So, 31st October has come and gone, and the Prime Minister appears not to have died in a ditch but is very busy preparing for a general election that is intended to solve the Brexit problem. Can we contemplate what happens if we get a hung parliament? No, let’s move on. It does seem odd that effectively a single-issue general election is not a referendum, but that’s politics and no doubt can be easily reconciled and explained. If it does provide an outcome, then some welcome certainty will be appreciated in corporate Britain amidst the continuing uncertainty of global economies that are slowing. It will be one less item to worry about in a world that seems to be increasingly anti-globalisation and pro patria.

The US continues to lead the charge in the fight for equitable global trading and continues to require more and more tariffs predominantly from the Chinese but even Scotch whisky makers are now facing a 25% tariff on exports of single malt to the US, as a tit-for-tat trade war between the US and the European Union intensifies. More tariffs were due to be imposed over the next few months which would further hinder global economies. 2020 is an election year in the US and despite both main political parties in broad agreement about the one-sided nature of trade with China, it will be interesting to see whether the Trump administration alters course prior to the election. Most agree that if the imposition of tariffs created a recession in the USA then Trump’s re-election would be severely hindered. However, has there been a significant change?

In October, upon a handshake agreement that included a promise by China to buy more US agricultural products and a promise by the US to freeze tariff rates at 25% on $250 billion of Chinese goods, Trump described the US–China relationship as a “love fest.” An interesting term considering in late summer President Donald Trump referred to President Xi Jinping as the “enemy “of the US.

Undoubtedly it represents a welcome reprieve in the escalating tit-for-tat of the past 18 months or so, and it probably decreases the chance that Trump will move forward with the last tranche of tariffs (15% on $160 billion of goods) come mid-December. Many of these tariffs are on consumer products and the US administration was mindful of not upsetting voters with pre-Christmas price hikes. The “substantial deal,” as Trump described it, is more like a temporary reprieve than a permanent resolution. Uncertainty around trade policy and US–China relations is likely to continue for the foreseeable future – and will likely be a continuing intermittent headwind for markets and create much noise and volatility.

However, maybe this time it will be different and the love fest with China will hold through the US elections in November 2020. However, China is a popular target for Trump on the campaign trail and confronting China resonates well with voters. So, it would not be surprising if the romance is short-lived and Trump returns to not only more adversarial rhetoric but also more combative actions. Let’s wait for the Tweet!

The many asset managers we meet do not believe a US recession is inevitable in 2020 but acknowledge that growth is slowing. If we look towards China, there are early signs of an economic recovery and this should have a positive knock on effect potentially most noticeably in Europe with China being the EU’s main source of imports and second-biggest export market.

Further to this Simon Ward (Chief Economist at Janus Henderson) believes the global slowdown seen in 2019 was due to monetary policy tightening in China and the US, with the trade war being secondary. Monetary signals seem to be bottoming out in Q4 2019 leading to a potential recovery in 2020, where Europe could do very well, potentially leading the global economic recovery.

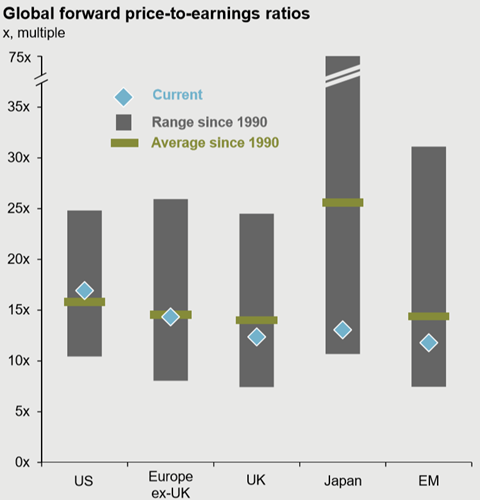

The chart below (Source: IBES, MSCI, RefinitivDatastream, Standard & Poor’s, J.P. Morgan Asset Management) shows where we are just now compared to equity valuations since 1990. This chart, we believe, provides some surprises that many would not have expected. There is a lot of commentary that equity prices are hugely elevated compared to history.

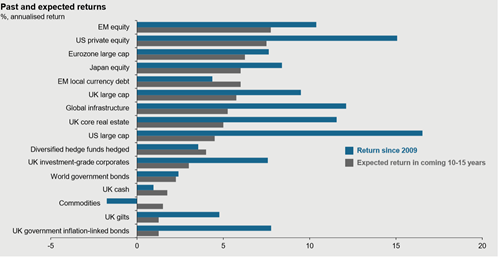

The chart would suggest that is not so, with only the US above the average since 1990. Few would argue strongly that equities are cheap but equally based on history they are not living in some stratosphere way above the average. The challenge over the months ahead will be to see if earnings can be grown in a slower growing economy or maybe slow growth has bottomed out. Since the financial crisis investors have done well as the chart below confirms (Source: 2019 Long-Term Capital Market Assumptions, November 2018, J.P. Morgan Multi-Asset Solutions, J.P. Morgan Asset Management). It is evident that whilst annualised returns of >15% may be very hard to find over the next decade or more, the possible expected returns remain attractive and dwarf holding cash.

Douglas Kearney C.A. Investment Director

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.