The first two months of 2019 have gone someway to repair the pain of the final quarter of 2018. The year 2018 proved to be a negative year for almost all asset classes, which was something investors had not experienced for many, many years.The worst December since 1931!

During the Christmas holidays, the Chairman of the Federal Reserve appears to have had a change of heart about raising interest rates and the frequency of rises. A series of interest rate hikes in 2018 drew President Trump’s wrath, even though he nominated Powell to the Fed position after choosing not to put up former Chair Janet Yellen for a second term. The Fed under Powell unanimously approved four rate hikes in 2018, continuing a move toward policy normalization that Yellen began in December 2015. Trump has said the rate hikes are the biggest threat to U.S. growth and made it very clear on his now familiar Twitter account he wasn’t happy! Whatever the reason for Powell’s change of heart, it was welcomed by markets. This, coupled with a sentiment that the US / China trade war might be softening, helped global markets in the first few weeks of the year. What is apparent is that the global economy is slowing but few believe a recession in the US is just around the corner. Some developed European economies appear fragile with Germany looking weak and teetering on the edge of recession and Italy struggling. China’s target of growth of more than 6.5% looks a bit optimistic but it still outstrips developed economies by some distance.

Investors were probably too anxious and cautious in December, but equally, investors may be a bit too optimistic now, and the Fed’s pause is not a reflection of economic strength. On the bright side, however, if slower growth means lower earnings expectations, then US markets have probably factored in much of that slowdown. US economic growth of around 2% per cent would support low single-digit earnings growth. Markets have moved rapidly since the start of the year to reprice this changed environment, and with the S&P 500 close to 2,800 just now, further significant upside may be elusive in the short term, but rash decisions rarely pay off.

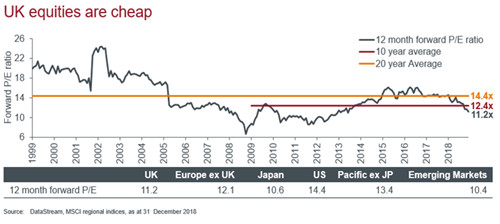

European growth continued to disappoint towards the end of 2018 and start of this year, however, there are signs that activity could start to improve. Leading indicators may have bottomed out, while a trade truce between the US and China could help boost external demand later this year. Meanwhile, the underlying fundamentals remain sound. In the UK, Brexit uncertainty has persisted longer than had been expected, and will probably now cause more damage to growth than previously forecast. The probability of a no-deal Brexit remains high, but even the outlook incorporating an orderly Brexit is looking less favourable due to the delays. The UK market has been unloved for some time and potentially could be viewed as offering interesting value. At a recent presentation it was described as “cheap”, but we would perhaps suggest that it may provide an interesting opportunity unless an Armageddon Brexit is the outcome.

The last quarter of 2018 and the first two months of 2019 provide a good reminder that it can be very costly taking a short-term view based on short term outcomes. Whilst the end of 2018 was uncomfortable the more prudent approach was to take an active action and do nothing and ride it out. A recent paper from Schroders reinforces that trying to time and react to market movements can be very costly.

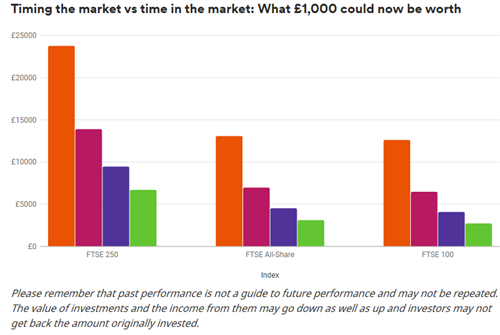

Buying low and selling high is every investors goal. However, timing the market precisely is notoriously difficult, if not impossible. Over three decades, mistimed decisions on an investment of just £1,000 could have cost you more than £17,000 worth of returns. Schroders’ research examined the performance of three indices that reflect performance of the UK stock market – the FTSE 100, the FTSE 250 and the FTSE All-Share. If at the beginning of 1988 you had invested £1,000 in the FTSE 250 and left the investment alone for the next 30 years it might have been worth £23,800 by the end of 2018. However, if you had tried to time your entry in and out of the market during that period and missed out on the index’s 30 best days the same investment might now be worth £6,749, or £17,051 less (not adjusted for the effect of charges or inflation).

In terms of annualised returns, over the last 30 years you could have made:

- 11.1% if you stayed invested the whole time

- 9.1% if you missed the 10 best days

- 7.8% if you missed the 20 best days

- 6.6% if you missed the 30 best days

The 2% difference to annual returns between being invested the whole time and missing the 10 best days doesn’t seem much but the effect builds up over time, as shown in the table below. If you had invested in the FTSE 250 it could have “cost” you nearly £10,000 during that time.

When observing returns over long periods, investors should also bear in mind that markets can be volatile, with many ups and downs during the timespan.

The chart illustrates what £1,000 invested in the FTSE 250, the FTSE All-Share or the FTSE 100 at the start of 1988 might be worth now if you had left the investment alone (orange bar), missed the market’s best 10 days (magenta bar), missed the best 20 days (purple bar) and missed the best 30 days (green bar).

As 2019 unfolds, we expect the markets to be more volatile than many investors might have become used to. The temptation is to overreact and seek to withdraw from the market, hoping to return in more settled times. This study shows that this strategy can be damaging to your financial wealth and investors should try not to look at quarters, instead taking a longer view to avoid the potential of missing the good days.

Douglas Kearney C.A. Investment Director

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.