UK Budget Announcement

By the time you read this the UK’s first budget from a female chancellor will have been delivered. The speculation has been intense, covering almost all taxes other than those involving “working” people, albeit that is now arguable. The wait has been damaging and caused huge anxiety.

We will be reflecting on the content and implications for retirement planning as the detail comes under scrutiny, but it is unlikely that the announcements made on 30th October will be enough to remove concerns about further significant changes over this period of government.

According to research carried out by the Skipton Building Society prior to the budget, seven in 10 (70 per cent) people admitted to feeling worried or anxious about what the government might announce. The research, which surveyed 2,000 UK adults, found 49 per cent of people believed the budget would have a negative impact on their personal finances, compared to less than one in five (17 per cent) who were feeling more optimistic.

Within this, 36 per cent said they were worried about a rise in the State Pension age. This is a worry that is particularly prevalent among women, with 43 per cent of women concerned about this compared to 29 per cent of men. Almost a third of respondents (30 per cent) said their biggest financial concern would be if the State Pension became means tested, and 28 per cent were worried about the possible removal of the triple lock. Neither have happened, so some fears allayed for now.

Skipton Building Society head of financial advice distribution, Helen McGinty, said: “With costs rising and savings getting stretched, those with one eye on their retirement are concerned as budget speculation around pensions and retirement continues to grow.” The major impact on pensions has been that Inheritance Tax will be charged on inherited pensions from April 2027. As yet the detail needs to be scrutinised and digested. A consultation period is now running into the New Year.

The immediate response to the budget has not been well received by markets so far as investor worries over the substantial additional borrowing set out in the budget are creating concern. The rise in yields have taken UK 10-year borrowing costs close to the 4.63 per cent peak hit in the wake of Liz Truss’s September 2022 “mini” Budget, which sparked a crisis in the gilt market and caused the pound to crash to an all-time low. It is unlikely this budget will create a similar impact. However, concerns exist that the budget assumptions are too optimistic, and further gilt issuance will be needed to fill the shortfall. Furthermore, the Institute for Fiscal Studies warned that the government’s increase in employers’ national insurance contributions would not raise “anything like” the £25bn estimated by the Treasury.

Others have commented that the rise might simply be due to the possibility that there will be fewer interest rate cuts by the Bank of England next year. Rising bond yields would be unwelcome as it would impact both bond prices and UK equities and hinder the speed of reducing interest rates. UK equity markets have also responded negatively to the budget so far, but it is much too early to draw conclusions.

US Election

The major international event that takes place in early November is the US Presidential election which from the many polls appears too close to call. An old saying goes that “elections have consequences”. U.S. Bank investment strategists studied market data from the past 75 years and identified patterns that repeated themselves during election cycles.

The analysis points to minimal impact on financial market performance in the medium to long term based on potential election outcomes. The data also shows that market returns are typically more dependent on economic and inflation trends rather than election results.

Results of the analysis contradict conventional wisdom that a Republican or Democratic “sweep” of the presidency and Congress is most likely to cause market disruption. In fact, historically there has not been a statistically significant relationship between single-party control of both the White House and Congress and market performance.

The data uncovered three divided-government outcomes with a statistically significant relationship to market performance. Two scenarios corresponded to positive absolute returns in excess of long-term average returns:

- Democratic control of the White House and full Republican control of Congress.

- Democratic control of the White House and split party control of the Senate and House.

One scenario corresponded to positive absolute returns modestly below long-term average:

- Republican control of the White House and full Democratic control of Congress

We will see whether one of the divided outcomes noted above is delivered, particularly one that historically has delivered excess returns. As we often state, uncertainty is the enemy of markets. It is hoped that the result of the Presidential election is clear and does not see a repeat of the scenes of January 2021.

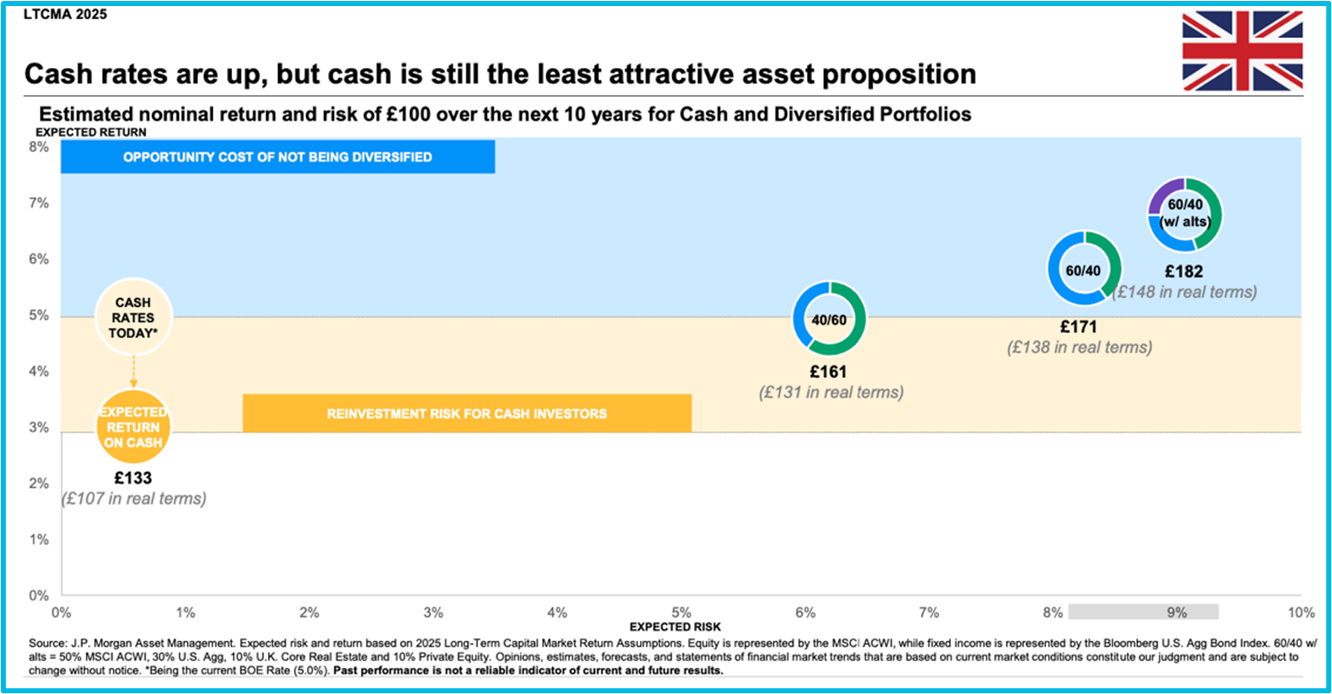

It is easy to get distracted by the barrage of news about budgets, elections and other macro and geo-political issues. What constantly remains important is to be a committed long-term investor to seek to deliver good returns. Nothing can be guaranteed unfortunately, but the recent work by JP Morgan looks forward to what might be achievable from a mix of assets over the next 10 years. It is a comprehensive and detailed exercise by this asset manager, but an exercise carried out by every major asset manager. What it suggests, as can be seen in the chart, is that over the next 10 years cash is the least attractive asset to hold. A £100 portfolio of 60% bonds and 40% equities is estimated to be worth around £161 in 10 years compared to cash at £133. In real terms for the 60/40 portfolio that is £131 compared to £107 for cash.

The next best return is expected to be a 60% equity portfolio with 40% bonds but adding some alternative asset classes might further boost returns in real terms to £148. Alternative assets include private equity, private credit and hedge funds and real assets (real estate, infrastructure transport, timber). Liquidity of alternative asset classes might be the challenge.

To close at this often-gloomy time, we leave with a comment in the JP Morgan report: “Despite the often alarming headlines, we forecast that the global economy will be one of the strongest in years, providing a healthy foundation for asset markets”. Now that would be good.

Douglas Kearney C.A. Investment Director

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.