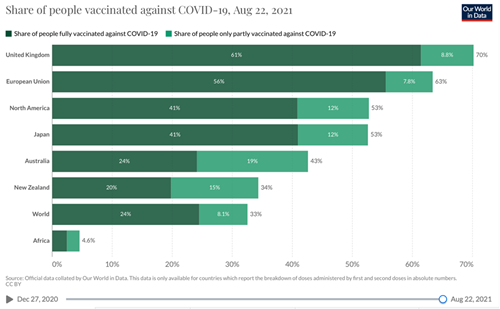

The global economic recovery has been sustained through the summer, with the vaccine rollout making steady progress in many countries and restrictions on activity being eased throughout the UK and in several major developed markets. However, sentiment has been somewhat dented recently by the continuing spread of the contagious Delta variant of Covid-19, raising concerns that the path to normality may be bumpier and longer than previously expected. The New Zealand strategy of national isolation that worked very successfully through much of 2020 is under stress and it seems inevitable that the rollout of the vaccine will need to be accelerated without delay. Australia is also facing similar issues. The US is also seeing a significant number of cases across the country.

The chart above shows significant variations between countries, with New Zealand very noticeably lagging behind. It is also concerning that the rate in Africa is so low, as it is widely accepted that no one is safe until everyone is safe. Data for China was not available.

The Delta variant could lead to a slower rebound in parts of the world where vaccination rates are lower, but there is little evidence at this stage to suggest that the recovery will be derailed. Consumers are driving a strong rebound in growth and still have plenty of firepower in their pockets, while policymakers continue to provide ample support, although under constant review, the uncertainty of which adds to volatility.

The easiest part of this recovery may now be behind us, both for markets and many parts of the global economy, but ultimately, the asset managers still see scope for risk assets to move higher over the course of the year, albeit with likely higher volatility ahead. The Vix index (which is a measure of volatility) is around 17 which is vastly lower than the mid 80s it reached in March 2020.

However, several factors are impacting sentiment at the moment. More signs have emerged of an economic slowdown in China. On the US domestic policy front, recent signals from Federal Reserve policymakers that they would soon begin tapering the central bank’s monthly asset purchases are also concerning investors. Central bankers from around the world are meeting in Jackson Hole to discuss monetary policy as the global economy enters the 21st month of the coronavirus pandemic. The key issue for investors is likely to be Federal Reserve chair Jay Powell’s speech and any clues he may offer about when the central bank may begin tapering its monthly purchases of $120bn of government debt. Minutes from the Fed’s July meeting showed disagreement among officials, though a majority believe the taper could begin later this year.

Most recently, the rapidly changing situation in Afghanistan, which clearly has potentially huge humanitarian implications, creates a wider uncertainty with fear of a return to the security risks that were suffered by the Western world two decades and more ago. This has made markets jittery but it is tapering, growth and inflation that are the main focus of concern.

In the developed world, the easing of virus-related restrictions has resulted in a surge in demand. As widely reported, supply is struggling to keep pace and the result has been meaningful upside inflation surprises in many regions, although like for like comparisons can be very misleading. As the market looks to the rest of the year, it is questioning whether the surge in growth and inflation will prove transitory. Despite the apparent ecomomic slowdown in China, we subscribe to the view that growth will remain strong as considerable pent-up savings are still to be unleashed and supply will catch up, although it is hard to know how quickly. However, we also expect inflationary concerns to linger. Questions over what this all means for monetary policy may generate volatility but that should be clearer after the Jackson Hole meeting. There is wide expectation, perhaps hope, that monetary policy will be tightened only gradually, and we again share that view and hope. Gradual rate increases will raise longer-term bond yields but shouldn’t hinder the economic expansion.

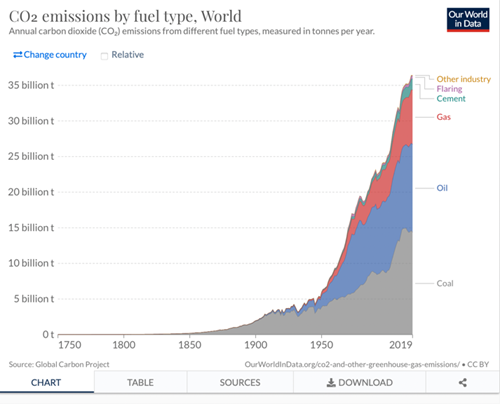

Leaders of over 190 nations are meeting in Glasgow in early November for the 26th Conference of Parties (COP26). President Biden has brought the US back to the table and increased the global momentum towards tackling climate change. It is hoped that the recent events and his decisions surrounding Afghanistan will not detract from the importance of this issue. As we entered the pandemic, we saw wild fires raging through Australia and since then wild fires through the west coast of America, Europe and flooding in many parts of the world, with the pictures of flooding in China etched in the mind. Many rightly view this as at least equally if not more grave than the pandemic. The group will aim to flesh out a coherent plan to reach zero emissions in the coming decades. Infrastructure overhaul is one part of the conversation. A common carbon price is a critical but contentious part of the discussions. Inaction would be potentially catastrophic as the impact of climate change is becoming ever more obvious and worrying.

As the summit gets nearer we expect an even stronger focus will be placed on sustainable, responsible and ethical investing that is encompassed under ESG, which stands for environmental, social and governance. While not a new concept or strategy, ESG awareness has become a key investor topic. ESG issues were first mentioned in the 2006 United Nation’s Principles for Responsible Investment (PRI) report consisting of the Freshfield Report and “Who Cares Wins.” ESG criteria was, for the first time, required to be incorporated in the financial evaluations of companies.

Over the last couple of years, as natural disasters continued to pick up in intensity and COVID–19 brought rising income and healthcare inequalities to centre stage, corporations have increasingly been pouring more focus into their own ESG measurements and practices in conjunction with their corporate social responsibilities. Further work is required to demonstrate conclusively the extent to which ESG has affected past performance. It does appear that a strong ESG approach is rewarded. We expect the shifts in government policy, regulation and consumer preferences to result in much larger leaps forward that will shift the landscape.

It is by being ahead of those announcements and changes in the coming years that the potential exists for investors to generate enhanced portfolio returns whilst benefitting the environment. Fund managers are very aware of this. However, it is a complicated area as it involves potentially many ideological conflicts for investors. Does the end product justify the means? An electric car requires a lithium battery, which requires to be mined, transported, processed, regularly charged for use and eventually scrapped. How does that journey impact the environment? For many years we have sought to find funds that saw ESG as part of their DNA. It is not yet perfect but it is an area we are constantly considering, as do the asset managers. We seek funds that are investing in companies that are very aware of their ESG responsibilities, in addition to performance. Each year we see more funds becoming aware of this growing need and each year the conversations amongst investors are more frequent.

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.