The start of 2020 has been hugely unsettling for investors, albeit until a few days ago, markets continued their upward run, with many reaching new highs. The speed and ferocity of the recent correction has been extremely dramatic.

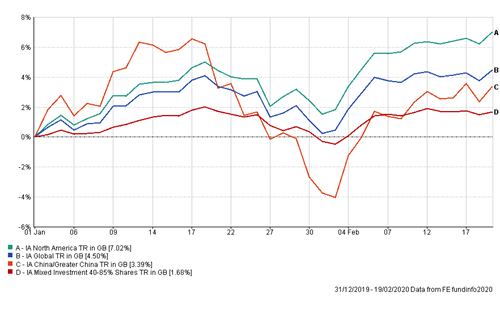

As the world returned to work in early January, which now seems an eternity ago, a United States drone strike near Baghdad International Airport targeted and killed Iranian major general Qasem Soleimani of Iran’s Islamic Revolutionary Guard Corps (IRGC). Soleimani’s killing sharply escalated tensions between the U.S. and Iran and stoked fears of a military conflict. Global markets reacted swiftly and negatively with the fear of the conflict spreading and intensifying. The repercussions that might ensue are not appealing on any level. Markets were awash with fear and uncertainty which curiously eased following the calamitous shooting down of a Ukraine passenger airliner. This huge error, amidst the escalation, resulted in leaders from both countries reducing the aggressive rhetoric as all seemed thankfully reluctant to further escalate the crisis and the markets moved on as the chart from 31/12/2019 to 19/02/2020 of some key sectors shows (Source: FE FundInfo).

This was then followed in January by dramatic television footage of the fires raging through Australia. The New South Wales Rural Fire Service tweeted on 2nd March “For the first time since early July 2019, there is currently no active bush or grass fires in New South Wales. “That’s more than 240 days of fire activity for the state. “The south eastern state was the worst-hit region since an extraordinary fire season began in June 2019. This led to much debate about the impact of climate change, responsible and sustainable investing and a letter from the CEO of the world’s largest asset manager informing the world’s companies of the BlackRock requirement to gain investment support. It is worth reading as it will be hugely influential in steering boardrooms to take the BlackRock views into account.

Into February, markets continued to progress with global growth looking quite positive. A word that very few of us had heard a mere couple of months ago, was creeping into our vocabulary. A virus was evident in a major Chinese city and seemed to be spreading with no vaccination available to stem its impact. The Coronavirus, was causing widespread shutdowns of factories which would hamper the economy. Despite efforts to isolate the virus it has now as we know spread and is present across the globe. The impact and extent of the virus remains uncertain.

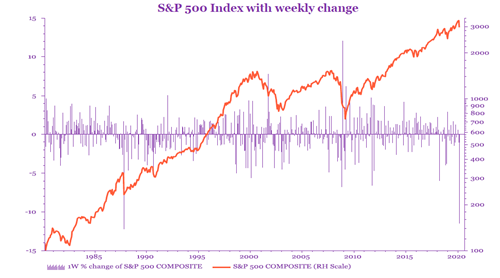

The markets, which had for a while shrugged off the coronavirus risk, began to realise that the economic impact of this flu-like illness could cause widespread global disruption and temporarily derail the global economy and even, potentially, cause some countries to fall into recession. Once again, it is the huge uncertainty that has so dramatically spooked the markets. The sell off at the end of February was the largest weekly drop since 1987.

The chart above (Source: RLAM, Refinitiv Datastream as at 28 February 2020) shows the weekly changes in the S&P 500 since 1980. There have been some big inter-year swings, but the direction of travel over the last 40 years has been positive and rewarding for the long-term investor. This dramatic sell off should soon be history, perhaps 2 or 3 quarters: It could be more, nobody can tell. It is unsettling, it is uncomfortable, but it is not unwanted by fund managers. Good companies just got cheaper.

In situations like this history suggests that it is wise to sit tight, let the markets settle and avoid making knee jerk decisions based on the shortest of timescales and very limited information. It would be optimistic to believe that the virus will not have some negative impact on global growth but the selling over the last week in February looks potentially overdone.

The possibly good news from all this is China can build hospitals amazingly fast, pollution over China has dramatically reduced and the scientists look to be significantly shortening the time to develop a vaccine. The bad news for Donald Trump is a Department of Commerce study found that 97 percent of all antibiotics in the United States come from China.

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.