Markets continue to head upwards as we move into the last two months of the year; many now reaching new highs. For the first time since 2007, all developed economies are growing. Germany’s and Japan’s elections produced no surprises to upset markets. We are now seeing the US Federal Reserve contemplating a more aggressive path for interest rate rises and balance sheet reduction than forecast earlier in the year but inflation may surprise on the downside; the Bank of England clearly shifting its position to reflect a desire to avoid overheating (a rate rise is very likely in November), the ECB gently intimating plans for tapering its asset purchase programme; and the People’s Bank of China tightening liquidity and raising policy rates. The global economy is now faced with the first synchronised tightening by major central banks since the global financial crisis. Quantitative Easing changing gear and switching to reverse.

This is new territory for economists and investors. QE saw many asset classes gaining a sustained boost, particularly equities as the hunt for yield intensified in a low interest, low growth global economy. Although, hindsight is a wonderful skill that many claim to have, few predicted the significant positive outcome that QE delivered. It would be a very brave person to predict the outcome of a synchronised global tightening, if indeed it will be proven to be synchronised. Getting the speed of tightening will be crucial for Central Banks to avoid market shocks. Perhaps the US will raise rates and dampen consumer credit and inadvertently stall growth.

“While this naturally brings some trepidation, especially given recent disinflationary surprises, recent robust data suggests a policy mistake is not in the offing. Although there can be a significant lag before a policy mistake would be evident in the data, in the US and China where rates have increased steadily over 2017, leading indicators, such as labour market data and consumer sentiment, have calmed nerves by showing continued improvement. In emerging markets (EM), where Fed tightening can reduce capital flows, net portfolio flows for 2017 are set to double the total amount seen over 2015-2016, while currencies have been broadly stable” said Standard Life in a recent publication.

Going forward, the main unknown remains political risks – how will Brexit negotiations affect the economy? Who will lead the Fed and will this lead to a change in policy? How will Trump’s US protectionism affect the domestic inflationary outlook and EM growth? While confident in the underlying recovery, these questions may and should perplex central banks. The global business cycle expansion is still intact, supported by continuing growth in the US and joined now by a gathering upturn in the Eurozone and the start of a renewed upswing in global trade. The expansion among the developed economies is having beneficial effects on the export-oriented, manufacturing economies of East Asia, the Americas and some of the commodity-producing emerging economies.

As we discussed in the previous Investment View, one of the UK’s leading fund managers believes we may only be half way through this economic cycle. This view was supported in a recent paper by a major fund house, which suggested that ”There is good reason to expect that the current expansion will be an extended one, perhaps even the longest business cycle expansion in US financial history. This would imply a continuous upswing that exceeds the record trough-to-peak expansion of 120 months between March 1991 and March 2001 (as measured by the National Bureau of Economic Research) and presided over by the then Fed Chair, Alan Greenspan. The only real threat to this prospect is the possibility that central banks make a mistake and tighten too much during the current or coming phase of monetary policy normalisation. If they overdo the tightening, there is a real risk of a slowdown in 2018-19, and a continuation of below-target inflation rates across many major economies”.

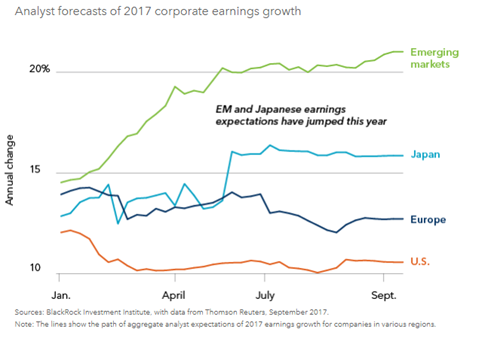

We are seeing a broad consensus, which could be slightly worrying, for global growth forecasts in late 2017 and into 2018 being revised modestly higher, as consumer spending, business activity, capital spending and trade data improve across Europe, North America and Asia. At this phase of the business cycle, companies are managing the pressures on corporate margins, underpinning strong profits growth that is proving supportive for global equity markets. There is the potential for an additional boost if the Trump administration can push ahead with major tax cuts, although political obstacles are clear and growing. This improvement in corporate cash flow is more than offsetting relatively expensive valuations in many markets.

We remain committed to a broad Global exposure for portfolios. We believe Europe and selected emerging markets (the Pacific region) offer opportunity, and the US and Japan should not be discounted or ignored. Japan could be set fair after Abe’s election victory. Brexit uncertainty can weigh on UK equities, so we continue to temper exposure but certainly do not exclude them.

The global economic outlook has been described by many as the “Goldilocks” economy. This is because economic growth is not too hot and not too cold. We’re seeing growth pick up, particularly outside the US. Emerging markets are doing better, Japan’s doing better and the Eurozone is doing well at the moment. The UK has not really shared in that as much as it should have. The uncertainty of Brexit is weighing on decisions about spending and that’s holding things back, although the weaker pound has flattered performance. The other side of the goldilocks economy, of course, is that inflation is well-contained, particularly in the US where inflation has tended to surprise on the downside. That’s important for markets because it could mean that interest rates won’t have to rise as much as perhaps people thought earlier in the year, but we are not convinced that will be the outcome.

So, combining that outlook with the goldilocks economy, and with the easing of some political risks, it means that the environment for risk assets appears pretty positive. Doubt it will stop investors being anxious though!

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.