Thankfully, April has brought a little bit of calm to global markets. March saw markets fall at the fastest pace in history with enormous volatility and no safe harbour to take shelter. During mid-March liquidity became a major issue which brought central banks into swift action to settle the nerves and provide the fixed income market with stability and comfort. At one stage, a fund manager reported that US Treasuries, probably the safest haven, were struggling to trade and effectively for a short while $100 was selling at $95. Unprecedented, it certainly was as indeed was much that has happened to us all since Coronavirus swept across the world impacting everyone, every business and economy.

The response by Governments has been widely applauded, particularly with the fiscal and monetary ammunition launched at solving the immediate problems of economies closing and the ensuing distress. A new word for most of us, furlough, became part of our vocabulary as did PPE. The response has been immense and whilst creating huge national debt was essential to allow a road to be navigated through this maelstrom whilst to some extent alleviating immediate financial worries and put the focus on health and staying safe. The central banks actions, which have been rapid and dwarf the action of the Great Financial Crisis over 10 years ago has altered views towards fixed income. Government bonds have, unsurprisingly, risen in esteem after a short but rapid sell-off, while investment grade and high yield credit are looking interesting. A question, though, is whether all the intervention will lead to a sovereign debt crisis. It is very possible so we view the latter asset classes more favourably just now.

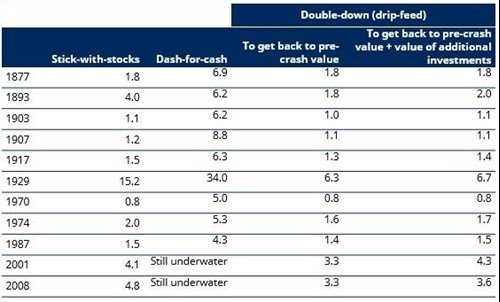

The temptation during times of market crisis is to head to the hills, sell the portfolio as fear takes over that this downward rush is never going to end. We know from behavioural finance that we are wired to be loss averse. The feeling of a loss is much more acute than the pleasure of a gain. Our message through this crisis continues to be do not run, stay invested and wait for some clarity to appear.

The table below extracted from independent information compiled by Schroders would confirm the historical benefit of that strategy.

It has been described as comparing it to driving your car. If you only look 6 inches beyond your bonnet you will likely end up in trouble. You need to look way ahead and work out what you are seeing and if there are obstacles to be avoided or to be aware of. If you can’t see, then park up and wait until you can.

Although it might be less dense, we still think there is quite a thick fog around the global economies, and no one is clear what lies ahead and how long it will be before economies (and life) can revert to some normality. This vision also is relevant when considering valuations or Price/Earnings. It is the future cash generation that matters and often that gets lost by many.

It is encouraging that many asset classes have recovered some of the very dramatic falls experienced through March. The rate of recovery has been surprisingly fast when in reality little has happened as yet to resolve the cause of the crisis. Whilst vaccines and drugs are under test, there is more hope than expectation that a solution can be found quickly. It could be argued that the extreme sell-off was indeed extreme and everything was marked down – the good, the bad and the ugly. There are technical reasons that can cause extremes, and this happened here.

A positive from this turmoil is that fund managers have been reviewing their portfolios and seizing opportunities. The immediate task was to review each company within their portfolios examining their robustness and ability to endure distressed economic conditions for many months. Those that did not have the necessary robustness were sold. The next step was to identify and buy positions in companies that had been on their radar but had been previously too expensive. The fund managers have been active in taking advantage of the volatility and not looking at 6 inches over their bonnet but looking at the contribution these companies can make over the next 3 – 5 years or even longer. Exactly as looking down the road rather than peering over the end of the bonnet. However, we would caution that it is not clear by any means whether a second wave of the virus will be experienced in the autumn or winter. This would impact markets and we must all be alert to that.

Although there are serious questions regarding data that came out of China regarding coronavirus, we are watching how their economy and markets are repairing. The early signs are encouraging, albeit based on quite limited data. It would appear that economic activity has increased rapidly, and the hope is that will happen in the western economies too. The caveat is moving too quickly resulting in a wave of mass infection. Governments are very conscious of that and the damage to the recovery.

Property funds remain deferred or suspended as the panel of valuers believe that it is not possible to provide accurate valuations for at least 20% of the assets. We consider it will take several months to resolve this. There continues to be much speculation about the potential changes that this pandemic will have on property use. Certainly, demands for office space may change. Also, online shopping may increase faster than anticipated which will require a larger warehousing and distribution infrastructure. It is much too early to predict the impact, but the property fund managers are most definitely aware of the changes that they may need to embrace. Property, in whatever shape, will produce a rental income stream but the suspension now and following the referendum is a matter for concern which will be addressed by the industry once the dust has settled. Historically, it has been a good diversifier in portfolios but lately it has become a fair-weather friend.

It remains a very challenging time for everyone but hopefully there will be some long-term benefits for us all. The way we live, and work may change for the better. The way we commute, or travel may change. Many have had to embrace technology and become the Zoom generation. If you hold some Baillie Gifford or T Rowe Price Funds, you may well be benefiting from the Zoom boom.

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.