It eventually happened. Early February saw a correction to markets that was primarily caused by good news. It is a strange old world. Good news from the US raised concerns that interest rates might rise faster than expected and inflation might be making a stronger than expected return. This triggered a sell off, much computer generated, compounded by the unravelling of some complex products built around volatility. One such product lost 95% of its value almost overnight. It would seem the sell-off was exaggerated, but that gave fund managers an opportunity to buy on the dip. The markets have since been edging up but what is generally agreed is that volatility is likely to be a feature of 2018 and more importantly, in our view, the market blizzard of early February doesn’t change the economic climate. Global growth continues, interest rates are indeed likely to be moving upwards (is that a surprise?), inflation is likely to be more evident (isn’t that usually good for equities?) and fixed income is challenging in a rising interest environment.

Such periods of corrections or volatility in markets are quite unsettling for many investors and for almost two years investors have had a positively calm journey to new highs. Over the long term these uncomfortable bumps smooth out but at the time it is probably good for most to look away, don’t react, and wait for sense to prevail.

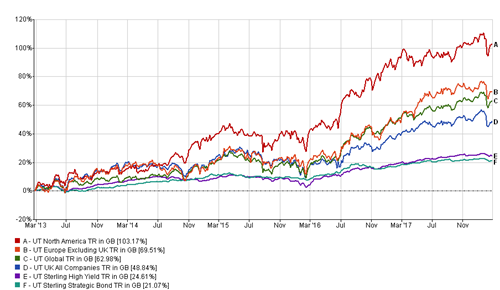

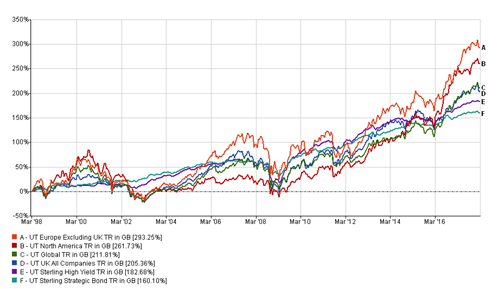

The charts (Source: FE Analytics) show a variety of popular assets classes over 5 years and over 20 years. The journey is never smooth but for all of the asset classes, the direction of travel is positive and the returns beat anything cash could have done over either period. The 20 year chart includes the dotcom boom and bust and then the Global Financial Crisis. Both periods were of great drama and scary headlines delivering constant bad news for investors.

What we must now expect is more periods of lumps and bumps but there is little to suggest that any fundamental change has taken place. 2018 got off to a flying start which made the correction feel more dramatic.

Strength in corporate earnings, a pick-up in economic growth and optimism over US tax cuts helped drive up prices in many markets across the world to the highest on record in January. The global equity market rally found fresh momentum as the positive sentiment which pushed global equity markets to record highs in 2017 remained intact.

A brief overview of what was happening at the beginning of 2018.

In the US, January registered the strongest start to the year since 1987. Earnings from corporate America also continued to impress and optimism surged following the end of the US government shut down. European equity markets started the year on a strong note. Stocks advanced amid a robust growth backdrop and accelerating economy. Data released this month showed Eurozone GDP expanding by 0.6% in the fourth quarter of 2017, marking 19 quarters straight of expansion. The strong macroeconomic environment led to a rise in German government bond yields which reached levels not seen since 2015.

Asian equity markets ended the month higher in US dollar terms, partly driven by the rise in Chinese equities, increased confidence in the growth outlook and US dollar weakness.

Japan’s equity market made a positive start to the year, ending the month higher for the fifth consecutive month, lifted by expectations that global economic growth will fuel an improvement in corporate earnings. However, the market pulled back towards the end of the month after the yen strengthened against the US dollar due to concerns surrounding: the protectionist trade policies touted by President Trump; speculation that the Bank of Japan may start to normalise monetary policy; and the US Treasury Secretary’s remarks welcoming a weaker dollar.

Emerging equity markets enjoyed a strong start to the year with broad gains being registered across all regions and sectors. The advance in stock prices was supported by an improving global growth outlook and increasing optimism that companies will be able to deliver on the earnings front in 2018.

After rising strongly into the close of 2017, UK equity market performance faltered in January in response to upward revisions to US interest rate expectations and a corresponding increase in government bond yields. The UK’s major market indices missed out on the wider rally seen across global stock markets against a backdrop of rising commodity prices, strong global growth expectations and strengthening sterling. January 2018 saw the US Treasury market lead government bond yields higher. The rise detracted from returns for more interest rate sensitive parts of the corporate bond market. However, high yield corporate bonds, which have a lower interest rate sensitivity, outperformed investment grade corporates and delivered a positive return.

Contributing to the rise in bond yields was the improving economic backdrop.

January 2018 saw the US Treasury market lead government bond yields higher. The rise detracted from returns for more interest rate sensitive parts of the corporate bond market. However, high yield corporate bonds, which have a lower interest rate sensitivity, outperformed investment grade corporates and delivered a positive return.

“A majority of participants noted that a stronger outlook for economic growth raised the likelihood that further gradual policy firming would be appropriate” Minutes of the Federal Open Markets Committee, 30–31 January 2018. Schroders have recently published their latest view which states “We are upgrading our global growth forecasts to 3.5% for 2018 and 3.3% in 2019, from 3.3% and 3.0% respectively. The increase reflects the continued buoyancy of near term indicators such as the Purchasing Managers surveys, business and consumer confidence alongside further fiscal stimulus in the US. Our global activity indicator hit its highest level for seven years in January”

So whilst we have hit a bump and expect more bumps ahead, our overall view has not altered. We still expect 2018 to be a positive year for investors as global growth continues to strengthen. What we might see is a slight shift to “value” as that tends to suit rising interest rates and inflation but we don’t expect “growth” to wither. We must also remember that fund managers prefer some volatility as that provides opportunities.

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.