As we head into Autumn, markets continue to surprise. The turmoil of March has been repaired across many global markets, although the UK continues to be the straggler by some distance. Widespread economic devastation, unemployment and a grim prognosis for recovery have not stopped the US stock market’s exuberance. On Tuesday,18th August, that undying optimism propelled the market to a new high, pushing it past a milestone reached only six months ago, when the coronavirus was just beginning its harrowing journey across the United States. In mid-March there can be few who would have predicted such a rapid recovery, the fastest ever recorded.

Maintaining portfolios and not making reactive changes to portfolios through spring and summer has been rewarded. Holding tight and avoiding panicky moves is a sensible strategy at times of extreme volatility. It is pleasing that many portfolios are ahead of the market and indeed many are ahead for the year. Equity funds cannot be immune from short term market volatility, but it should be remembered that the companies that the fund managers support are supported because of the long-term outlook for the company.

Too often this can be forgotten, and it is worth keeping this thought at the front of mind when it feels like the alarm bells are ringing and the instinct is to head for the exit.

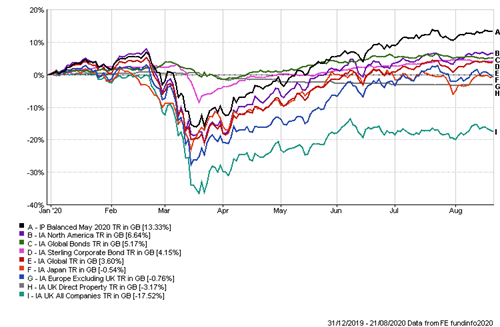

As can be seen from the chart many individual asset classes are positive or close to positive for the year. The UK is not. There are perhaps many reasons that could be listed. Perhaps currency, the FTSE 100 are “value” stocks (banks and oil) rather than growth or new economies (Amazon, Netflix, etc), dividend problems and of course Brexit uncertainty.

We will be watching UK market developments and will not abandon exposure, but it does look like a long uphill struggle.

Property funds continue to cause huge frustration. The majority of property funds were closed because the coronavirus crisis had caused “material uncertainty” in the UK property market, meaning valuers were unable to value the assets within the funds with the same degree of certainty as would otherwise be the case. Indeed, some had been subject to restrictions prior to that.

Although the Royal Institution of Chartered Surveyors somewhat surprised the market on 9th September by recommending a general lifting of guidance on material valuation uncertainty, it is not expected that many retail property funds will rush to open as managers will be carefully considering liquidity demands and endeavouring to prevent a flight to cash. Investors could remain gated for some time yet.

As a support to tenants during the pandemic, the government suspended forfeiture provisions within leases which has prevented the use of statutory demands to take rent. Whilst this has helped tenants survive, the Government action creates uncertainty on rent receipts. Because commercial properties in the UK are now unable to receive guaranteed income or yield from rent, potential buyers have held back from making transactions in the market.

The head of UK valuation at CBRE, said, “If your primary rationale is to receive [that] income, but this is no longer guaranteed, you’re likely to pause on your investment until we get back to a normal situation.” Quite what normal will be is a hard question to answer as the impact of the pandemic has seen huge shifts to remote working, the reduced need for office space, massive footfall reductions in city centre retail and hospitality and generally changes that could not have been imagined a mere few months ago.

It is expected that retail property funds will attempt to open in unison but that could be some time away. Some pension property funds have now re-opened. Recent FCA proposals suggest calling for up to 180-day notice periods for redemptions on open-ended direct property funds. Most are daily traded which has proved challenging since the Brexit vote saw most funds gated. This “notice period” could be a “death knell” for the sector due to complications it creates for retail investors and advisers. Property managers are less pessimistic unsurprisingly as they are correct in their view that it is a long-term asset. However, rebalancing of portfolios becomes more than difficult if an asset class requires 6 months to trade.

The FCA is seeking feedback on a new notice period of between 90 and 180 days, according to a consultation published recently. The FCA said its proposals should make property funds higher quality investments but that there may be some clients, indeed many, where the long notice periods don’t meet their requirements and for most the lack of rapid liquidity will be a deterrent. The recent problems with Woodford funds have made liquidity a key issue for investors. The US regulations restrict redemptions of open-ended property funds to monthly or quarterly. So, some significant change is almost inevitable, but 180 days is a long wait in this world of instant action that we all demand. We will see how this develops but there is a likelihood that direct property funds will no longer be an attractive asset class for many investors. It has been suggested that some funds may decide to go into a controlled and orderly run off to provide investors with a satisfactory exit. Regrettably, there is no liquidity solution for holders of property funds.

As autumn heads our way, so does a US presidential election. The election is scheduled for November despite the incumbent seeking to have it postponed. Exactly what this will mean is anybody’s guess and despite polls, the outcome will be hard to predict based on recent history. What is fairly certain is that the US market will react to the noise, which in turn will impact all markets and most asset classes. This, along with concerns over a second spike in coronavirus infections and Brexit deal or no deal, will make it an uncertain and likely volatile run into the New Year.

Douglas Kearney C.A. Investment Director

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.