It has been another good month for equity markets with quite a lot happening around the globe. The UK triggered Article 50, an Article few of us knew about not so many months ago, the Federal Reserve in the US raised interest rates, Donald Trump was again thwarted and failed to have Obamacare revoked, and the UK inflation rate was reported at its highest level since 2013. Around Europe the Netherlands did not vote in any significant numbers for the anti-Europe party, in Germany Chancellor Angela Merkel’s conservatives won a regional election in the western state of Saarland, dealing a setback to their Social Democrat rivals and boosting her prospects of winning a fourth term in Germany’s September national election. In France Marie Le Pen continues to have a mountain to climb to gain control of the National Assembly to effect any power.

Lost amongst all this noise was encouraging economic data from around the globe and it seems the world’s economies are on a more solid growth path. What is also evident is that interest rates appear to have bottomed out and now at worst are stable but more likely to rise from here. Inflation not deflation is the broad sentiment of markets and economists. Stable or rising interest rates with inflation of under 4% is historically a good backdrop for equity markets but not so positive for bond markets.

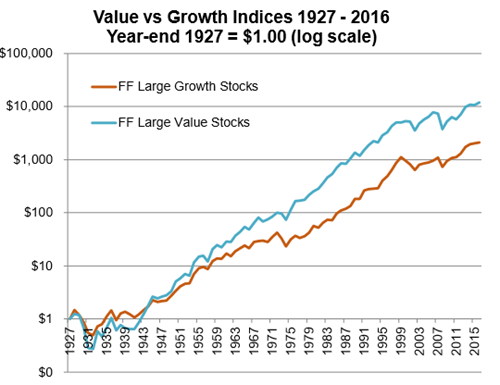

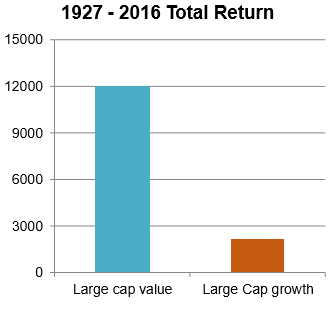

This change in market conditions has potentially a significant impact for the “style” of investing. Since the financial crisis with interest rates falling, recession, and deflation rather inflation the concern, investors have headed for growth stocks rather than value stocks. One way to look at the difference between the two camps is the length of time before you might expect to make your money back. The value business a ‘short-duration’ asset and the growth business a ‘long-duration’ one. The last seven years or so, however, investors have been far less concerned about inflation than they have about deflation. In times of deflation, prices of goods and services head downwards, and so your £1 buys you progressively more goods or services the further out you look. However, as the charts produced by Neptune Investment Management show, over the last 90 years a value bias has outperformed and the stage may now be set for value to return more to the fore. We have already included some value bias funds into portfolios.

In particular, we view Europe as an area that offers attractive targets for this style. One area in particular is the financial sector which does well as interest rates rise. Despite the reporting of significant adverse issues with some Italian and German financial institutions, Europe offers some attractive banking opportunities and banks are still the cheapest sector in Europe. This summer Basel will finalise the last regulations on capital, litigation is never over, but we should now be through the worst and earnings upgrades have started. European fund managers are slowly building up their positions from underweight to overweight in this sector amongst other “value” opportunities. Provided there is no seismic election shock in France, Europe looks to be well on the road to delivering attractive returns for investors. It is also worth noting as we shall see later that Japan is a deep value market.

The changing picture of inflation and stable or rising rates also changes the landscape for fixed income investors. As we have talked about many times, fixed income is challenging in this potentially transitional environment. As with equities the length of time to get returns matters. The key point to remember is that rates and prices move in opposite directions. When interest rates rise, prices of traditional bonds fall, and vice versa. So if you own a bond that is paying a 3% interest rate (in other words, yielding 3%) and rates rise, that 3% yield doesn’t look as attractive. It’s lost some appeal (and value) in the marketplace. Duration is measured in years. Generally, the higher the duration of a bond or a bond fund (meaning the longer you need to wait for the payment of coupons and return of principal), the more its price will drop as interest rates rise. Fixed income managers are looking for shorter duration bonds to mitigate anticipated rising interest rates. Over the last few months fixed income has been quite volatile and this is likely to continue with many investors shunning bonds, which we view as a mistake. We continue to prefer high yield and strategic bonds and the managers are acutely aware of market conditions.

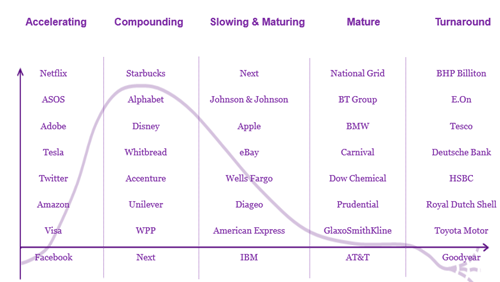

Despite Donald Trump’s setbacks, the US market continues to perform. It is often viewed as expensive; it is certainly not cheap. Hopefully the charts produced by Royal London Asset Management provide some explanation why this is likely to be the case for the foreseeable future. The first chart breaks down the composition of the “type” of companies in each part of their business cycle. The accelerating companies include some very familiar names that are at the leading edge of their sector and have still a long way to develop. As can be seen most “Accelerating” names are US based companies, whereas most of the Mature and Turnaround are not. This is not a complete list but a list for illustrative purposes.

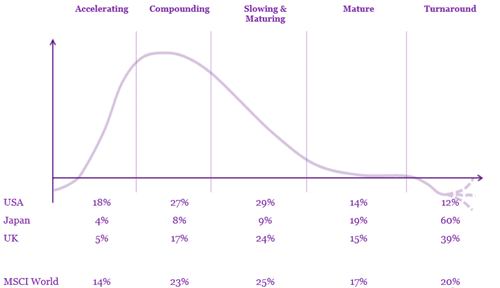

As can be seen from the second chart the US has 74% of its component companies in the rapidly growing, compounding and maturing segments. This compares with 46% for the UK and 21% in Japan. Investing in the US provides exposure to some of the world’s fastest growing companies and that comes at a price. That is unlikely to change. Whereas Japan has been through the “lost decade” and has a host of potential value companies that with a bit of engineering might flourish along with many exciting smaller companies developing or exploiting exciting new technologies.

The economic data is encouraging, the backdrop of a bit of inflation and stable or rising interest rates sets a sound platform for equities. The political scene is yet to be settled and it will be key, in our view, that Donald Trump does not become a lame (Donald) duck. That could disturb markets but in a recent article by Artemis, it was suggested that the US rally was already happening and Trump is in the right place at the right time and much of the progress could be attributed to the work of the Chinese leader Xi Jinping. In late 2015, Beijing unleashed a large, co-ordinated stimulus programme of bank lending, government spending and fixed investment by state-owned enterprises. So even before Trump, prices of industrial metals were rising, worries of deflation were being banished, bond yields were rising and the global economy was growing. Yet, lacking the ‘Trump trade’s’ alliterative allure, there is no talk of a ‘Xi trade’.