At times, it is difficult to remember that retirement portfolios are for the long term. It is also easy to forget that what we are living through has never been experienced by anyone, so no manual exists on how to develop a strategy. It is all new. The last few weeks have been one of those periods as news continually flowed of crisis after crisis, shortages of almost everything but bad news. It seemed that everything was doom and gloom, and then the earnings season started and the results surprised on the upside. This encouraged markets and sentiment improved. Hopefully, it may be sustained but what seems reasonably clear is that good companies will navigate their way through this period, perhaps better than many expect. We must be mindful that the last quarter of the year could be challenging, but long term investors should avoid short term noise.

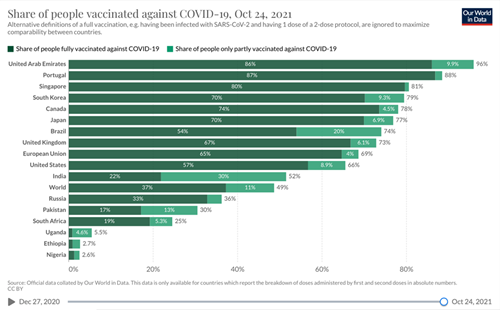

The news of the pandemic around the globe also has been far from encouraging, with cases rising in many countries, although that might be changing in the UK based current data. News of vaccinations continues to provide some comfort, although many countries remain at unacceptably low levels as can be seen in the above chart. The number of people globally who have also had a booster jab is extremely low and that must be some concern as winter approaches in the Northern Hemisphere.

The pandemic is not yet over by quite some distance, so it should not be such a surprise that economies around the world are finding some real hurdles in many key areas. What perhaps remains more surprising is how strongly economies and markets have rebounded since the alarming gyrations of the markets in mid March 2020 when the Vix Index often referred to as the “fear” index reached the mid 80s. As can be seen from the chart, it is now trading at a level of just under 15, so we have come a long way, but “normality” is not nearly with us as yet and a degree of patience will be required for some time despite some mixed messages from the world’s leaders.

We have seen over the last few weeks some anxious days in markets as concerns over rocketing energy prices, problems with the movement of freight and in particular lack of HGV drivers across many regions in the global economy, lack of supplies in many industries, particularly semi conductors, and significant issues in food processing, care and hospitality due to lack of labour. There is clearly something very unusual happening when the price of a used car is higher than a new car. It would be optimistic that these issues will be resolved in the next few weeks, but undoubtedly they will be resolved over time.

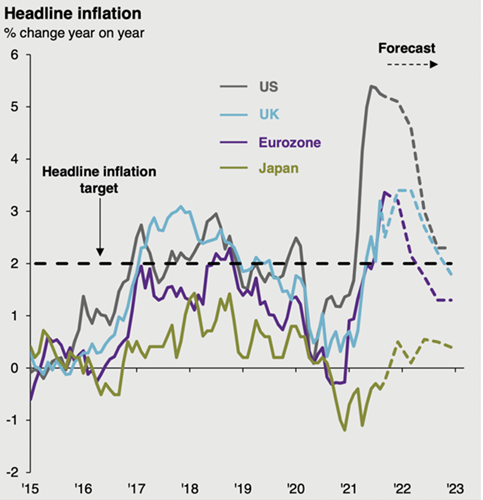

These problems are creating inflation. Inflation in the UK is now expected to hit c 5% and the US has already reached that level. The question is whether inflation at elevated levels is transient or a feature that is with us for the foreseeable future. Opinion is very divided on this. The chart, below, produced by JP Morgan is forecasting inflation will peak this year and fall steeply through 2022. In the near term, it would seem almost inevitable that inflation will remain elevated as supply struggles to keep pace with the rebound in demand due to post pandemic bottlenecks. Whether or not the rise in inflation proves transitory ultimately depends on the extent to which monetary and fiscal policy remains too loose for too long.

Governments appear to have lost their fear of debt and have great ambitions to “build back better”. After a decade of struggling to generate inflation, there is a risk central banks may be complacent and too late to tighten.

Equities have historically performed well in an environment of modestly higher inflation. Pricing power does generate profits. Some equity sectors will fare better than others. Real estate, albeit in our view, has become an illiquid asset class for portfolios, and core infrastructure have historically been good inflation hedges.

Inflation is typically the enemy for bond investors. It nibbles away at nominal fixed coupon payments. While inflation-linked bonds will outperform nominal bonds in the event of an unexpected pickup in inflation, inflation expectations priced into these bonds have already risen significantly over the last year and as JP Morgan reports, are currently offering a negative yield. They may make sense as an inflation hedge if you think inflation will average more than it is currently expected to over the next decade. That would be quite a brave call. However, inflation linked bonds are still vulnerable to potential rises in real yields. Gold is similar in that it tends to do well when real yields fall but faces challenges when real yields rise.

It is not surprising that inflation has been high in recent months, particularly given oil prices are around 60% higher than they were a year ago. Even though energy now only makes up a relatively small 5%-7% of inflation baskets in developed markets, the rebound in demand for fuel has added to inflationary pressures. While that will fade over time, there are still other factors keeping upward pressure on prices at least over the remainder of 2021.

Ultimately, what matters over the longer term is how policymakers work to balance supply and demand. Some of the disinflationary supply forces that have been working to keep inflation low over the past decade remain, such as automation, globalisation, and the de-unionisation of the workforce.

Investors will increasingly look to labour markets for signs as to whether higher inflation can be sustained. Unemployment benefits and stimulus cheques in the US appear to have discouraged workers from rushing back to the first job on offer. Now that the more generous unemployment benefits have expired in many countries, wage growth is more likely to be determined by the amount of slack in the labour market. A significant portion of the jobs that have not yet been regained are in the leisure and hospitality industry, which should boom once Covid is no longer impacting activity. The question remains of how many have left the workforce. It seems high but that might not be so. We will see.

Central banks face a difficult balance in the coming months, reacting to inflation concerns but not challenging the market’s view that monetary conditions will remain accommodative. China’s near-term slowdown could also be greater than expected if restrictions required to contain the virus coincide with a more meaningful slowdown in activity. The difficulty for investors is that government bonds – traditionally the investor’s friend in times of woe – may not cushion a portfolio as effectively as in the past, particularly if the concerns stem from rising inflation. We are though long-term investors and our message remains unchanged: let the fund managers manage and don’t get intimidated by the noise.

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.