The Trump Effect

2025 was a year like no other. From start to finish it was dominated by one man. It is impossible to believe that will change throughout 2026. Donald Trump entered the White House in January 2025 and so began a journey that few around the world could have imagined.

Images have stayed with us, starting with the contentious Zelensky meeting early in the year. Elon Musk waving his chainsaw around in February and then falling out with the President in June. Trump with his charts in the White House garden with gigantean tariffs against almost all nations in April, although Russia was not included. Subsequent press conferences updating the tariff position that sent markets swirling up and down, or more like down and up. Information that would make a hedge fund a fortune no doubt.

The intervention of Scott Bessent to prevent the debt market doing a “Truss” on Trump was another key moment for markets everywhere and the dollar’s reputation was somewhat tarnished. The introduction of a new word in the dictionary, TACO, Trump Always Chickens Out. The cease fire ceremony in the Middle East and the Alaska meeting with Putin also come to mind. The culmination surely was just recently with FIFA awarding the US President the inaugural peace prize from the world’s football governing body. An image few will forget as we head into 2026. With 2026 only a few hours old, Trump surprised the world by his intervention in Venezuela. This has been followed by considerable rhetoric about other targets in his sights. A disconcerting start to the new year and undoubtably Trump will once again dominate the agenda.

2025 Market Overview

Despite the impact of many very serious geopolitical events and the roller-coaster that markets faced with introduction of hefty tariffs and frequently very quick row backs which caused much turmoil, markets performed.

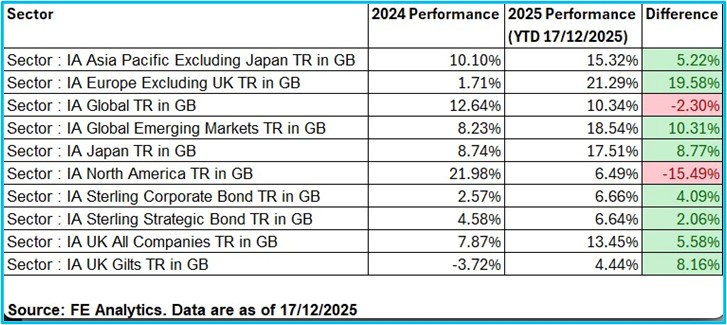

As can be seen from the charts and graphs, performance was good across most asset classes.

Perhaps the biggest surprise is the performance of the North American sector. Whilst performance was positive, it is greatly subdued compared to 2024. The weakness of the dollar following the tariff saga (which began on 2nd April 2025) severely impacted performance when translated into sterling, which grew stronger along with other currencies against the dollar.

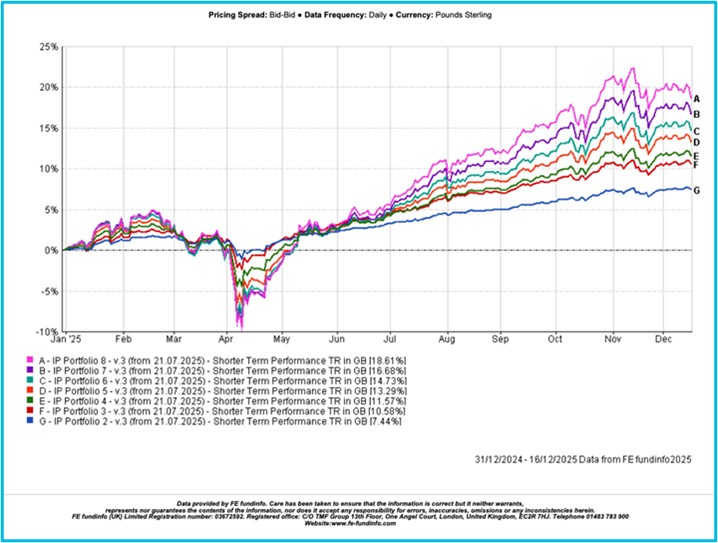

As the global equity sector comprises around 60% of North American equities, this sector was impacted by the decline in North American performance. This overall performance was evidenced in our risk-rated portfolios as can be seen in the graph below. The portfolios delivered outcomes commensurate with the risk and delivered very satisfactory returns across the range.

As can be seen in risk-rated Portfolio 8, the greater exposure to Emerging Markets was rewarded in 2025.

Emerging Markets delivered around 18.5% which just behind Europe that achieved over 21%. It is also pleasing to see the lower risk rated portfolios delivering good results for the more cautious investor.

It is worth noting that Emerging Markets continue to receive positive sentiment as we move into the new year.

The Magnificent 7 and the AI Bubble

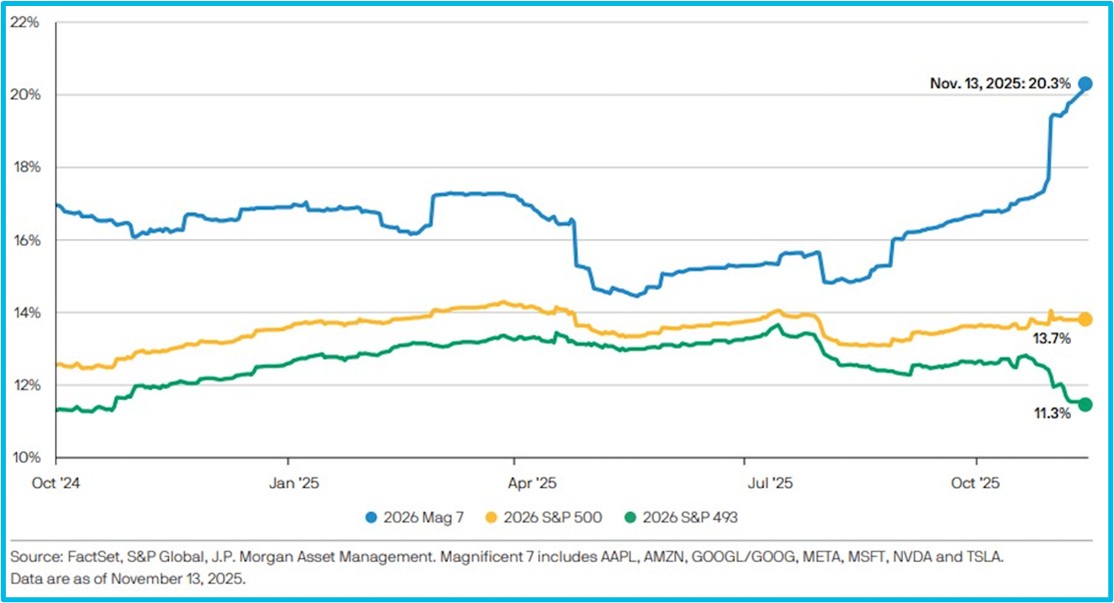

For much of 2025 The “Mag 7” or Magnificent 7 dominated US markets. They are a group of large-cap US technology companies—Apple, Microsoft, Amazon, Alphabet (Google), Meta (Facebook), Nvidia, and Tesla—known for driving significant market growth and representing a large portion of the S&P 500.

These tech giants lead in areas like AI, cloud computing, social media, EVs, and e-commerce, making them hugely influential in the stock market. There are many conflicting views on whether these companies and the AI giants in particular are significantly overvalued and a bubble has been created that is set to burst.

Undoubtedly, this topic will be a feature as we head into 2026. Many fund houses that we speak with are not supporting the bubble argument, albeit recognise valuations are high. However, the chart above shows that earnings for the Mag 7 are estimated to shoot up while the S&P’s 493 shoot down. It is the strength and visibility of these earnings, which were not evident 25 years ago, that provides the asset managers with the confidence to believe this is not a re-run of the dot-com bubble. The strength of earnings may not be sufficient to allay some anxious investors.

2026 Outlook

As we head into 2026, we are seeing employment concerns begin to rise for a variety of reasons including the impact of AI on staffing requirements. This will be a feature of the year ahead that we will be watching closely. It is also expected that interest rates will reduce over 2026. Inflation may be a feature in the US as the consumer shares the pain of the tariffs. It may dampen demand which may exacerbate unemployment and we might start to hear recession rearing its voice.

2025 was a good year for UK equities, with records broken. The UK equity market has been in the doldrums for some time, but 2025 was much more positive with the FTSE 100 leading the way. Whilst the economy and political landscape are troubled, it is encouraging to learn that UK Gilts are viewed as attractive by many managers, particularly in comparison to the deeply indebted US Government’s Treasuries. This sentiment is rarely heard.

Global macro conditions heading into 2026 are increasingly defined by divergence. As we have considered, valuations across risk assets are elevated and potentially represent a key vulnerability. Any correction in AI-related growth expectations could spill into broader market weakness via a negative wealth effect. Although the shock factors associated with tariffs are now behind us, there remains a great deal of uncertainty on that front, and the final word has not yet been said. What we do know is that staying the course has proven to be rewarded rather than attempting to time the market.

On lighter note, according to a new study, the late-night drop of the latest series of a hit show by streaming services such as Netflix causes market returns to decline the following day, with the effect said to be linked to tired traders binge-watching new episodes. “Since sleep deprivation results in mental lethargy, investors are less willing to spend effort in making decisions that require more mental effort,” the research claimed “As a result, sleep-deprived investors make fewer buying decisions that require more cognitive effort as compared to … selling decisions. Hence, stock returns decline as sellers outnumber buyers.” The study was published by Hong Kong University Business School and co-authored by academics at Queen’s Management School at Queen’s University Belfast, Cardiff Business School and Cambridge Judge Business School.

The phenomenon was found to be stronger in stocks with larger market values (not good news for the Mag 7!). They said the “effect is stronger for stocks that are the habitat of institutional investors”, possibly because already sleep-deprived professional traders see their rest “deteriorate even further if they are watching late-night shows”. The report’s authors said their findings on the impact of “binge-watching late-night TV shows” were “robust to a wide range of alternative explanations”. following the release of popular late-night shows”.

On average, the S&P 500 index drops by about 0.25% on the day following these shows, the research claimed. Annually, the cumulative decrease in market returns is about 2.3%, based on an average of ten popular shows being released every year, they said.

So be wary of watching too much TV over the months ahead!

As regular readers of Investment View will know, we avoid making forecasts for obvious reasons. However, we might make an exception and predict that Donald J Trump will continue to dominate the world agenda in 2026. No one could have predicted what he would do through 2025 and we will not attempt such a folly for 2026. Let us hope the world finds solutions to some of the many geopolitical, social and trading conflicts and that we can find opportunities in the volatility that will constantly be with us.

Douglas Kearney C.A. Investment Director

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.