Global markets have continued to be volatile over the last couple of months. There has been much to unsettle them with the fear of a US Trump driven trade war top of the list. The global economic backdrop remains positive and is substantially unchanged but markets are twitching constantly on positive or negative news flow. Overall, our discussions with fund managers remain upbeat with their general expectation that 2018 will deliver positive returns over the year for most asset classes, particularly equities. Although upbeat, it is clearly a different environment from the one investors have become very used to.

Perhaps investors are very conscious that if the US economy continues to grow through the second quarter of 2018, the current expansion from trough to peak will equal and then surpass the second longest on record (106 months recorded between 1961 and 1969). This trend naturally raises the question about whether the cycle is nearing an end. It seems investors are jittery and desperately looking for signals that might herald the end. There is a risk that there may be an irrational overreaction at times which is adversely impacting markets.

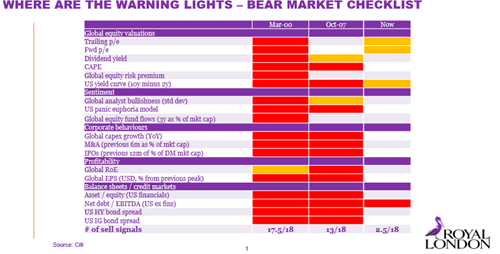

It is hard to find signs that this cycle of US economic expansion is coming to an end, although some of the popular newspapers frequently run articles contradicting this and one equity manager at least believes it has ended. However, from our conversations most equity fund managers do not share this view and none is predicting the imminent start of a bear market or recession but maybe a new normal. The table above that was recently presented by Royal London shows the warning indicators of the two most recent crashes (March 2000 and October 2007) and the beginning of bear markets and compares these indicators to what is happening just now. Although we mustn’t put too much emphasis or reliance on such data, it does suggest that the “sell” signals are low compared to the previous two episodes.

Investors believe that as the US equity market has been the leader in the bull market which started in 2009 the converse is likely to be true. What we are seeing is that reported earnings are not generally disappointing and indeed Amazon and Apple delivered quarterly earnings that significantly exceeded the analysts’ expectations. Although the US Federal Reserve continues to raise rates, it has not surprised investor expectations. The longer term view of interest rates remains below 3% which is important for the sustainability of US and other equity valuations. Despite inflation measures rising more recently they remain in line with forecasts, therefore lowering the risks that the Fed is forced to accelerate rate rises in the near-term. For now, the risk of tightening liquidity too quickly is not evident. The US dollar has remained weak and economic data has been much as expected.

What might de-rail global markets and economies is the Trump inspired trade wars to protect certain US industries. Although, this topic has always been on his agenda, it has come as something of a surprise that it is being actively pursued as history shows there are no winners from trade wars. The US has announced plans to impose tariffs of up to 25% on $60bn of Chinese exports and unsurprisingly the Chinese have responded with a range of proposed tariffs on US imports. These announcements unsettled markets during the period. However, it may be a bargaining strategy on the part of the US administration, which has been quick to grant exemptions from its earlier steel tariffs and has been wary of putting tariffs on goods which the US consumer would notice.

These moves suggest that trade wars may not be the end game here. Instead, we believe what is wanted is a deal with China that can be held up as a victory ahead of the crucial US mid-term elections in November. If this view is wrong and we see a more sustained shift towards protectionism, we would view this as a challenge for growth expectations as global trade has been the main factor driving the global expansion over the last year.

Undoubtedly, we must be realistic that we are in the latter stages of the cycle but not necessarily the end by any means. One highly respected UK fund manager believes it has still a long way to go and history may be clouding views. North American and emerging market equities have outperformed, the dollar has weakened and the Japanese yen and emerging market currencies have strengthened. UK offers value but perhaps for good reason as Brexit hangs over markets. Europe and Japan still look to offer opportunities. Investors mustn’t be complacent and the fund managers that we support are certainly not. Our portfolios provide broad diversification across asset classes. We prefer fund managers that are not wedded to a style nor driven by betting on macro or other unpredictable outcomes. Measuring data rather than forecasting with data. Valuations are not cheap and inevitably the dearer the entry price the reality is lower returns.

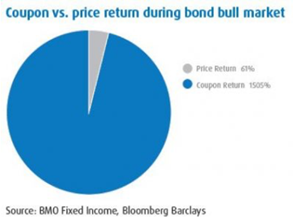

As we have often written, headlines have declared the end of the bond bull market for years, yet if correct, this ominous warning should be embraced by investors in the fixed income market. A recent article by BMO Global Asset Management made interesting reading for the fixed income doom-mongers. Undoubtedly, the asset class has challenges but it was pointed out that over time, yield, not the change in yield, has driven returns and investors should welcome the prospects of that higher yield. Higher rates should offer investors the ability to meet their targets with greater ease and lower risk, utilizing a greater proportion of traditional fixed income relative to recent history to achieve their goals. The recent rise in Treasury yields has shown this, pushing benchmark yields to their highest level in eight years. Were Treasury yields to continue their rise and aggregate bond indices to offer yields in the mid to high 3% range, would non-core assets be as relevant? Even without a further change in rates, which could raise its income component, traditional fixed income continues to offer diversification, liquidity and capital preservation to investors.The article concludes “Rather than fearing the rate rise, we believe this timeframe represents a “take your medicine” moment for markets, a period to be actively managed, which will ultimately lead to healthier outcomes for investors. So, while we anticipate challenges, a proactive approach can mitigate these short term, while setting up investors for a more attractive investing landscape in the future”.

It may be the reversal of quantitative easing by the Global Central Banks that pushed up equity prices post the financial crash that will have the biggest bearing on where markets head over 2018.January 2018 saw the US Treasury market lead government bond yields higher. The rise detracted from returns for more interest rate sensitive parts of the corporate bond market. However, high yield corporate bonds, which have a lower interest rate sensitivity, outperformed investment grade corporates and delivered a positive return. Contributing to the rise in bond yields was the improving economic backdrop.

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.