It’s a Mad, Mad, Mad world. The title of the popular 1987 film has never seemed so apt for the world we are living in. A President cancels a state visit on Twitter as the host country is simply not interested in selling a significant part of its territory to the visiting world leader. Two superpowers continue to play tit for tat in a battle of trade wars causing concern of hastening or indeed creating a global recession. Global markets swinging up and down provoking investor anxiety and for some a flight to safer assets only for another tweet to reverse the vitriol and market sentiment.

Although much of the focus has been on trade wars with China, the US President has not been silent at home. He has continued attacking the Federal Reserve and blaming them for its failures that are damaging the economy. The chairman, Jerome Powell, has been the target of much criticism from the President.The FED has responded to the criticism. “The Federal Reserve’s policy decisions are guided solely by its congressional mandate to maintain price stability and maximum employment,” a Fed spokeswoman said. “Political considerations play absolutely no role.” Not unsurprisingly, commentators are questioning whether his 2020 re-election campaign will be hurt by his own potentially destructive actions. Momentum in job growth in the crucial swing states of Michigan and Pennsylvania is slowing and Mr Trump’s bragging about the booming economy is no longer convincing voters who are feeling the pain.

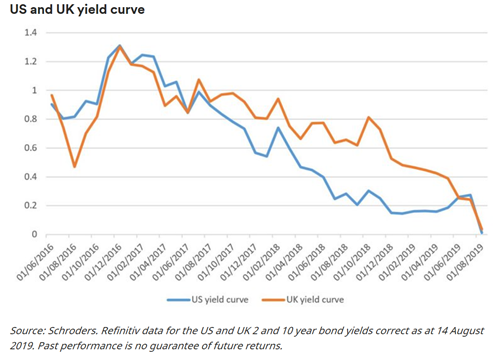

Meanwhile, thoughts of extending the battle into Europe are being mooted. The UK and Brexit continues to dominate domestic politics. We are assured the salvation of a “no deal” Brexit will be a quick and easy deal with the US. The quick and easy deal was the original premise of the “leave the EU” campaign but somehow that seems to have been spectacularly derailed. How does a million to one quickly become “touch and go” in such a short time? We now learn that the UK Parliament might be suspended to allow democracy to succeed. Meanwhile, it feels like some world leaders’ fiddle, or rather fail to turn up, whilst the Amazon forest burns, and others wait for apologies before dealing with the crisis. Hong Kong has rarely been out of the news with some worrying pictures filling our screens. It is a very challenging and chaotic global picture for investors to interpret. As global market turmoil continues, and pundits rush to read the runes of the Dow’s worst drop of the year and fresh inversions of the bond yield curve in the US, the economic signals all seem to be flashing red. The question everyone is asking is: “What comes next?”

It is quite surprising that markets have so far held up with a fair degree of resilience despite the geopolitical machinations that most of us watch in utter disbelief. Few would argue that the global economy is slowing, but few would have thought politicians could create so much self-harm across global economies. Economies that have been slowly getting back on their feet after the 2008 financial crisis. There have been some technical warnings – the inversion of the yield curve, which we discussed a few months ago – that suggested a global recession was looming, but most asset managers do not see that as the likely outcome. At times it is very hard to avoid the noise and remember some fundamentals.

Our discussions with equity fund managers have been much more positive. They reinforce that whilst the global economy can’t be ignored, it is the individual company and its prospects that attracts investment. The growth prospects, resilience, product innovation, management ability and flexibility are much more important than a macro economic view of the world. One successful manager recently explained that the “talking heads” don’t have to take the investment decisions, but the manager does and is accountable. He was totally convinced that if he had followed the wisdom of the talking heads, his fund would have been in some very wrong spots. Therefore, the strengths and qualities of the companies are the vital components. Managers also explain that forecasting global economies, currency rates and political outcomes is not something they could remotely contemplate, so their energy and expertise is devoted to sourcing companies with the key attributes to justify inclusion in their fund(s). This is not new thinking, but the way successful funds have consistently operated. It is the belief and subsequent performance in the underlying companies that delivers performance, not guessing the outcome of events out with their control.

In August, the yield spread between two-year and 10-year U.S. Treasury bonds moved below zero for the first time since February 2006. Though it has since widened back to positive territory, the move was significant because such “inversions” of the yield curve – in which short-maturity yields exceed those for longer-maturity bonds – have preceded nearly all recessions dating back to the 1950s. The move has also, understandably, made investors more wary of the economic outlook. With all of this in mind, it’s not surprising that markets have priced in a higher probability of recession. “But while we agree that the risk has risen, a recession over the next year or so is still not a foregone conclusion. Unlike the lead-up to past U.S. recessions, today’s financial stability risks appear moderate, bank balance sheets are strong, household leverage is manageable, and the personal savings rate is high. All these fundamental factors should help buffer an economic downturn” said a spokesman for Pimco.

Researchers still struggle to understand why the yield curve is historically such a good predictor of recessions. At first glance, an inverted yield curve seems counterintuitive. Why would long-term investors settle for lower rewards than short-term investors, who are assuming less risk? The answer: When long-term investors believe that this is their last chance to lock in current rates before they fall even lower, they become slightly less demanding of lenders. As you might expect, since lower interest rates generally mean slower economic growth, an inverted yield curve is often taken as a sign that the economy may soon stagnate.

While inverted yield curves are rare, investors should never ignore them. They are very often followed by economic slowdown—or an outright recession—as well as lower interest rates along all points of the yield curve.

Douglas Kearney C.A. Investment Director

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.