Financial Times reminded us in a recent article, “It’s an oldie but a goody”, and we reckon it’s good to resurface from time to time as a reminder of how hard it is to make predictions, especially about the future. Please bear that in mind as we enter 2025. The Chancellor will be hoping the Governor of the BoE is not good at predictions.

Douglas Kearney C.A. Investment Director

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.