Undoubtedly, a couple of momentous months are looming before we say farewell to the year we would wish to forget but never will. Could we ever have imagined as we welcomed in 2020 what the ensuing months would bring? Brexit, which since the 2016 referendum had consumed media of all forms, endless hours of reporting, arguments, information of varying accuracy and often hostile debate, became forgotten and at best a postscript, as the pandemic took hold. It seems that the pandemic will rightly continue to grab the headlines as the second wave appears to be rushing towards us.

We have watched global leaders struggle to navigate through unchartered pandemic waters. Waters that continue to cause economic destruction, all manner of health issues and unimaginable government borrowing to keep the ship afloat. Indeed, it may be that the President of the United States will become a casualty of the pandemic through his initially dismissive crisis management that has not been well received by many of his citizens.

Over the next few weeks, the UK will be saying its goodbyes to the European community. Perhaps with Boris’s oven ready deal, but that is far from certain. Perhaps having knowingly broken international law enroute to the departure gate. Meanwhile, a second wave of coronavirus is rushing round the globe causing further illness, death and grief of all sorts, albeit China and much of the East seem to be back to near normal. The uncertainty of all the world events causes volatility in global markets.

There is an index created to measure volatility. It is known as the Vix index but also known as the fear index. First, it’s important to understand what volatility is in relation to the stock market. Volatility measures price swings, both up and down, over a certain period of time. Simply put, the wilder and faster the swings, the more volatile the market is. Volatility is not “bad”. Fund managers like volatile markets as they can find more opportunities in volatile conditions.

Volatility can be measured using historical price swing data, known as “realized volatility,” or it can be a measure of expected future volatility implied by options prices. Going by VIX calculations, if traders expect 1% daily swings up or down on the market the VIX score is 20, which is roughly the index’s long-run average. So, under 20 is little volatility, around 20 is average and the bigger the score above, the bigger the swing expected in prices. It has not been at below 20 since the beginning of the year and is currently just under 40, which is high. We are living through a heightened period of volatility, which is surprising considering recent history and the uncertainty ahead.

The index remains much higher than normal which indicates that we will continue to experience turbulent markets but hopefully the extremes of March when it peaked at over 85 will not be repeated over the months ahead.

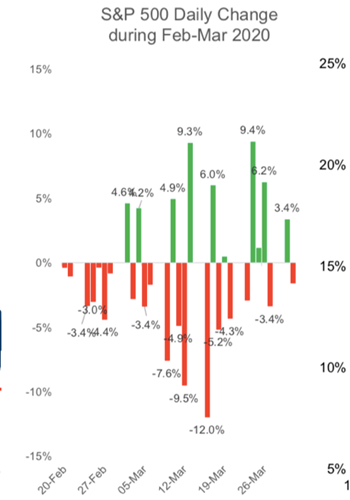

In view of these market conditions, we will be continuing to limit any portfolio changes to an absolute minimum to avoid changes to portfolios being caught up in erratic market swings which could unnecessarily punish a portfolio. The chart below (sourced from a recent, Goldman Sachs Global (Investment Research and GSAM) presentation dated as of 31 August 2020) shows the wild daily swings experienced at the start of the year by the S&P 500. With so much happening and so much uncertainty still surrounding global markets, rebalancing of our portfolios is unlikely to recommence soon as volatility risk remains high. Indeed, recent days have yet again seen some large swings.

In September, valuers were able to lift the Material Valuation Uncertainty clause from almost all the property funds we have invested in. Most of the funds are once again open and trading. Unfortunately, the M&G pension property fund that we have supported remains in deferral as it builds up cash reserves to allow redemptions to be completed. We have not yet seen figures from each of the property funds, but we understand that there have not been significant outflows. However, the possible restrictions on trading under consideration by the FCA would make this asset class hard to support coupled with the likely uncertainty around the sector as changes in commercial property requirements caused by the pandemic are assessed.

Fixed income remains challenging with historically low interest rates and negative rates becoming more and more a feature. The swift and substantial monetary policy response to the pandemic shock is largely behind us. Nevertheless, the bias for central banks remains accommodative and even towards incremental easing. Recent commentary from Australia has firmed up expectations for a rate cut in November and potentially more quantitative easing. Meanwhile, New Zealand is expected to take rates into negative territory in early 2021 and the Bank of England continues to flirt with a similar move, while the European Central Bank looks set to expand its bond purchase programme.

Although the future path of the Fed’s quantitative easing programme is less evident, and it’s possible that corporate purchases will not be continued into 2021, markets will likely be reassured by the expectation that the Fed will step back in if needed. Even though most of these potential actions are largely anticipated by investors, the direction of travel for central bank policy appears to be supportive for fixed income assets albeit with dampened returns almost inevitable.

Investors have quite rightly spent much of 2020 focused on other matters and that will continue as the second wave sweeps around the US and Europe in particular. The US election can’t be ignored, and commentators are focussing on a result being challenged. That will unsettle markets. Corporate tax proposals appear to be the clearest difference between the two parties, but the direction of travel is more similar on other key topics such as mega-cap regulation and US-China which markets have been wrestling with for some time now.

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.