The first two months of 2025 have been dominated by the start of Donald Trump’s second term as President of the United States. His bark has been ferocious with Canada, Mexico, the Panama Canal, Greenland, Denmark, Gaza, Europe, Ukraine and NATO all coming under fire. Talk of tariffs, land grabs and much more has emanated from him and his representatives in the first weeks of the year. Europe has come under significant attack with The President stating at his first cabinet meeting that the EU “was formed to screw the United States”. This followed JD Vance’s speech at the Munich Security Conference in which he stated Europe’s “threat from within” is graver than that posed by Russia and China that hit out at alleged infringements of democracy and provoked a shocked and furious response from European officials. There has also been a very distorted and erroneous view on the war in Ukraine and its leader put forward by the President. What this concerning barking will lead to in actual actions, we will need to wait and see. There were many bold actions spoken of during Trump’s first term but few actioned. It may be different this time, and it feels like it is, but it is certainly not a time to overreact.

It does feel like a huge change is taking place in the relationship between Europe and the USA. As the recently elected Chancellor of Germany said after his recent victory “For me, the absolute priority will be to strengthen Europe as quickly as possible so that we can achieve real independence from the USA step by step,” We have seen in the UK a recent commitment to increase defence spending, which is something the USA has wanted from many European nations. So perhaps the President’s bark is forcing others to do the biting. Perhaps that was the cunning plan.

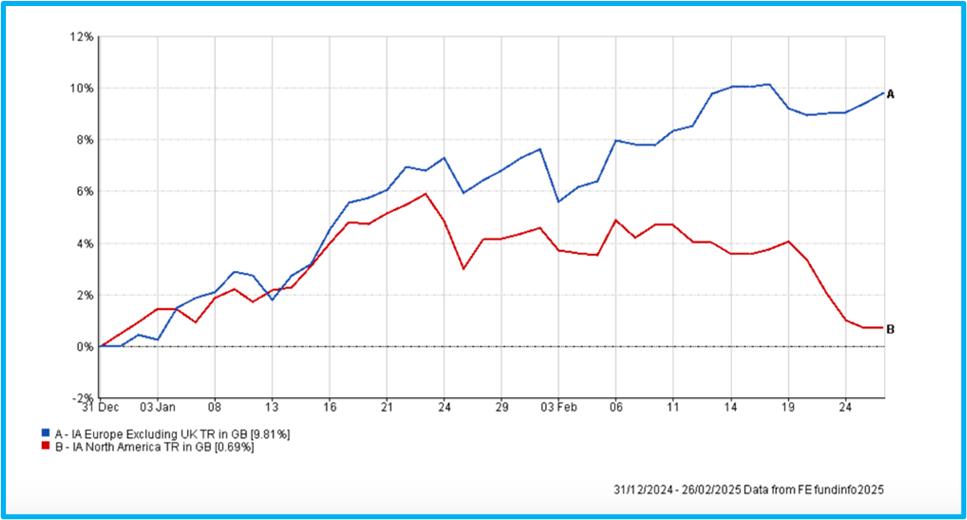

Initially, markets responded positively to the Trump victory in November, but the picture has changed. As both charts show the impact since the inauguration of Donald Trump in late January has seen a marked downturn which contrasts very significantly to a strong performance in Europe. USA performance lags all the other regions as the lower chart confirms.

It is much too early to draw conclusions and nothing of any significance can be taken in such a timeframe. The impending imposition of tariffs is the primary reason for the decline in US performance. Such policies create concerns with creating inflationary pressures and severely dampening consumer demand.

Furthermore, Walmart’s recent trading announcement about forecast sales and profit for the current year were well below Wall Street estimates, citing the need for caution in navigating an uncertain geopolitical landscape. High interest rates and persistent inflation have hampered U.S. consumer spending for two years.

President Donald Trump’s new tariff on Chinese goods and threatened tariffs on products from India, Mexico, Europe and Canada, have further cast a shadow over the economy. The European leading performance may change as the likelihood of tariffs heads their way, with the auto sector the primary target.

Despite all that has happened in a very few weeks, sentiment remains generally positive towards the US market, but that may be changing. Schroders commented in their recent Economic and Strategy Outlook that the first 100 days of the Trump presidency will remain very noisy (perhaps an understatement) as the new administration sets out its stall on key policy objectives. They believe that the early signs are in line with their baseline assumption that key economic policies will be milder than those promised on the campaign trail clearing the way for solid global growth of 2.5% in 2025 and 2.8% in 2026. They continue that the US is still set to lead the way and now expect the core CPI rate to remain around 3% through this year and next. The Federal Reserve is likely to remain on pause in the months ahead as it assesses the impact of Trump’s policies but continue to expect it to start raising rates again in 2026. They do acknowledge that “risks to our forecast remain unusually high due to uncertainty about US policymaking. Our Aggressive Trump scenario, that assumes high trade tariffs and large deportations, would be stagflationary for the US economy and probably tip the rest of the world into recession” Most asset managers remain positive on the outlook for the USA but are alert to the risks and recent activity is seeing a change in sentiment. BlackRock commented that “the U.S. can keep its edge, even if the S&P 500 has lagged so far this year”.

Sentiment towards Europe is also broadly positive. Eurozone growth is expected to show some improvement as political clouds start to lift and looser financial conditions feed through to activity. Inflation is still a concern and is likely to stay elevated as wage growth remains stickier. As a result, interest rates are unlikely to fall as much as was generally expected.

The UK economy continues to be unloved as growth remains elusive. Many expect inflation to climb above 3% later this year and exceed the 2% target throughout the forecast horizon leaving the Bank of England (BoE) with little room for manoeuvre. The mix of anaemic growth and inflation is not a happy outcome.

There are mixed views about the near-term outlook for China. While the economy showed some improvement towards the end of last year, leading indicators remain consistent with much softer activity in the first half of 2025 plus the impact of tariffs from the USA cannot be ignored.

Undoubtedly there will be winners and losers in this rapidly changing global environment with policies rewritten or scrapped. Since taking office, President Trump has already pulled the country out of the Paris Agreement, cancelling U.S. global climate finance and severing international partnerships on climate, including stopping the participation of U.S. scientists in the Intergovernmental Panel on Climate Change. It is not hard to imagine that the renewable energy sector will have a tough time. This has been evidenced closer to home where oil and gas giant BP announced at the end of February that it is slashing its renewable energy investment and increased funding for greater fossil fuel production.

Whilst the real threat of the US reducing their commitment to the security of Europe is leading to an almost inevitable greater spend on defence. The UK has already responded by confirming a higher spend over the next two years and other European nations are likely to follow. It must surely be inevitable that there will be a boost to those companies operating directly and indirectly in the defence sector. Over many years, funds have taken a negative view of investing in such companies, as a response to the demands of many investors reflecting the world around them. This now is changing too with security of the nation a top priority for most.

Also, in recent years, the growth of ESG (Environmental, Social and Governance) requirements for companies and funds has been growing to reflect investor sentiment. Though the term “ESG” made its first mainstream appearance in a 2004 UN report it was not until the late 2010s and into the 2020s that ESG emerged as a much more proactive (instead of reactive) movement. We will be watching whether ESG becomes a target for change and follows the fate of DEI (Diversity, Equity and Inclusion) which President Donald Trump has dismantled across many sectors through executive orders, prompting many companies to drop or alter their DEI initiatives.

It has been a whirlwind start to the year due to one event. Now is the time to step back and see how it settles. The fund managers are watching and will be acting where necessary and finding opportunities in this volatile time.

Douglas Kearney C.A. Investment Director

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.