2016 remains a volatile year with many issues overhanging markets. The continuing lack of growth in developed markets seems to have no end in sight which casts a heavy cloud across almost all asset classes. This coupled with the issue of Brexit in the UK, US elections, negative yields, interest rate movements, struggling commodities, weak wage growth and central bank monetary policy running short of strategies does not make it an easy time for investors and fund managers. The January and February fear of US recession, which would impact all major economies, seems to have receded and the almost panic sell off that we experienced during that time was an overreaction, which is not an unknown feature of markets.

A brighter spot is the Eurozone. GDP growth jumped to 0.5% in the first quarter compared to 0.3% in both the third and fourth quarters of 2015. The acceleration in growth comes as a surprise as most business surveys over the first quarter suggested a slowdown due to external weakness. Although not yet confirmed, it appears domestic demand remained resilient, while the drag from overseas trade eased. Another brighter spot is Emerging Markets. Though 2016 is likely to be another tough year for the BRIC economies, there are signs that 2017 will see an improvement, overall. The worst is probably behind us in Russia and Brazil. China though will continue to slow down, but avoid a crisis for now. Since early 2014, our view has been to support Pacific funds which do not invest in either Russia or Brazil. Although performance has been far from stellar we are confident these funds are well positioned with many holdings in new technology companies that have a strong niche.

Overall due to lack of growth and earnings equities no longer look cheap. The MSCI World Index is up 14% from its mid-February low, as stocks have shaken off fears of a global recession, an oil-price collapse and a Chinese currency devaluation. What would make markets more bullish? Evidence of reflation, and an emphasis on expansionary fiscal policy and structural reform over monetary policy globally.

As the Brexit vote approaches we have seen Sterling fall in value although it has recently rallied on the expectation of a “remain” vote winning the day. In the last issue we looked at the possible impact of Brexit on asset classes. The first real “impact” occurred during the month. Many property funds have invoked a “swing” to the fund pricing. Many property funds base their unit pricing on a creation or cancel calculation. Some, notably L&G, constantly value on a mid-price basis, which lies between creation and cancel. Those, and that is most of the property funds use the creation and cancel mechanism. Each month, each fund, receives a forecast from an independent monitor that concludes whether the fund is likely to receive more cash coming in than cash going out. During the month the forecasters concluded that was likely that cash outflows were likely to exceed cash inflows and that the “Swing” mechanism should be invoked. M&G were the first to invoke it and very soon afterwards others followed. This is not a surprise as funds that don’t invoke it could be hit by substantial outflows as investors seek to pre-empt the swing in their fund. The reason that this mechanism exists is to protect remaining investors. Without this mechanism the remaining investors would bear the brunt of transaction costs other expenses unfairly. So it is a method to create equality and not punish those that continue to support the fund. The impact is broadly a movement of around 6%- not insignificant.

It is hard to estimate how long the “swing” will remain but it has been caused by mostly foreign investors withdrawing funds to avoid any Brexit shock and to a lesser extent the view that central London has little growth left to offer for the time being and that is where much of the foreign investors look to support. The Funds that we support tend to avoid Central London and look outwith that area for opportunities. We remain supportive of property for a variety of reasons but acknowledge, as we have done many times, the growth experienced over the last 3 years or so will be significantly tempered but it remains an attractive yielding investment with some capital uplift going forward. Estimates suggest that returns from property over the next few years should be around 5-6% which is attractive compared to most other yielding asset classes and substantially above Gilts.

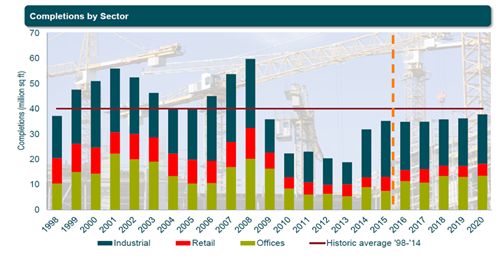

One concern could be that substantial amounts of property are about to hit the market and depress values due to oversupply. As we can see from the chart there is no evidence that this is likely to occur as completions are currently well below historic averages and even by 2020 the supply has not reached the average. Much of this shortfall is a result of finance being much harder to source since the main banks substantially withdrew lending and rightly imposed tougher hurdles for developers following the rather cavalier lending that was seen prior to the global financial crisis. There are many statistics and forecasts that support property and indicate that it will be a steady asset class for some time yet. It is clear that to expect double digit returns to continue would be an error but acceptable returns are achievable. We will continue to focus on Funds that look outwith Central London for opportunities. It is also clear that a Brexit vote would likely change the picture in the short term as tenant demand could be muted and Central London capital values impacted. It is also likely that the slowdown in property transactions that has been seen in the first quarter of 2016 and into this quarter would continue for the remainder of the year and well into 2017. If a “Remain” vote wins we expect transactions to burst into life after 24th June and foreign investment return.

The next major event for investors, which we will be watching closely, is the US increasing interest rates. The odds of a summer Fed rate increase rising if U.S. data due shortly show solid jobs gains, rising wages and an inflation pickup. Tricky to know how markets will react as last year’s rise caused issues within markets. Lots to think about and lots to watch for.