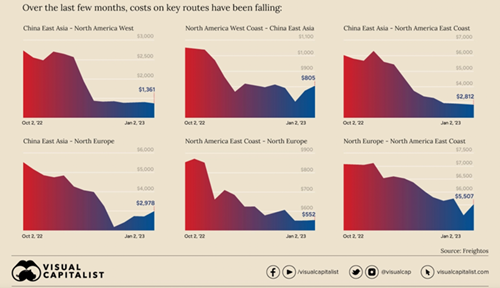

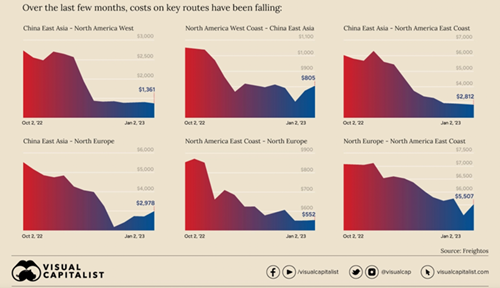

Overview The year has got off to a more positive start than 2022, but we are still experiencing significant volatility as the last week of February has shown. It remains a very jittery investment world and a world full of potential flashpoints. Inflation appears to be or indeed may have peaked across many economies but not falling fast enough. Recession is an uncertainty but increasingly looks at though it may be avoided in many developed economies. However, growth is very anaemic across the globe. Central banks policies and messages come under microscopic scrutiny to assess (read, guess) what will be happening to rates. A major (positive) turning point will be when sentiment and hopefully evidence supports that rates have peaked. This should bring confidence to investors and a bit more positive sentiment to markets. It is hoped that this will happen sometime this year, but opinion differs on when it might be. Market indicators Many of the anomalies of the post pandemic world are reversing and will help bring inflation down over the months ahead. We can remember the frequent reports of the multiple increases in container costs that were faced causing goods to rocket in price. The shipping charts from Visual Capitalist[1] confirm how container costs and shipping costs are returning to pre pandemic levels which is very welcome and not surprising.

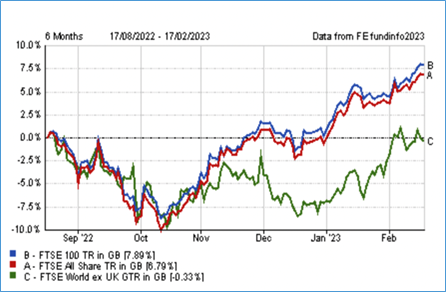

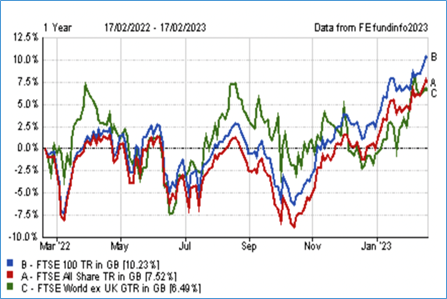

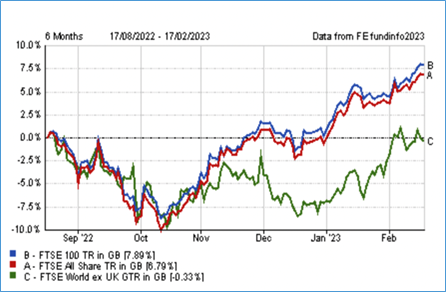

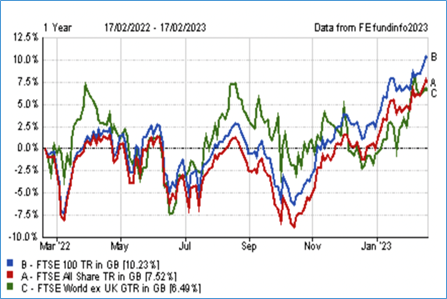

We are also aware that the premium on second hand cars is abating, and it is no longer the norm that new cars, which were hard to source, are cheaper than used cars. The shortage of microchips, which are in so many products, is also being addressed with new facilities under construction, particularly, in the USA to prevent a recurrence of the supply problems of late 2022 and into 2023. Supply chains are repairing and re-engineered. Shipping costs have come back to earth with many routes now at pre-pandemic levels. A recent study by the IMF covering 143 countries found that shipping costs are an important driver of inflation, so these reductions are welcome in the fight to reduce inflation. It is hoped we can look forward to supply chain efficiency once again and significantly less inflationary pressure. The 10x increase in profits for the shipping companies will likely soon be history. Perhaps, a harbinger that economies will revert to more normal relationships and that might be reflected in investment market activity and behaviour. So many varying opinions exist, which is not surprising as clarity is elusive. Recently, fixed income has had a revival in fortunes, but opinions are divided on whether this is permanent or not. UK view We have seen the FTSE 100 reach new peaks over recent weeks, breaking through 8,000. The FTSE 100 is a very good example of why long-term investing is key and judging performance on short term data can be very misleading and often expensive. Hopefully, the charts below demonstrate a clear understanding of the benefits of taking a long-term view, unless the optimist can time the market. Few investment professionals would claim that skill. The charts below map the performance of the FTSE 100, FTSE All Share and FTSE World ex UK over 6 months, one year and ten years. The 6-month chart shows strong performance from the UK indices whilst the World index has lagged. Over a year, the chart records a slightly different result but the UK indices slightly ahead of the World index. However, the lower chart plots performance over 10 years and the outcomes are very different. The FTSE World Index has delivered almost three times the performance of the FTSE 100 and All Share. 6 Months:

1 Year:

10 Years:

Intelligent Pensions Portfolios It is worth reminding ourselves that almost all the funds in our portfolios base their objectives, targets, and performance over 3 years but most set 5-year goals. We have been, and continue to be, strong supporters of global funds which have substantially delivered, albeit 2022 was very challenging and almost unique in almost all asset classes falling as one. The recent increases in base rates around the globe have been welcomed almost universally by fixed income managers. An excited Fixed income manager has been a rare sight, but for the time being, no longer. As we have frequently discussed, assets in the fixed income world were operating in a difficult landscape, some with negative rates at times, and all with historically low rates for over a decade. That made finding opportunities very hard, but as rates increase so do opportunities, as we are now seeing. Yields of 6 and 7% are appearing in some very good funds which are catching our attention. If rates continue to be roughly where they currently are, or even a little lower, then opportunities should be attractive and Fixed Income in portfolios will be a welcome component rather than a strategically defensive position. Some commentators are not yet convinced, so we must be wary. We remain committed to being patient and whilst the very dramatic changes of the shipping world are unlikely to be mirrored in the investment world, holding firm may be pleasantly rewarded. |