Overview

Following a strong rally towards the end of 2023 driven by the hope and expectation of interest rate cuts and significantly lower inflation in 2024, markets retreated at the start of 2024. In the UK, inflation at the turn of the year got stuck at 4%, lower had been the forecast. The retreat was also hindered by stronger economic data dampening out those rate cut hopes. (The thinking being that strong data might result in central banks and policy makers being reluctant to take the foot off the brake to avoid inadvertently creating a rise in inflation). Markets have since recovered, and we have seen the S&P 500 Index rise to record highs. In 2023 more than 70% of the constituents of the S&P 500 trailed the market with many stocks underperforming relative to their own earnings growth. Equity concentration in the S&P 500 was at levels not seen since the 1970s. This concentration was also seen in global equities.

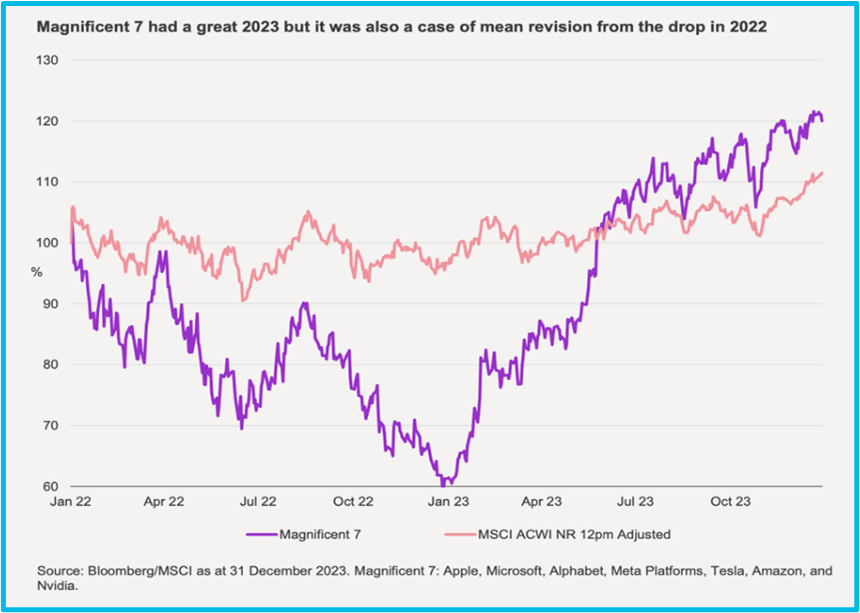

The US Nasdaq market has also experienced huge concentration and has been somewhat dominated by the magnificent seven. The “Magnificent 7” are the U.S. tech giants of Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla. It is hoped that 2024 will see a wider dispersion of returns across markets. February also saw Japanese equities at a new all-time high, with the Nikkei 225 Index breaking the previous record set over 30 years ago in December 1989. That is a very long wait even for the longest long-term investor.

It is encouraging to see equity markets cheering the growing prospects of a ‘soft landing’, albeit the UK is reporting a (mild) recession through the latter half of 2023. (A soft landing is a cyclical slowdown in economic growth that avoids recession. A soft landing is the goal of a central bank when it seeks to raise interest rates just enough to stop an economy from overheating and experiencing high inflation, without causing a severe downturn). Growth appears intact and inflation easing. This will hopefully give the Fed and other central banks the green light to loosen financial conditions in the coming months. Particularly in the US, companies too are proving resilient, with earnings expectations improving and easing costs helping to boost margin expansion this year. Big Tech earnings and artificial intelligence euphoria are also lending support. While the momentum may continue, extended valuations and complacency could leave markets ripe for correction according to T. Rowe Price, one of the asset managers we support. There is a lot riding on the Fed keeping the course on easing that remains vulnerable to incoming data. Also, geopolitical flashpoints are increasing across the globe and the US is nearing another contentious election in the coming months. But for now, it is hoped that stocks could keep on progressing, looking through the risks, pointing to the positives on both the economic and earnings front.

Global growth expectations have stabilised, near the same levels as last year, with disinflation gaining momentum hinting at a global ‘soft landing’. US growth remains most resilient amongst developed economies, while European growth remains weak. The emerging markets growth outlook is improving, with hopes for stabilisation in China driven by policy support. Despite a range of stimulus measures rolled out since the second half of 2023, China’s economy remains challenged. Little so far has led to a meaningful turnaround in activity or its stock market’s decline, albeit there have been some positive market days very recently. While Chinese officials pledge more aggressive support, investors are becoming increasingly concerned as there seems to be a disconnect, with consumer confidence slipping along with stock prices to five‑year lows. While policymakers look to shore up the foundation of the world’s second‑largest economy this year, a ‘quick fix’ is unlikely to be enough, leaving investors hopeful for more substantial policy changes to bring more sustainable growth to China, which remains a key component of the global economy albeit the outcome of the forthcoming US election may disrupt that.

As we have discussed, progress on inflation and stable growth give support for central banks to move towards rate cuts. The Bank of England may keep rates higher for longer. The Bank of England Governor told a parliamentary committee that he was “comfortable” with investors betting on rate cuts this year, although he also asserted that the economy was “showing distinct signs of an upturn” after a recession last year. He added: “We are not making a prediction of when or by how much [we will cut rates]. But…it’s not unreasonable for the market to think that.” The European Central Bank is moving closer to easing as it balances fragile growth and inflation. The Bank of Japan cautiously eyes exiting its negative rate policy in the first half of this year. Key risks to global markets include impacts of geopolitical tensions, central banks’ policy divergence, a retrenchment in growth, a resurgence in inflation and the trajectory of Chinese growth and policy. A recession in other economies in 2024 remains a possibility.

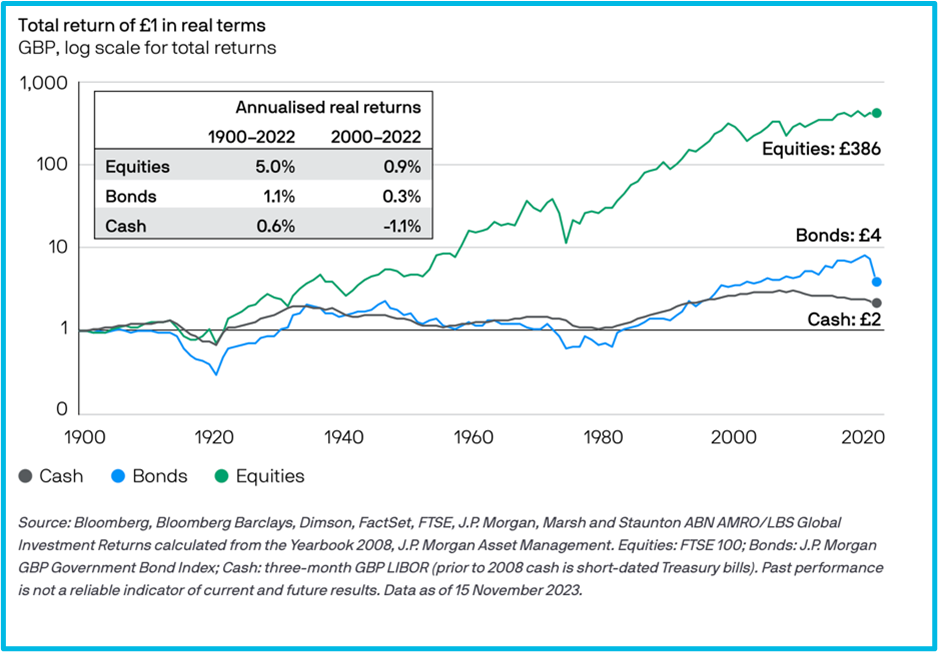

With short-term interest rates at their highest level since 2008, it is easy to sympathise with the view that cash looks tempting. Back in late 2006 and early 2007, when interest rates in the UK were last above 5%, conditions were nothing like they are today. As one of the bond managers that we support recently said: “It was boomtime and Northern Rock was happy to offer you a 125% loan-to-value mortgage. At the risk of pointing out the obvious, we are not in the middle of an economic boom today. Interest rates will have to fall from here. They are simply out of step with reality. In the bond market, meanwhile, yields are higher than they have been for nearly a generation. And bonds typically perform very, very well when the Bank of England starts cutting rates”. Cash looks tempting but history suggests otherwise. Rates will be key to 2024.

Douglas Kearney C.A. Investment Director

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.