Overview

The first quarter of 2024 has seen positive returns across many sectors and funds, although fixed income has been something of a laggard. Equity markets rallied in the first quarter of the year, continuing the satisfactory performance which began in the autumn of 2023, as hopes for a soft economic landing grew. Global equities built on their strong year-end performance by delivering further gains during the first quarter of 2024. This welcome momentum was halted in April as concerns grew around stickier inflation and the growing reality that interest rates may be higher for longer.

Markets are far from settled and remain very fragile to both economic and geopolitical news and events. Interest rates and inflation remain a major key to performance throughout 2024. At the beginning of May the Federal Reserve Chairman hinted strongly that rates are likely to be held steady for longer than anticipated. However, he also emphasised though that the next policy move is “unlikely” to be a hike, countering some commentators who have suggested a rate increase could be on the cards. JPMorgan Chase CEO recently warned that interest rates could rise to 8 percent or higher.

Equity Markets

In the US, equity markets produced significant gains for the second consecutive quarter.

Japanese equities also produced strong returns, though yen weakness reduced those gains for non-domestic investors. China was a continued weak spot, as equity markets in Hong Kong and China produced weaker returns.

Artificial intelligence (AI) continued and continues to be a key driver of equity markets, as Nvidia, a company few had heard of until very recently, and other beneficiaries of the new technology wave produced strong results and share price returns. While equity market returns were once again driven by a relatively narrow group of large US stocks exposed to AI, the broader equity market also performed well, supported by positive economic data, as US economic growth and labour markets continued to show resilience.

In Europe, economic data also surprised positively, while the UK remains relatively “cheap” but perhaps unjustifiably so. It is often overlooked that there is also a concentrated European group of quality large companies driving performance. Several are the “picks and shovels” of $190bn capital expenditure spend of the US technology giants who are investing heavily in infrastructure such as data centres.

Inflation proved stickier than expected, and while it continued to edge down year on year in both the US and UK, it remained above central bank targets. Geopolitics, ongoing conflicts, trade wars and China’s recovery from economic malaise all have the potential to produce disruptive effects to economies and markets over the short term.

Fixed Income

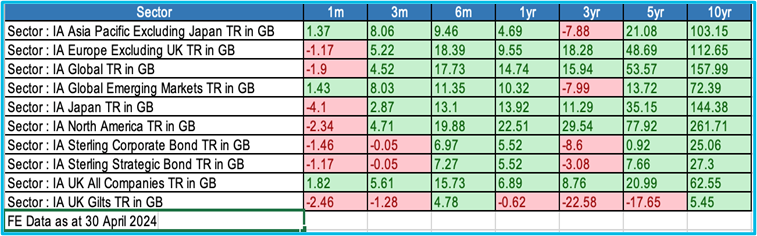

Fixed income markets have performed less well than equities as the table produced from Financial Express (FE) below shows (the table shows sector returns to the end of April 2024):

Bond yields increased, due to negative returns from the major bond markets. These conditions also provided a better environment for the US dollar, which strengthened over the quarter.

It was also a difficult start to the year for sovereign bonds, as major central banks continued to signal delays to the start of the new easing cycle, resulting in a rise in yields as expectations of interest rate cuts were scaled back. However, towards the end of March, yields declined as the US Federal Reserve maintained that it envisages three rate cuts as a realistic scenario for this year, however as noted earlier, that now might be optimistic. German Bunds and UK Gilts moved in tandem with US Treasuries throughout the quarter. Despite a disappointing performance, there remains strong support for bonds and gilts with high expectation of strong returns to come over the years ahead.

Risk Rated Portfolio Performance

The performance chart shows how our risk rated portfolios have performed over the last year.

As can be seen, the outcomes are reflecting the level of risk which is pleasing. The longer-term performance is also recording a very similar picture.

The risk rated portfolios are constructed based on asset allocations that reflect the risk assessment that each individual client completes.

The chart reinforces the importance of accurate risk-rating, as it can be clearly seen how volatility increases the higher up the risk ladder you go. The portfolios comprise a foundation of a blended selection of risk rated multi-asset funds supported by single strategy funds. The multi-asset funds allow market opportunities to be grasped to the advantage of portfolios, whilst single strategy funds are predominantly high conviction funds taking the long-term view which is so important to portfolios. Markets have most certainly changed over the last few years with the end of quantitative easing, low interest rates and high inflation. Perhaps we are returning to a more “normal” investment environment which will be new to many.

Over the last two years we have noticed the conversations on ESG (Environmental, Social and Governance) slowly beginning to change with the asset managers and commentators. The recent geopolitical events that have seen the horrendous wars in Ukraine and the Middle East, coupled with the global energy crisis caused by the soaring gas prices have begun to raise serious social questions. There is a growing sense that as globalisation retreats there is a critical need to be substantially energy self-sufficient. Will we see a case that nuclear energy is socially essential? Is the defence of the nation also socially critical, essential and responsible? We will be seeing where these conversations go but there is a sense the goal posts might be on the move.

Douglas Kearney C.A. Investment Director

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.